Small-cap momentum stocks have been popping off…

And every day, I’m on the hunt for these plays because I believe if you can identify them ahead of time, it’s possible to uncover some fast movers…

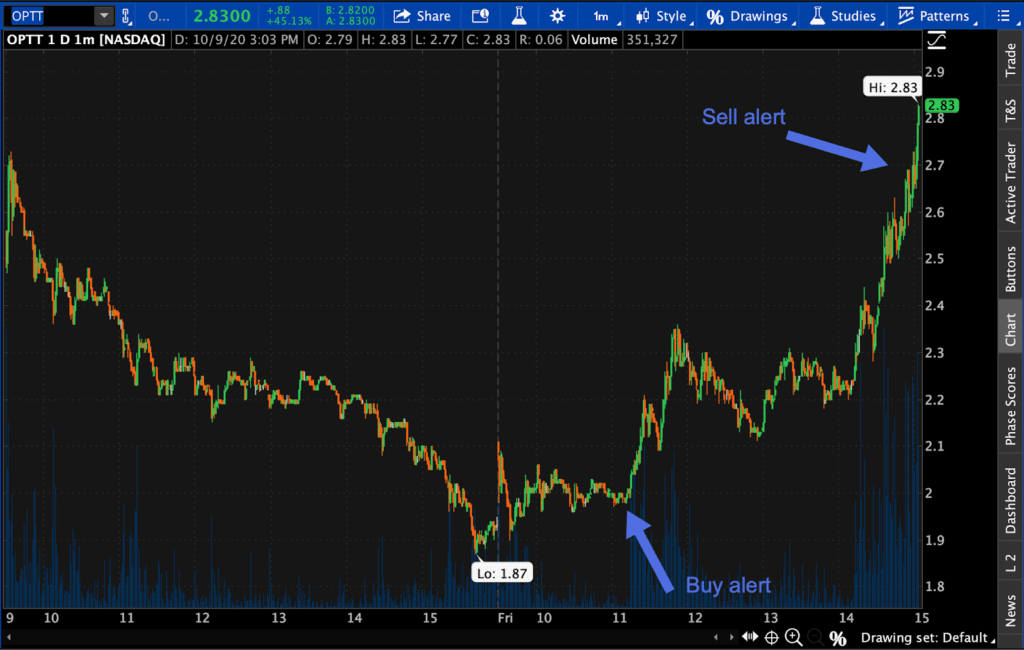

Take a look at the chart below.

This is one stock my chart pattern spotted, and I teach subscribers how to uncover these setups.*

That said, let me show you which momentum stocks I’ve uncovered utilizing some of my favorite techniques…

And why I believe they can pop off.

Can These Three Momentum Stocks Take Off?

Last week, I mentioned to keep an eye on WWR, and it exploded… spiking from $4.80 to more than $12 at one point. This week, I’ve got some interesting plays with some of my favorite setups.

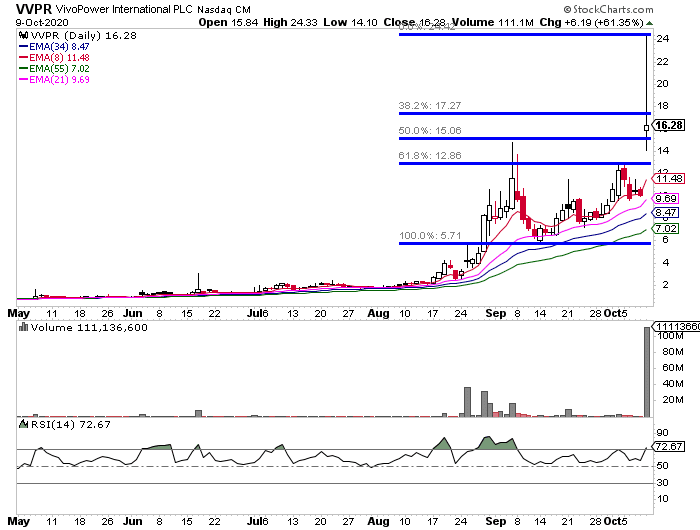

Vivopower International (VVPR)

- VivoPower International is an international solar power company that serves customers worldwide. VVPR manages solar power assets to provide commercial, industrial, and government customers with renewable energy

- On Oct. 9, the company announced a deal to buy a majority stake in Tembo e-LV, a Netherlands based EV company. VVPR will also have an option to buy the remaining 49% of shares.

- The stock gapped up from $10 to $15, and rallied to the highs of $24.55 intraday. This news could be a game-changer for the company, and I don’t think the run is over just yet.

- If this stock pulls into some critical Fibonacci retracement levels, I believe there will be some pretty attractive risk-reward opportunities.

VVPR closed just above the 50% retracement level, and if there’s another pullback, I’ll be keeping an eye on $15.06 and $12.86 as potential areas of entry.

Next up, I’ve got another solar play.

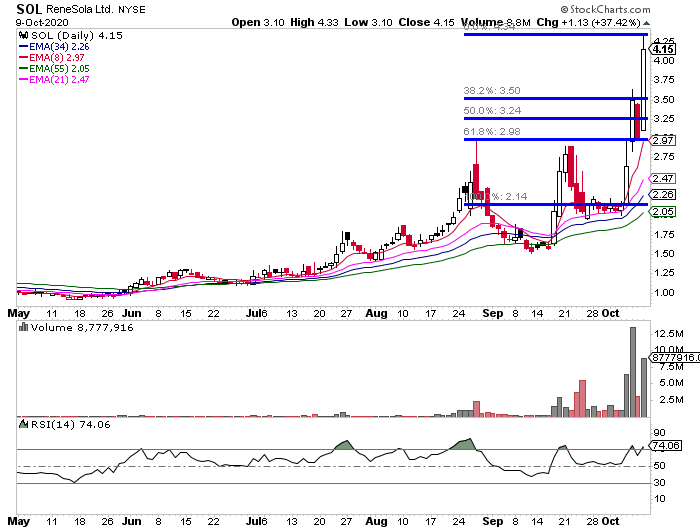

ReneSola Ltd (SOL)

- Another alternative energy play with huge potential is SOL. The company focuses on solar power project development, construction management, and project financing services.

- On Sep. 29, the company announced a joint venture with a German peer Vodasun to develop and market solar projects in Germany.

- ReneSola reminds me of JinkoSolar, another Chinese alternative energy company. However, SOL’s market cap is $182.3M, less than 8% the size of Jinkosolar’s $2.765B

I think this one is a sleeping giant, and I can’t afford to miss it. I want to keep an eye on this one if it dips. The 50% and 61.8% retracement levels look pretty attractive from a risk-reward standpoint (the prices are $3.24 and $2.98, respectively).

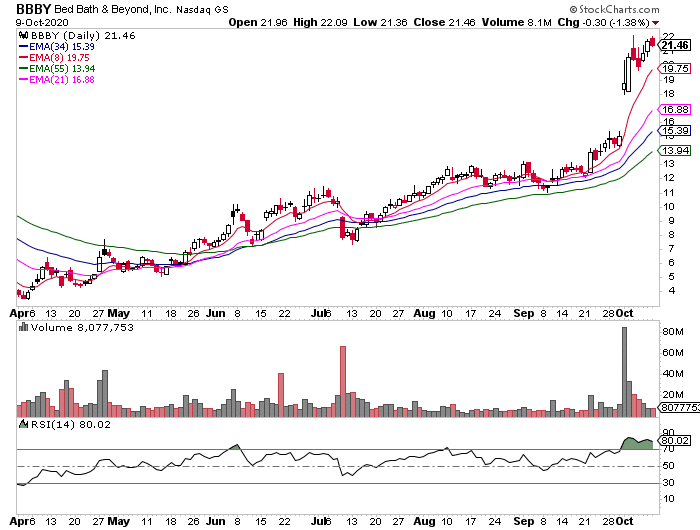

Last up, there’s Bed, Bath & Beyond (BBBY). Although it’s technically not a small-cap, I want to show you that my patterns don’t only work with small-cap stocks but also stocks of all market-caps.

Bed, Bath & Beyond (BBBY)

- The iconic domestic merchandise retailer needs no introduction. Despite the sector struggling as a whole, BBBY was able to benefit from stay-at-home through digital sales channels.

- On Oct. 1, the company reported blowout Q2 results: surprise adjusted EPS of $0.50 vs. a consensus estimate of ($0.30), revenues of $2.69B vs. $2.62B estimated.

- Shares are consolidating above $20, which has been a key resistance level for the last few years.

- Considering the stock has a whopping 61% short interest, I’m keeping an eye on the $19 area (a previous resistance level) for potential entries.

I may look around the 8-day exponential moving average (EMA), which is just under $20 because that can be an area of support.

In this environment, I believe understanding price action and being able to recognize reliable chart patterns is crucial.

That’s why I put together this Chart Patterns Cheat Sheet.

Inside, you’ll find some of my favorite setups and how I utilize them to attack the market…

And uncover momentum stocks before they pop off.

Claim your complimentary eCopy here.

Flip through it when you’re free. I believe you’ll be surprised how easy it is for me to spot these patterns and how often they show up.

among the instructors i like you the best