Happy Monday Everyone!

The so-called Meme stocks – with AMC and GME being two absolute superstars – gave incredible opportunities both ways…

Then there was the small cap action: MEDS, LEDS, AMST are just a few out of many!

I often say – stick to what’s working.

Momentum names have so far not shown any signs of exhaustion, so why would I reinvent the wheel?

Here’re 3 small cap stocks I’m keeping on my watch this week:

Novan, Inc – NOVN

- Market Cap: 137.11M

- Free Floating Shares: 14.07M

- Short Interest: 2.18%

- ATR: 1.72

Summary: After a major crash following a disappointing trial in early 2020, NOVN, a biotech stock, has lived a life relatively obscure and forgotten.

There was an attempt at a run up in February – March, but that didn’t really lead anywhere either.

All of this changed last week – the company put out promising updates on 2 of its ongoing trials: Phase 3 trial for treatment of Molluscum Contagiosum and Phase 2 trial for treatment of COVID-19.

This could be what I like to call a “changing fundamentals” trade. The name speaks for itself – a new piece of information comes out that gets investors excited about the company. I also like the fact the stock just had a 1:10 stock split, reducing the number of shares in circulation.

The action will likely be wild – to consider a long, I’d like to see clear support above $17 for a potential move into $25.

Vinco Ventures – BBIG

- Market Cap: 129.11M

- Free Floating Shares: 19.08M

- Short Interest: 23.92%

- ATR: 0.63

Summary: I’ve been keeping the name on my watchlist ever since the incredible move in early January: the stock jumped from ~$1.5 to a high of nearly $10 in a matter of 1 day. It’s given most of it back, but gained some traction over the past 2 weeks.

The company has historically been pretty active putting out PRs – coupled with its short interest and current position on chart, this can be one explosive combination.

I don’t want to get ahead of myself and need confirmation first – if the stock holds the $4.5 area well, I would consider a long position for a move into the $7 area.

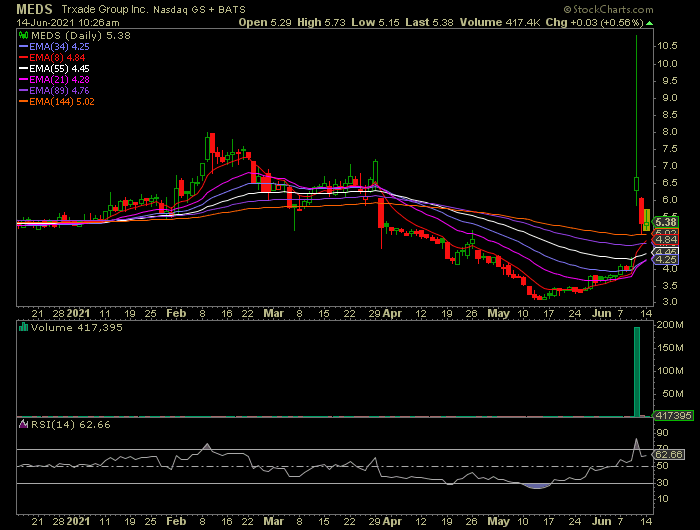

TRxADE Health – MEDS

- Market Cap: 54.20M

- Free Floating Shares: 3.28M

- Short Interest: 0.1% – likely, inaccurate given last week’s action

- ATR: 0.76

Summary: Similarly to NOVN, MEDS is a name that likely hasn’t been on many watchlists.

Last week the company announced it’s COVID-19 Health Passport App and it sent shares ecstatic – from $4 to a high of $10.82 in a matter of one session.

While one may argue how significant the news is, I do need to go by price action – the stock has retraced a lot of its gains very quickly and I won’t be surprised to see at least a bounce from current levels.

I like any hold above $5 and then above $5.50 to consider a long trade against these levels with a target at $7.

Pro Tip: Confirmation is Key

Even if this is the very first time you’re seeing a watchlist by me, you might’ve noticed common language between all three picks – to consider a trade I want a stock to “hold above” a key level.

In trading we call this “confirmation” – the key decision making component that may convert a name from one of the many you’re watching into an actual trade.

Confirmation “validates” your thesis.

If you would like to go long – seeing all dips get bought and a stock hold a support area cleanly may “Confirm” to you that there is significant demand

Conversely, if you want to be short – failure to hold higher and continuous push backs from a resistance area may rightfully confirm there’s overhead supply.

Patiently waiting for confirmation vs entering just because something looks good – is one of the keys to becoming a skilled trader.

0 Comments