No matter which way you spin it…

Whether you’re a bull, bear, swing trader, or day trader, there are plenty of money-making opportunities out there.

If you’ve missed out on these opportunities or even if your account took a hit, don’t beat yourself up.

We’re in Q4 of 2020, and I believe there will be even more action than we’ve already seen this year thus far.

That’s why I wanted to show you:

- Some techniques I’ll be implementing

- How you can define your risk and trade options as if they were stock

- Three options plays on my radar

If You’re Not Learning How To Trade Options Right Now, You’re Doing Yourself A Disservice

I get it.

Trading options can be pretty scary at first, but once things start to click — you might get mad at yourself for not learning it earlier.

The key to becoming successful at options trading, or any style of trading for that matter, is to remain disciplined. That’s why I created some rules for myself for Q4 and 2021 (which may change as I grow my account).

If you think about it, options make it easier for me to follow my rules as I plan my trades and execute them.

You see, with options, I can actually trade them as if they were stock. However, with options, you get that added leverage, so I can get more bang for my buck.

There’s something known as “delta” in options trading. This just simply lets me know how much an options will move given a $1 move in the underlying stock.

With calls, the delta ranges from 0 to 1 (some traders will quote delta from 0 to 100, since equity options have a multiplier of 100).

Puts, on the other hand, have deltas that range from -1 to 0 (or -100 to 0).

So let’s say I purchase 10 contracts of 90 delta calls on say Apple Inc. (AAPL) expiring in four weeks. Those calls will cost a fraction of the price of what it would cost to purchase 1,000 shares of AAPL (remember each contract has a multiplier of 100).

With the 90 delta calls, they’ll trade a lot like stock. You see, for every dollar AAPL moves, the calls will move about $0.90 (or $90 per contract).

Keep in mind, delta is always changing and that should be a factor to take into account if you’re trading options. If this is all unclear to you at first, don’t worry — I’ll conduct a lesson on delta in a future post.

So let me show you how it works in the market.

There are three stocks that I believe options can be very useful on right now.

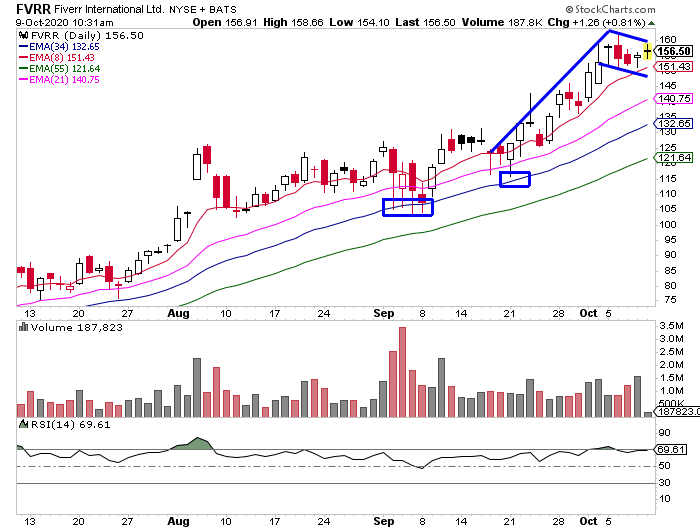

Fiverr International (FVRR)

Here’s the skinny on FVRR.

- Fiverr is an e-commerce gig-based freelance platform connecting customers with service providers all around the world

- The stock is up 600% in 2020 and has seen virtually no weakness or dips.

- Driven by the stay-at-home environment, the company has grown over 90% YoY and even turned a surprise profit in Q2; multiple upgrades followed the announcement.

- On Oct. 7, the company announced a $400mil private offering of 0% convertible notes, due 2025

- FVRR has shown remarkable relative strength, and with improving fundamentals, the stock might be far from done

- It recently broke to all-time highs after consolidating in $100-125 for almost two months.

- If the market stays strong, I believe it makes sense to look for options plays on dips to the 21-day exponential moving average (EMA).

So let’s say FVRR pulls back to near $140 and the 21-day EMA holds up. I would look to buy deeper ITM calls (the deeper ITM the calls, the higher the delta).

On the flip side, I can also look to enter a bull put spread to get in on the action. Instead of looking to deeper ITM calls, I would look to sell a put spread around a level I believe the stock will have a tough time breaking below.

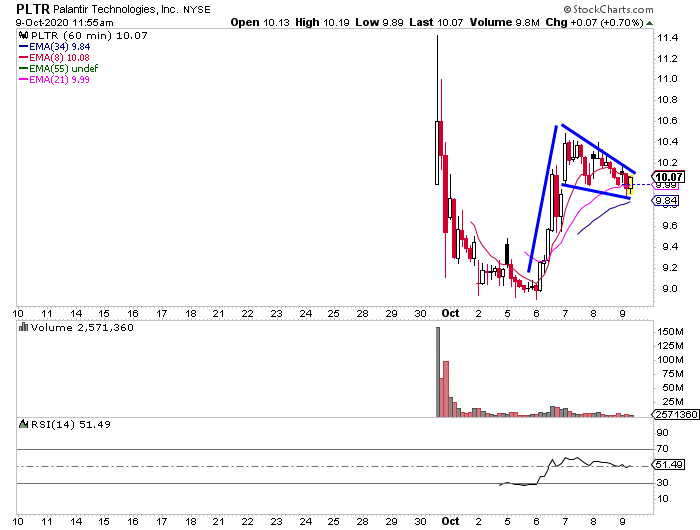

Next up, there’s Palantir Technologies (PLTR).

Palantir Technologies (PLTR)

- Big Data analytics company that uses latest data mining techniques for tasks of national securities and, as of late, private customers

- One of the biggest and most anticipated IPOs of 2020, the company sold shares in a direct listing at ~$10 per share and a valuation of over $21 billion – well above the $7.25 reference price and $16 billion expected valuation

- As is the case with hyped up IPOs – over the first few days/weeks price action is key and PLTR has been shaping up

- After briefly dipping over the first week of trading, PLTR is now back above the $10 level – IPO price and a big psychological level

On the hourly chart, PLTR is forming a bull flag / pennant pattern and may look to break out and test the highs.

PLTR is a $10 stock, and there are options on it as well. So I can efficiently use my capital and define my risk by purchasing deep ITM calls.

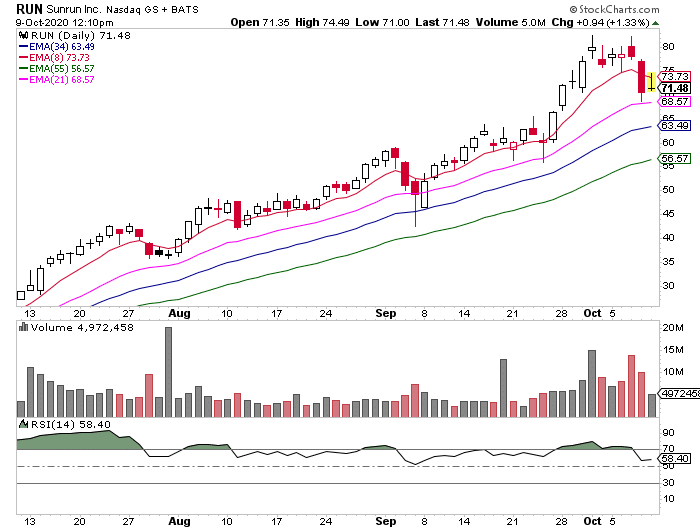

Last, but not least, there’s Sunrun (RUN).

Sunrun (RUN)

- Sunrun is a leading provider of residential solar, battery storage, and energy services

- The stock is up over 900% since March’s lows and almost 100% over the past month alone. Alongside its sector, RUN has been one of the biggest gainers of 2020

- The stock has maintained a high short interest throughout, currently counting 18.88%

- On Oct. 8 the company announced the acquisition of Vivint Solar in a move to accelerate Clean Energy adoption – Sunrun says the acquisition creates a Clean Energy leader with an Enterprise Value of over $22 billion and over 500,000 customers

- RUN sold off close to 12% on the announcement in what we believe may present a buying opportunity

- Despite the calamities – it remains one of the strongest names in a very hot industry – if it finds support, it may easily have another leg up

Right now, I believe it makes sense to look at the key EMAs for potential entries. The 21-day held up, but with stocks like these…

It’s important to remain patient and focus on the price action.

I’ve got my eyes set around $63 (the 34-day EMA) and $68 (the 21-day EMA) as potential support levels.

With this trade, one can look to purchase deeper ITM calls if they want to trade it like stock. However, I believe bull puts would work better here.

Listen if you want to learn more about options trading, then you’ll want to keep an eye out for my next lesson.

In the meantime, I want you to take a look at some of my favorite setups and how I utilize them.

After you grab my Chart Patterns Cheat Sheet and read it thoroughly, flip through some charts and I believe you’ll be surprised at how much my chart patterns pop up, whether they be in small- or large-caps.

Jason, Amazing week!! The picture of you riding the cheddar was the absolute perfect way to end this Friday!!! Awesome. I followed all your calls this week and had a great week. You remain the Cheddar King

Good Information. You are a great teacher . Makes me want to continue learning !