The last earnings season of 2020 is fast approaching, and there will be plenty of ways to make money and take advantage of this event. If you think I’m buying specific stocks and holding them into earnings, then I’m sorry to say, but you’re mistaken.

Today, I want to talk about IV crush because I believe this will be key to trading around earnings season.

You see, I actually want to take advantage of what’s known as the implied volatility (IV) crush — the pros usually call this vol crush.

This is one factor I believe all options traders should focus on — as an educator, I wanted to cover this because understanding the ins and outs can help you become a better trader in my opinion.

That said, I want to provide you with some trade ideas I have on my mind, and teach you how to take advantage of the vol crush.

If You Plan To Trade Around Earnings, Make Sure To Check On The Implied Volatility

In the coming weeks, companies are set to provide updates on their earnings, and some may even provide guidance. After the earnings release, there are typically analysts commenting on the company.

Most traders see this as uncertainty, but for me… all I see are opportunities.

When it comes to a company’s earnings release, the implied volatility rises prior to the announcement. You see, no one really knows what’ll happen with the earnings announcement and how it would be received by traders.

So the level of uncertainty is a stock’s price heading into earnings rises ahead of the event, as the demand for options pops up.

If you don’t already know, options prices are broken into two pieces—intrinsic and extrinsic value. When the level of uncertainty rises, the extrinsic value goes up and we see this heading into an earnings announcement.

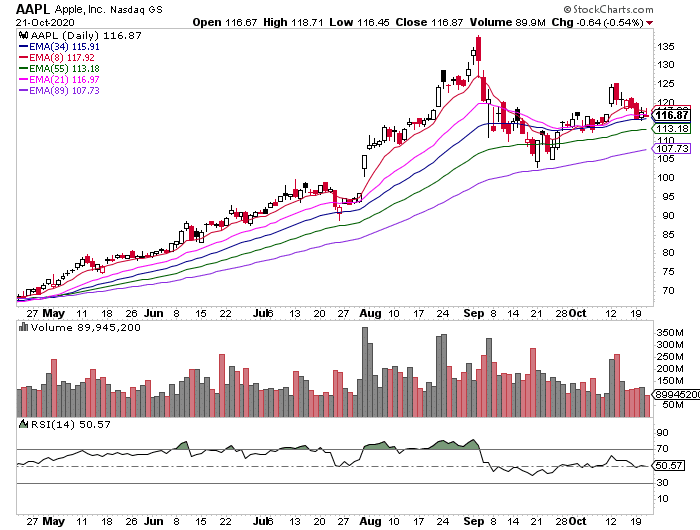

The way traders usually figure out how volatile a stock will be heading into an earnings announcement is by finding the at-the-money calls and puts that includes the earnings date. For example, Apple Inc. (AAPL) is expected to report on Oct. 29.

Since AAPL is trading around $117, I would look at the $117 calls and puts expiring on Oct. 30.

So the at-the-money (ATM) calls were going for about $3.80 on Wednesday, while the ATM puts were going for $3.95. To find the implied move, one would just add those prices, which creates a straddle, and divide it by where the stock is trading.

Here, it would be $7.75 / $117, so traders are expecting a 6.6% move. The key is to uncover continue monitoring the straddle prices heading into the earnings announcement.

The Vol Crush

No matter what the earnings release is, there’s brand new information that just hit the wires and traders have to digest the news. If you think about it, what happens after a company releases earnings? There’s less uncertainty, so the extrinsic value actually drops… unless there’s another key piece of information (such as corporate restructuring, M&A, etc.)

As mentioned earlier, this is known as the vol crush.

If you think about it, this is a catalyst for options to get crushed, and I want to target a lot of bull put IV crush trade ideas, and bull puts on stocks that crush their expected moves. This allows me to collect premium.

So how would I play this?

Well, I would wait until after the earnings announcement, then look for a key level. I find the exponential moving averages (EMAs) are helpful.

So the key levels I would look at here are $113 and $107, which are the 55 and 89 EMAs. I would monitor the price action and see whether it holds, and if it does… I would sell a put spread to take advantage of a potential drop in extrinsic value.

I’ll provide you with an update on any trade ideas I may have, and how I may play them soon.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

0 Comments