Yesterday, I talked to you about how there will be more than 180 in the S&P reporting earnings in the coming week.

I expect this week to be filled with fireworks and opportunities, and I want to show you how I plan to take advantage of them.

For the most part, I want to focus on the price action after an earnings announcement to potentially profit from the volatility crush.

That said, let’s take a look at which stocks are on my radar and which strategy I want to utilize this week to take advantage of the action.

Why I Think Now Is The Time To Learn How To Utilize Bull Put Spreads

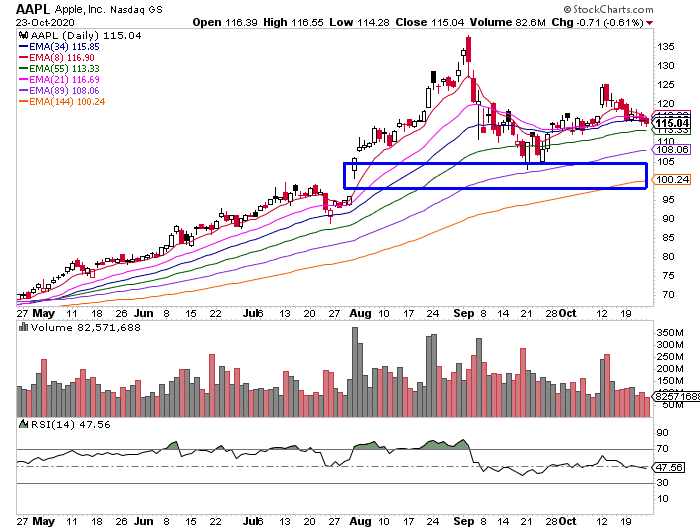

I mentioned on Saturday how Apple Inc. (AAPL) is set to report earnings, and which key levels I’m focused on

The areas I want to focus on are $100, $108, $113, as those can be key support levels for AAPL. So if AAPL beats earnings and gaps higher, I may look to get aggressive and sell the $115 / $110 put spread with a short time to expiration.

That means if AAPL closes above $115 by the time the expiration date rolls around, I would be in a position to collect the premium.

On the flip side, let’s say AAPL disappoints and sells off.

Well, I think the $100 / $95 put spread would be advantageous to sell. You see, that’s a key support level, and if AAPL pulls back around there, I expect the buy the dippers to come in and support the stock.

Regardless, AAPL is expected to move about 4%, and historically, it’s moved on average about 4.6% (over the last 8 quarters).

I’ll monitor this to see what the volatility is like headed into earnings. For me personally, I don’t want to get in front of the earnings and sell a put spread because it can be risky.

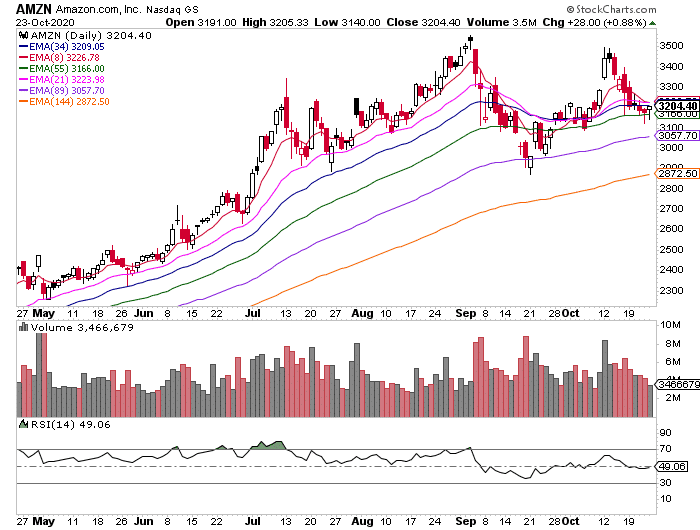

Next up, Amazon (AMZN) is another stock with earnings that’s on my radar.

I want to keep an eye on the 21-, 55-, 89-, and 144-day exponential moving averages (EMAs) because I think they’ll be in play… and it’ll help me select strike prices for my spreads.

AMZN is expected to move 6%, and over the last eight quarters, the stock moved about 4.5% on average.

With AMZN, I want to keep an eye on the $3200, $3000, and $2872 levels. So if AMZN sells off, I might look to sell the $3000 / $2900 put spread to take advantage of a potential bounce. On the flip side, if AMZN takes off and runs, I’ll look to sell a put spread around the $3200 level.

Now, it’s going to be a volatile week, so make sure you manage your risk properly.

With the bull put spread, I’m able to put myself in a position to win, in three different scenarios. Not only that, but if the volatility in these options get crushed… those options would lose value fairly quickly.

For me personally, understanding the price action will be key. If you want to learn more about some of my favorite setups and how I uncover trading opportunities, then click here to receive your complimentary eCopy of Momentum Hunter.

0 Comments