On any given day, I notice dozens — sometimes hundreds of momentum stocks poised to run. You may have noticed this before too in the pre-market or after the opening bell. However, I think it’s nearly impossible for one individual to trade all of them (unless they have a trading algorithm).

That’s why I came up with techniques to scan and filter for momentum stocks I believe can move.

For me personally, my process starts with what I believe to be a simple scan and filter.

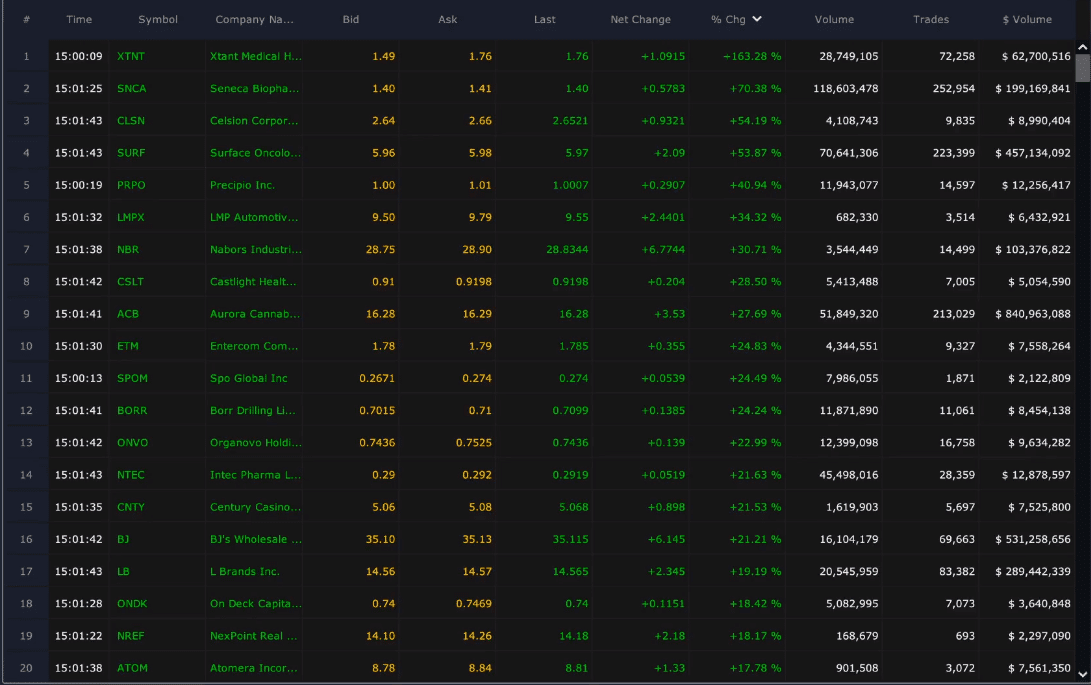

Source: Scanz Technologies

If you take a look at the scan above, you may believe it’s difficult to narrow down this list.

Sure, it can be if you don’t have any patterns or setups to look for. At that point, it’s like trying to find the needle in a haystack in my opinion.

Heck, when stocks are flashing green and red, how can anyone actually be efficient and effective trading these names?

With so many stocks out there to potentially trade, traders often get caught up in all the noise.

That’s why I use a scanner to let me know what’s moving on any given day. However, I’m not just looking for stocks that are gaining on the day… I think that would just be foolish.

For me personally, I don’t just want to trade stocks that are moving, I want to find liquid momentum stocks.

What do I mean by that?

Well, before the opening bell, I look at my scanner and only look for stocks with a dollar volume of at least $200K. I believe the dollar volume provides me a better view of liquidity, in relation to share volume.

You see if I just look at share volume… I would see penny stocks that may not be very liquid. On the other hand, with dollar volume — I can actually try to figure out where the money is flowing.

Now, after the opening bell, I filter for stocks with a dollar volume of at least $2M. If I keep it at $200K after the opening bell, I think there would be a lot of noise and the stocks may not be as liquid.

As I filter through these stocks, I actually sort by % gainers to see what’s moving. Sometimes, I may sort by % losers too… if I want to play potential bounces.

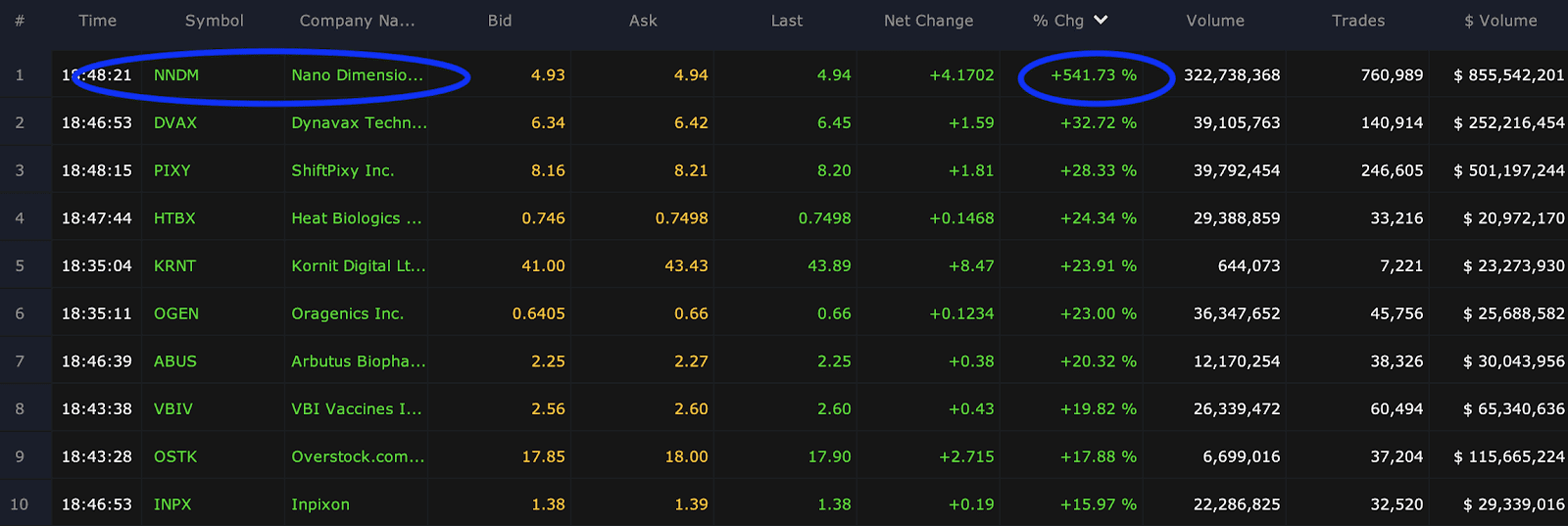

Source: Scanz Technologies

I know what you’re thinking… “What do you do after you scan for these stocks?”

I look for my bread-and-butter setups.

Let me show you what I mean by that with a case study.

Case Study: The Bull Flag Setup & Fibonacci Retracement

One trading day, I spotted NNDM moving… and if you notice, the dollar volume ($ volume) in the scan from earlier… you’ll notice the $ volume at the time was more than $855M. That let me know this stock could have legs.

By following that process, I was able to spot NNDM and another 100% move in the stock.

Why did I think NNDM could run higher after being up a few hundred percent on the day?

Well, there was a catalyst… and my chart pattern popped up.

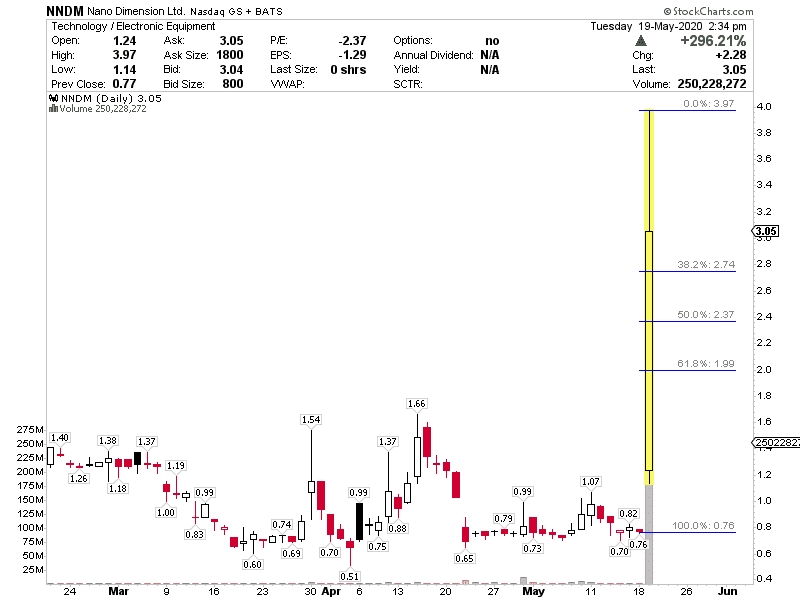

Source: StockCharts

Basically, I noticed the Fibonacci retracement in NNDM, and there were areas of value in the stock, in my opinion.

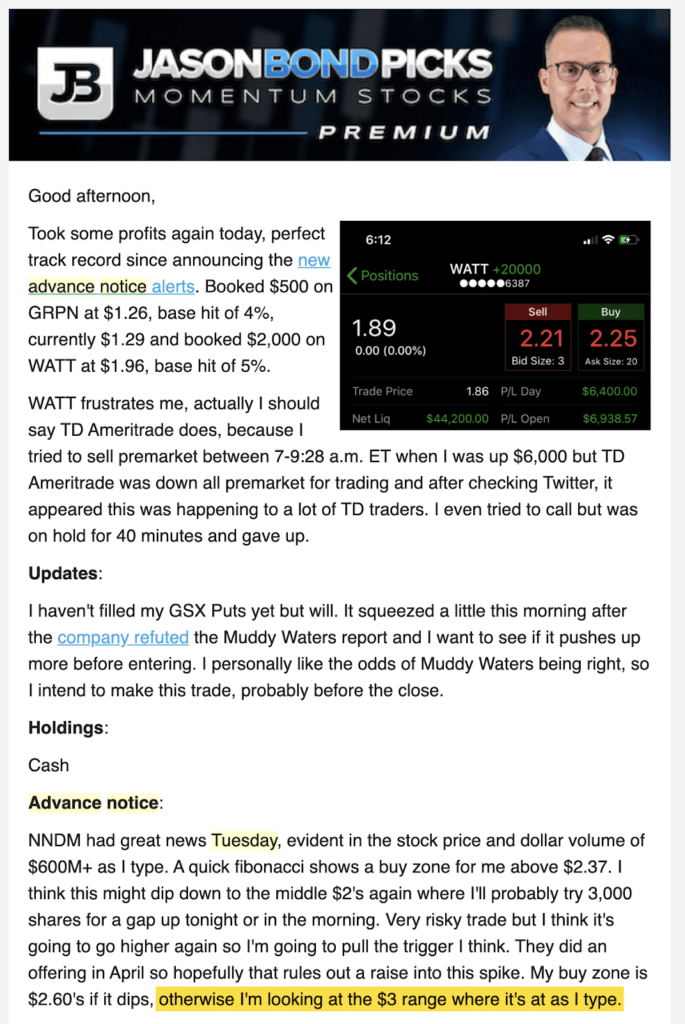

So I quickly came up with a trading plan and sent out NNMD in an advanced notice alert.

Now, NNDM didn’t dip a whole lot and I actually had to wait for the right time to get in. I actually bought shares at $3.21 and intended to hold the stock overnight for a potential gap up…

But guess what happened in the afterhours the other night…

Source: thinkorswim

Of course, I was a little mad because the stock actually ran all the way up above $6!

Source: thinkorswim

I was only mad for a few hours because I actually exceeded my typical profit target of 10-20%.

Instead of moping around… I just went back to the grind and looked for other potential plays from my scanner.

Of course, there are other techniques I use to uncover momentum stocks to trade… and this is just part of my trading edge.

In my next lesson, I’ll reveal to you another one of my favorite patterns and a case study on how I use it to my advantage.

Stay tuned.