In this market environment, buy the dip has been working… and with a slight pullback from highs last week, I’m on the hunt for plays.

Typically, I trade options on stocks such as Apple Inc. (AAPL), Tesla (TSLA), Shopify (SHOP) — the fast-paced large-cap momentum plays…

Today, I want to switch it up and show you three recent large-cap IPOs building up momentum and are flashing buy signals based on the charts.

More specifically, I want to reveal some alternatives to buying the dip and why it’s helpful to pair chart patterns with options trading.

Three Large-Cap Stocks That Can Make A Move

I want to show you three large-cap stocks with triangle patterns today. These specific patterns let me know that they can continue higher, and I believe it’s crucial right now, especially when major indices are trading in a choppy mess.

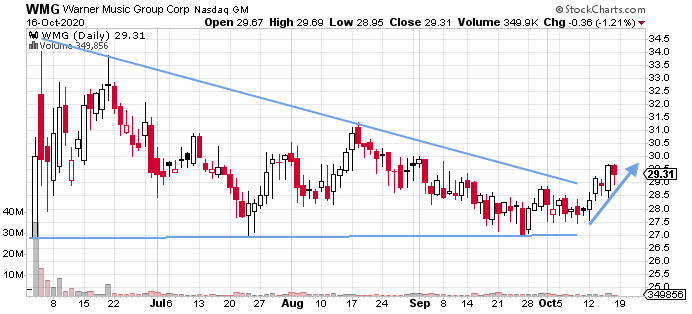

Warner Music Group (WMG)

- Warner Music Group is a music-based content company in the United States, the United Kingdom, and internationally if you don’t already know.

- WMG is a recent IPO: it opened for trading on June 3, 2020 at $27 after pricing at $25.

- The stock has been trading between $32 and $27 for the past three months. I believe it has built a lot of momentum and is primed for a move higher.

- Per usual, I think right now is a good place for a starter long position against the all-time lows of $26.94. You see, this pattern is typically a bearish setup. However, WMG failed to break below that support level right around the $27 area… and actually broke above that downtrend line.

There are two ways to play this if a trader is bullish on WMG after seeing this setup.

One can look to purchase call options if they believe WMG can explode. For me typically, I would look at at-the-money (ATM) or slightly in-the-money (ITM) options four to six weeks out.

Another way to play this would be to sell a put spread. So let’s say I believe WMG won’t break below $27 (that key support level).

I would look to sell, say the $27 puts, and simultaneously purchase deeper out-of-the-money puts (OTM). This would establish a position in which I would collect a premium if WMG stays above $27.

Both of those strategies would allow one to gain exposure for a fraction of the shares’ price. Remember, there’s a 100 multiplier with options, so if you purchase a call for say $2.50, then it costs $250 for one contract (excluding any fees).

Next up, I’ve got another recent large-cap IPO on this watchlist.

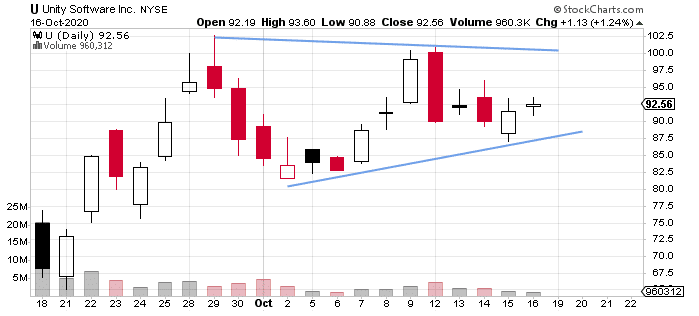

Unity Software Inc (U)

- Unity Software Inc. operates a platform that provides software solutions to integrate interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company has customers globally.

- The stock is a recent IPO. It opened for trading at $75 on 9/18/2020 after pricing at $52. Unity Software is represents gaming and VR, which is one of the hottest areas of growth for the next decade.

- I like the chart that the stock is forming: it is continually getting bid up at higher levels. I think we are going to see the wedge on the daily chart and a breakout afterwards.

- I think now is a good risk-reward place to get involved. If this setup is going to work, it should never get below the $87 area. If the setup fails, I will still keep this one on my watchlist for another opportunity later.

This is a bit of an ascending triangle forming, and typically if the pattern holds and if it breaks above the resistance level, it indicates the stock can run much higher, typically.

For this play, it would be very similar to WMG.

If I were to play this, I would look to buy ATM or ITM calls expiring in four to six weeks to play for a run up into a potential breakout.

On the flip side, I can look to sell the $85 puts and simultaneously purchase the $80 puts to collect a premium.

With an expensive stock like Unity, options allow traders to leverage their money and will enable them to asymmetric risk-reward opportunities.

Last up, GDRX is on my radar.

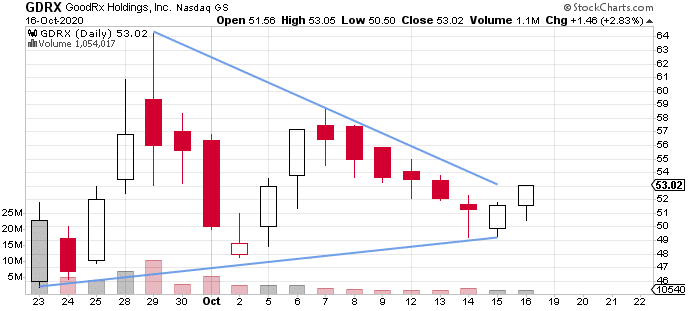

GoodRX Holdings (GDRX)

- GDRX is a tech company which operates a digital healthcare platform in the United States

- GDRX is also a recent IPO. It opened for trading at $46 on Sep. 23 after pricing at $33

- The company has the backing of Silver Lake, a global technology investment firm, with more than $60 billion in combined assets under management. To me, that signals that the smart money believes in GDRX business model.

- GDRX getting bought on dips and the trading plan here is similar. Key levels to keep an eye on are $49.20 and add if it breaks above $60, it could take out all-time highs and attract the FOMO chasers.

I’ll let you do a bit of homework and figure out how to use options with this one.

Listen, chart patterns are helping not only uncover money-making opportunities in small-caps, but large-caps as well.

If you want to discover how chart patterns can help you develop an edge in the market, then you’ll want to attend this special training workshop.

You’ll find out my favorite patterns and how I efficiently use them to uncover momentum stocks set to pop off.

0 Comments