Most traders will be focused on any stimulus news and the POTUS’ and FLOTUS’ health come Monday morning.

While I am keeping an eye on the news for potential catalysts that may move the market…

There is one strategy I love to use because if there are negative market-wide catalysts, the chances of it dragging the specific stocks I’m looking at is low, in my opinion.

What specific stocks am I talking about?

I’ve uncovered three that I believe can make a move this week, and I want to show you why I want to keep them on my radar.

3 Small-Cap Momentum Stocks Set To Pop Off

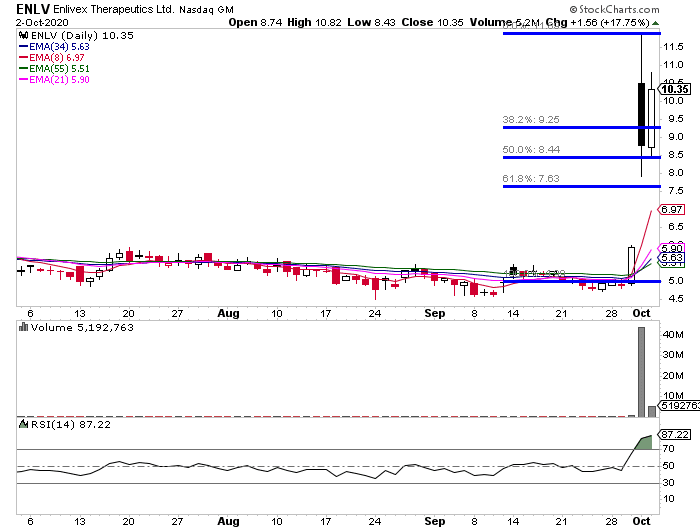

Enlivex Therapeutics (ENLV)

- ENLV is a clinical-stage biopharmaceutical company

- On Thursday, the company announced positive results from the clinical trial of its key drug Allocetra with significant improvements in COVID 19 patients.

- Shares shot up from $6 to $14.99 in the premarket session on Thursday, giving back some gains later in the day

- On Friday the stock started to show some strength again, closing at $10.35

On the daily chart, the pattern that popped up is the rest and retest. With the 50% Fibonacci retracement holding up well, I would look for potential entries on pullbacks and use either 38.2% or 50% retracement levels as stops.

The target would be highs around $11.50.

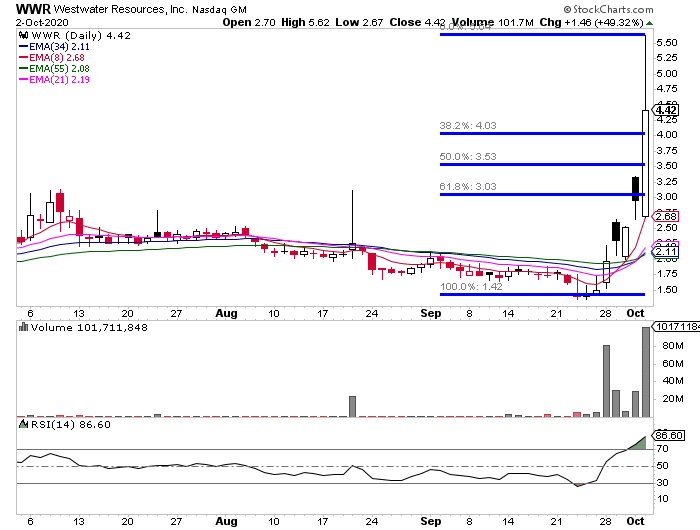

Next up, WWR

Westwater Resources (WWR):

- WWR explores and develops mineral resources essential to clean energy production. The company is involved in exploration of lithium, key component in lithium ion batteries

- Shares skyrocketed on Friday, up 49% on the day. The move came with the tailwind from the sector. Another lithium miner LAC closed up 17%

- Although there was no fresh catalyst in the stock, I believe the sector strength could continue the next week: a lot of shorts might be caught on the wrong side of the trade

- I would love to see this one open weak but hold a support level like $3.5 or $4 to lure some fresh shorts in. If the stock is able to hold and start perking up later in the day, I believe it could go parabolic. While I will need to see some confirmation first, I will watch this one closely next week

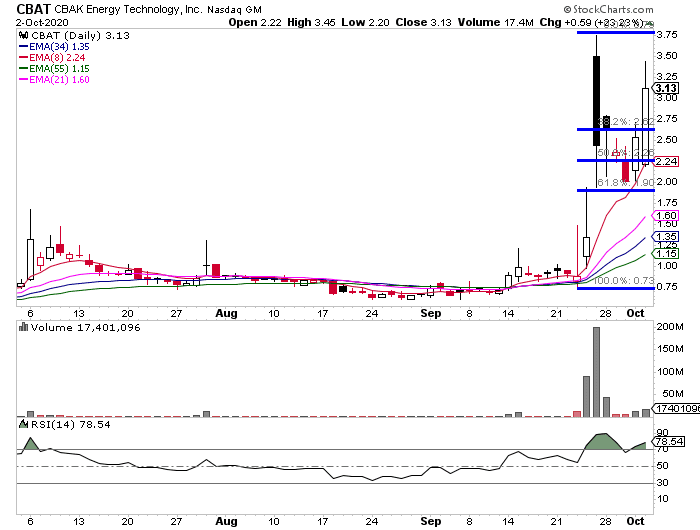

Cbak Energy Tech (CBAT)

- Another battery sector play, CBAT is a manufacturer of lithium-ion batteries for portable digital devices

- On Monday the company announced it developed a new battery technology that is expected to come into production in early 2021. According to the press release, the battery technology has technological advantages to Tesla batteries

- On Monday shares short up to premarket highs of $4.16. After a slight pullback, CBAT is on the move again with shares closing at $3.13

- With the tailwind from LAC and other alike, I believe CBAT could see a run higher next week. The most key areas of support are $2.5 and $3. If the stock is able to get above the pivot high of $3.45, I believe this one could go to $5

With volatility picking up, I believe many traders will start to turn to small-cap momentum stocks… and that demand can cause some wild moves.

If you want to find out how to uncover these small-cap momentum trading opportunities, click here attend this exclusive training session.

You’ll discover my techniques and favorite patterns to uncover these momo plays before they run.

There is a lot to learn, I can’t even figure out how to trade on my TD Ameritrade. I’m glad to receive all this valuable free training J. B.