Well, stocks traded lower all session to cap off the last day of the month. Of course, when there’s one red day…

A lot of traders start to think of the worst and panic.

You should know by now I’m all about chart patterns and price action — and to be quite honest with you today’s price action didn’t really shake me.

Now, that doesn’t mean I’m going to just go out and randomly buy stocks that have dropped.

Instead, I want to remain highly selective and utilize options to my advantage.

When you think of buying the dip, you probably automatically think to buy shares — for me personally, that can be a big capital suck.

That said, I want to show you two alternatives to buying the dip.

Two Ways To Play The Dip

When it comes to being a buyer of the dip, I think it’s important to learn how to limit your risk. The last thing you want to do is try to catch a falling knife and just continue to watch the position go against you… and continue buying.

Especially if you’re buying shares of stock. It can not only lead to you holding onto the bag, it’ll also eat up your buying power.

So the alternative here is to either purchase calls or utilize a bull put spread, in my opinion.

Let me show you what I mean by that.

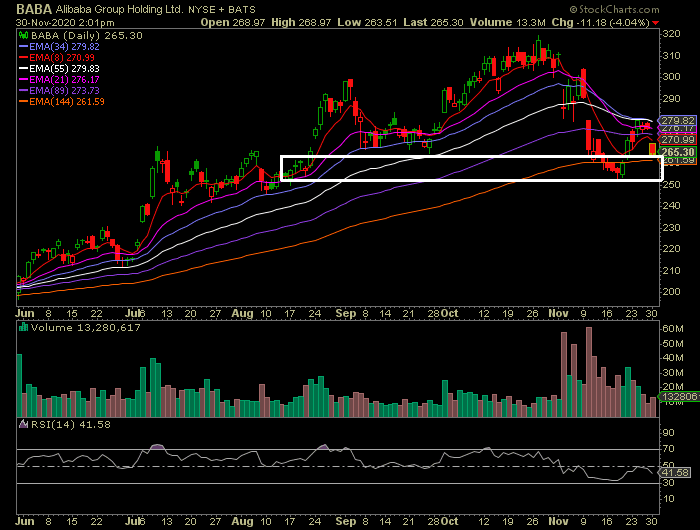

Check out Alibaba Group Holding (BABA) on the daily chart above.

It’s right at a key exponential moving average (EMA), the 144-day. What this signals to me is the stock can find support around this area. However, we’ve seen the stock trade below it and quickly rebound.

Since I see this as an area of value, there are two ways to play it.

I can look to purchase call options with 60-70 delta expiring in 4-6 weeks. So what does that mean?

Well, I would look for calls expiring in say January for this setup. Thereafter, I would look for ones with a delta of 60 – 70. On your options chain, it may show in decimals (0.60 – 0.70).

Basically, these options trade very similar to stock. That means for every $1 move in BABA, these calls would gain $0.60 – $0.70 (depending on what the delta is). In other words, each call option contract would gain $60 – $70, since there’s a 100 multiplier.

On the flip side, one can also sell a put spread to express a bullish opinion.

With a bull put spread (short put spread), the strategy can actually benefit in three different scenarios. If the stock runs higher, stays sideways, or even falls a little.

Just as long as the stock stays above the strike price at which is sold short by the expiration date, each day, you would be in a position to collect the premium.

For example, with BABA, maybe I think it can stay above $260 within 2 weeks. Then I would sell the $260 puts expiring on say Dec. 11, then simultaneously purchase the $250 puts.

That means if BABA stays above $260 and runs higher, I would be in a position to collect a bulk of the premium.

Makes sense?

If not, drop a comment below, email me at jason@jasonbondpicks.com, or text me at my Community number +1 (410) 210-4522.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

Good Morning Kyle Dennis. Thank you so much to join your activity. I am really enjoy with your activity but this first time to me, that way I need more information from you how to bring me take part in your activity. I am from East Timor.

A new country in the world so we are not yet familiar with your activity. I have email address and I don’t have website yet.