Good evening,

My large stake of 400,000 shares of LQMT at $.21 is inspired by footprints made by this company and to where these footprints are likely to lead. Hint: Liquidmetal new chairman and CEO, Professor Lugee Li (56), has embarked on a new venture and market that’s much bigger and profitable than the present commercial materials market his $661 million company, Dongguan Eontec now services.

The key to understanding the truly massive potential of LQMT must be gleaned by way of following the the company’s footprints. The driving force behind Liquidmetal Technologies is Professor Lugee Li. Essentially, Professor Li is the company, so allow me to tell you what I know about Li.

First, Professor Li spent his college years studying materials engineering, and achieved a Masters degree in the field. He, then, began teaching at colleges and universities throughout China, more than seven, in all.

At the young age of 33-years old, Li founded Dongguan Eontec an advanced materials company listed on the Hong Kong stock market as a $661 million enterprise. Since the founding of Dongguan Eontec in 1993, Li has sat on at least six boards of directors of companies involved in advanced materials for various commercial markets, primarily the medical devices industry.

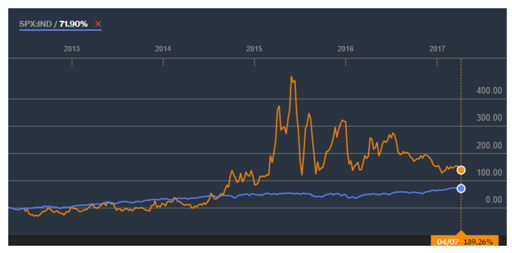

Below, is a chart of the performance comparison between Dongguan Eontec and the S&P 500. The orange line is the stock performance of Dongguan Eontec, and the blue line is the performance of the S&P 500.

From the stock performance of Dongguan Eontec, I surmise that Professor Li is not only an expert on advanced materials, he’s a good businessman, as well, the latter of which is of the most importance to investors of LQMT, of course. At last look, Dongguan Eontec is expect to earn a triple-digit increase in profits this year.

In December of last year, Li gained control of Liquidmetal with a majority stake that cost him approximately $41 million. He raised that cash from liquidating nearly 5% of his holdings of Dongguan Eontec in July 2016. So, it appears that the modus operandi of Professor Li is to take complete control of each of his companies within his budding empire and grow them rapidly.

The major players in the new field of ‘liquid metal’ alloys number only three:

1) Eontech (Liquidmetal): Liquidmetal is a spin-off in 2003 from California Institute of Technology (Caltech) and holder of numerous patents in the field of liquid metal. Essentially, Liquidmetal holds much of the legal power of this technology.

Since the company’s inception in the 1990s, Liquidmetal has sought to commercialize these leading-edge metal alloys, but has been unsuccessful in the past for the principal reason of the high entry price for entering the market. Liquidmetal needed big capital, and Li has now provided it and taken control of the company as part of his Dongguan Eontech business in China.

2) ENGEL, a privately-held Austrian company, founded in 1945, makes specialized manufacturing equipment for the production of advanced materials. At $1.6 billion of annual revenue, this company is the premier maker of industrial machines in the global advanced materials market. But ENGEL is not a direct competitor of Li’s.

3) Materion (MTRN), a publicly-traded company base in Ohio, is in the business of producing specialized materials, a US competitor of Li’s. At a market cap of $702 million, Materion is approximately the same size as Dongguan Eontech, and is a Certified Partner of Liquidmetal’.

Since Professor Li took control of Liquidmetal in December, he hasn’t wasted time positioning the company to service awaiting makers of consumer products and medical equipment. By March 2017, Li bought a manufacturing facility and machinery to begin production of liquid metal components. But the mystery is: who is/will be his customers?

I’ll first begin with the possibility that Li is angling to service the medical device industry, either initially and/or as a longer-term strategy. The number of applications in the medical devices industry for liquid metal is too numerous to address in this small space. And needles to say, the market size is billions of dollars per year of revenue. But I’m not convinced that Li’s fast-moving steps of taking control of Liquidmetal, buying a manufacturing facility and ushering in production machinery within a span of only three months points to a ready customer in the slow-moving medical devices industry.

Which leads me to a much more likely customer: Apple Computer (AAPL). There’s been a lot of speculation as to Liquidmetal’ connection with Apple Computer, and for good reason. Apple is famous for bringing leading-edge consumer products to market first, including products known for their ease of function and beautiful design.

For a good synopsis of the facts that suggest Apple is primed to incorporate liquid metal technologies into its iPhone series, read this well-written and informative article of March 31 on PatentlyApple.com, entitled, Apple Patent Describes using Liquid Metal (Metallic Glass) for the Backside of an iPhone, wherein the author restates the ‘smoking gun’ section of Apple’s application at the US Patent & Trademark Office to register a new patented design of its iPhone, which includes liquid metal as the material of the backside of the device.

The relevant text contained within Apple’s application is as follows:

In some embodiments, the metal substrate may be a metallic glass substrate. In some embodiments, a metallic glass coating is deposited on a metallic glass substrate to form a coated metallic glass. Pulsed radiation is applied to the coated metallic glass to form a metallic glass with altered chemical composition.

Liquid metal has always been filed in mysterious patent filings with only vague references to devices that might use the material but never a direct link to a specific product UNTIL NOW. In fact, in one very specific patent point reveals that the backside of an iPhone may be made of a metallic glass substrate with an added metallic glass coating for extra strength. Could this be what Apple will use for the iPhone 8 in order to make the glass crack proof?

Okay, Apple’s iPhone 8 (iPhone X) is anticipated by many analysts to be released no earlier than September of this year. It’s been suggested that the iPhone 8 will feature wireless charging, have no physical buttons, and sport an all-new design. For now, these suggestion are mere speculation, of course. But consider the effectiveness of wireless charging technology is greatly enhanced by removing interference caused by the material used in the device being charged, the urgency to incorporate liquid metal into the iPhone becomes crystal clear to me.

After the information gleaned from Apple’s most recent patent application, the issue of the features slated for future models of the iPhone (after the iPhone 7) may now also include the composition of the backside of the iPhone. Will the backside material of the iPhone 8 include liquid metal? If not, the odds of the next iPhone (after the iPhone 8) featuring these new composite materials for the sake of being able to remotely charge the device soar.

Here’s my bottom line to my thinking behind LQMT. Apple is on the cusp of incorporating liquid metal into its iPhones series. Taking a stake in LQMT now may even be a better buy for traders than waiting to buy some shares after developments surface at Apple and/or Liquidmetal at a later time.

But one thing I know, Apple and Swatch (VTX: UHR) have licensing agreements with Liquidmetal. Does the picture now become more clear? Apple has aligned its ducks with Liquidmetal before any other Apple competitor can negate any competitive advantage Apple has always enjoyed in the mobile device and other markets.

Much like a biotech stock running ahead of a scheduled FDA ruling, if traders wait too long, LQMT may become merely a good play (or bad play), not a potential ‘jackpot’ play. I’m holding now for the distinct possibility of a jackpot play on my investment heading into the iPhone X release date, not just hoping for a base hit. Just the speculation and hype surrounding the latest revelation that Apple plans to use liquid metal, alone, is worth the price of admission.

Trade wise and green!

Jason Bond

Disclosure: I am long 400,000 LQMT at $.21 and plan to hold for a few months heading into the iPhone X release.

Hi guys and gals.

As many of you already know I taught for 10 years in a NYS public school, had a negative net worth and just a few thousand in the bank at any given time. But through trading I was able to change my circumstances –not just for me — but for my family as well. I now want to help you and thousands of other people from all around the world achieve similar results!

Which is why I’ve launched my Millionaire Roadmap. https://www.jasonbondpicks.com/millionaire-roadmap

I’ve already created 1 millionaire trader and actually gave him a Porsche to celebrate the achievement. https://www.jasonbondpicks.com/kyle-success-story

Now I’m extremely determined to create many more millionaire traders out of my students and hopefully it will be you.

So when you get a chance make sure you check it out.

Jason Bond

One of the problems is the Apple deal with LQMT gives them no revenue if Apple does use it in the new iPhones. Apple also has rights to LQMT in all consumer devices. So basically LQMT can only make money in commercial (medical) markets. This is my understanding of the Apple contract. Not sure if it expired.

For some reason Apple didn’t acquire LQMT. If they saw huge potential the small acquisition would’ve been a no brainer for them.

They can’t get royalties/license fees, but they CAN manufacture for Apple. That’s where the money is anyway. Lugee has the machinery to do it and the alloy that is 1/3 the cost of Materion’s.

Maybe it wasn’t for sale.

They have access to many other areas of business, cars, industrial, medical devices etc. Maybe Prof. Li wasn’t keen to surrender his lifes work just yet…….

Smaller investor here long 5 k shares at .24. Thanks jb

guess you were wrong huh?

Well, no liquidmetal in iphone 8 or X. Stock tanked on Friday. Will sell off continue on Monday? Or will it rebound? I’ve been holding for a few years with an avg price of .13 so i will continue to hold. I really thought it was gonna make a run to .50 there for awhile until the no apple news sell off. Hoping it at least settles in the .30s until definitive news. I know Li bought a bunch of shares at .26 so perhaps that is where the bottom will be.

What do you think about Apple’s latest patent with Glassimetal? How can that affect Liquidmetal?

Apple really isn’t the play here, nothing has ever come from that deal they have outside of a runup into product releases, which is a great way to play the stock. Maybe something does happen but that’s not what I’m betting on, it’s just a nice secondary catalyst. I’m playing Li’s ability to build a small co big and with LQMT I think he’ll do that.

I have been following LQMT since iPhone 5. There has been several patent around that time as well, LQMT went to .33! The black tuesday every September never seems to fail. Wait for a pop and sell people!

I no longer see lqmt in the portfolio. Updates?