Today’s a half-day, and I’m going to take it pretty easy. Given the way the market acted after it made all-time highs, I think it makes sense to remain patient.

Of course, you’re used to me talking about large-cap tech stocks, but today…

I want to flip the script.

You see, there are just so many opportunities out there and it’s important to keep an open mind. That said, I have a renewed sense of focus and I plan to attack again very soon.

For me personally, it’s helpful to look at charts and key levels — so let me show you which stocks I have on my radar right now… and why I think traders will want to keep an eye on these.

Can These 3 Stocks Breakout In December?

With so many stocks breaking out to highs, it’s important to identify ones in an uptrend that are either near a resistance level or approaching.

That said, let me show you which ones that look attractive right now.

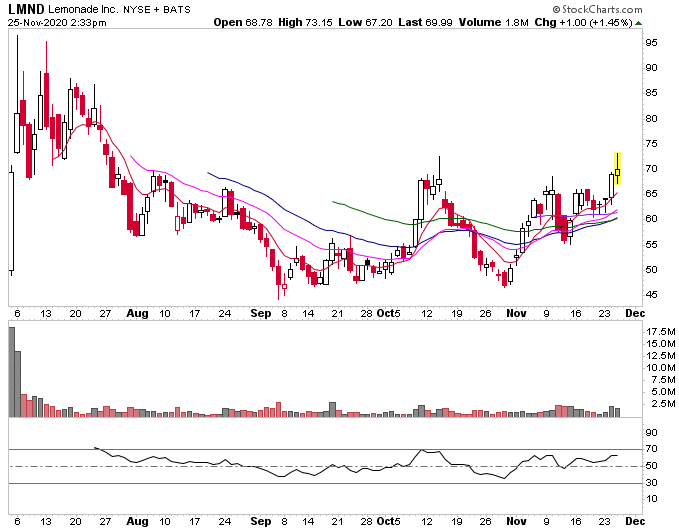

Lemonade Inc. (LMND)

The stock of this disruptor in the insurance space was one of the hottest IPOs of 2020.

The stock opened for trading at $50.06 after pricing at $29 per share on 7/2/2020. The stock went as high as $96.51 in two days but has pulled back as low as $44.11. However, the stock has started to recover.

In the past two days, the stock got some signs of life again with shares holding above the key EMAs and breaking above the triangle. Watch out for a move above $75.

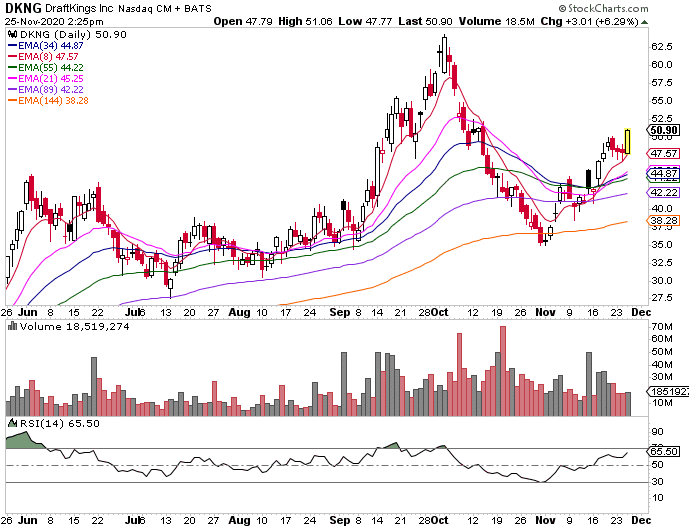

DraftKings Inc (DKNG)

Another hot stock of 2020, DKNG is now starting to look interesting on a daily chart for continuation higher. The stock just pulled into the 8-period EMA and has now resumed its run higher. DKNG looks interesting on dips as long as it stays above the EMAs around the $43 area.

By the looks of it, the stock looks as if it wants to run to recent highs.

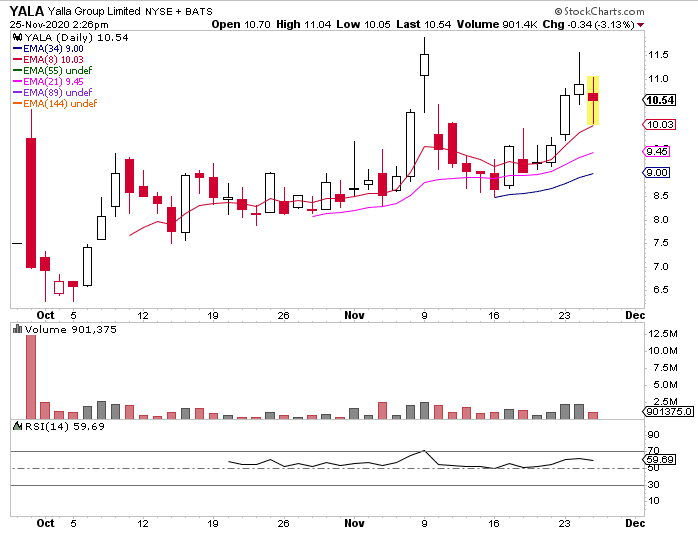

Yalla Group (YALA)

Yalla operates a social media platform in the Middle East and North Africa.

While this stock is a bit less “mainstream”, the chart setup deserves some attention here.

The stock sees strong support at 8-period EMA, which corresponds with the $10 area. Given how hot the market has been for recent issues, the stock looks interesting on dips.

Right now, there are plenty of opportunities at key levels, and the key is to have a plan in place and high conviction.

I want to let you in on a unique opportunity to receive my #1 trade idea every trading day.

I can tell you this is a rare chance to secure a price at this exclusive price.

Given the market environment, I don’t think you’ll want to pass up on it.

Thanks

hanks.

I am ready.

Have safe and wonderful weekend.