It’s risk-off sentiment as we approach the election…

While most will try to put the pieces of the puzzle together, I already know why this market has been bleeding — uncertainty.

Traders and investors hate uncertainty, and they’ve only got a few days to take some risk off before the next major catalyst hits.

Of course, when there’s uncertainty… volatility picks up — and I believe this creates a unique opportunity to take advantage of the pop.

Right now, I’ve got my eye on Apple Inc. (AAPL), as it reported earnings and sold off. I want to go over what I’m seeing and how to trade it around the election and its earnings announcement.

How To Trade AAPL When There’s So Much Uncertainty

On Thursday, after the closing bell, AAPL reported earnings and it wasn’t loved by the street.

AAPL’s earnings per share (EPS) came in at $0.73, while it reported $64.70B in revenues. The real kicker here was its iPhone sales. It missed the street’s expectations by a whopping 20%. Not only that, but the company didn’t provide any forward-looking guidance due to the pandemic.

Of course, it’s AAPL and there is opportunity here, in my opinion.

However, with the upcoming election, it’s a little too risky… so I want to take a step back and wait until after.

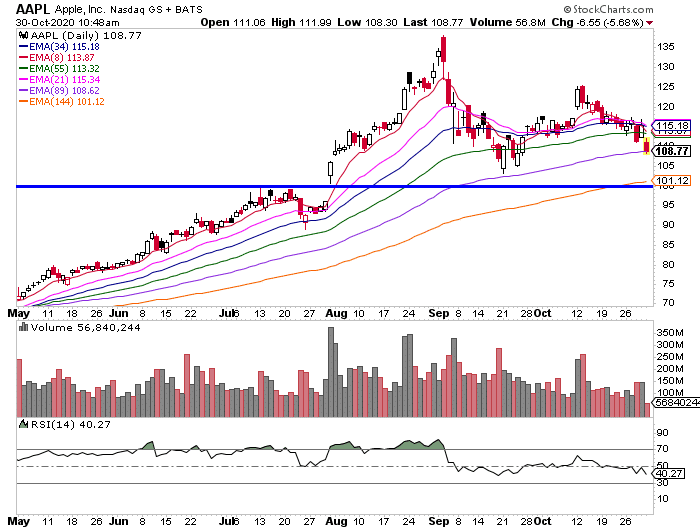

If AAPL closes below the 89-day exponential moving average (EMA) at $108.62, that’ll be pretty bearish action because that support level has held up before.

The next line of defense is the 144-day EMA ($101.12). There’s also a key psychological level around $100, and I think that can act as a support level as well.

With AAPL, I want to wait and see what the price action is like, and I want to wait until after the election. If the stock finds some support and starts to bounce, I think it’s a good idea to look at the bull put spreads.

Why?

Well, first, they would allow me to win in three different scenarios. When I establish a bull put spread, it means I’m betting a stock won’t get to that level. In other words, let’s say after the election AAPL breaks below $100, but finds support around $90 and starts to reverse.

I can look to sell puts with say two weeks until expiration, and simultaneously purchase deeper OTM puts to hedge my position.

That means just as long as AAPL stays above the strike price of the short puts, I’d collect premium. Not only will I benefit from time decay, but I’ll also benefit from drops in implied volatility.

Listen, the same can be done with other large-cap stocks. Again, I want to remain patient and wait until the dust settles.

The key take away here is to have key levels in mind. For me, I love to look at the 8-, 21-, 34-, 55-, 89-, and 144-day EMAs to identify key levels. Of course, there are other chart patterns that can be helpful to navigate this market environment.

That’s why I put together this special training session, so you can learn my two favorite setups that I believe will be useful next week.

Take some time out of your schedule and prepare yourself for a volatile week.

0 Comments