With thousands of premium clients who I communicate with daily through email and the largest stock chat on Wall Street, I have a unique perspective on the most common mistakes beginners make.

Additionally, I too made many of these mistakes early in my trading career so trust me, I’ve been there. Knowing what to avoid is quite often a quicker path to success. We all want to make money quickly but I assure you, if you lack of discipline in trading you’ll lose money quickly. Here’s how I see beginners get hurt, please read carefully.

1. FAILURE TO INVEST IN PRACTICE

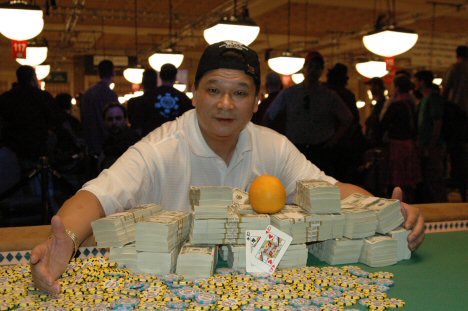

As a tourist and beginner poker player, if you were to sit down next to Johnny Chan in Vegas, who won the 1987 and 1988 World Series of Poker main events, it’s highly likely he’d clean you out in no time at all. Wall Street is the same as poker, if you win somebody else loses so get educated before getting cleaned out.

TD Ameritrade’s paperMoney is a groundbreaking paper trading application available as a downloadable platform. With paperMoney, you have access to a virtual margin account and $100,000 of “play money.” From there I ask they study my 8-hour $497 workshop The Basics of Swing Trading (FREE to clients), my video lessons and read Steve Nison’s The Candlestick Course. Apply my swing trading video lessons and see if you make money. As you do, your confidence will grow. Don’t play poker with Johnny Chan until you’re ready, trust me on this one. A good example of investing in practice was when I went to college to become a teacher. I spent a total of 6-years and about $70,000 getting my undergraduate / masters degrees. There’s also the loss of earning income during those 6-years of education to be factored in. Upon graduation I still had to find a teaching position which is extremely competitive. At the time the best school districts were paying $34,000 / year. I worked hard and was lucky to get hired right after graduation. So again, I invested 6-years, $70,000 and the loss of income during the schooling just so I could interview for teaching jobs. If you want to build wealth on Wall Street, learn how to do it first, I can teach you.

2. DAY TRADING

Last week I read a scary statistic that 95% of people who attempt to be a day trader lose money. Jason Bond Picks was built on a foundation of swing trading. Yes, there are elite day traders in my stock chat, but the majority of my clients are swing traders. Day trading isn’t for everyone as it requires the ability to think fast while handling extreme levels of stress. I have nothing against day trading, in fact it’s very popular at Jason Bond Picks, but if you’re a beginner STAY AWAY!

I put this warning out in my welcome email yet I can’t tell you how many clients email me later saying they wished they’d listened. If you want to become a day trader use the paperMoney account to practice and do NOT skimp on the amount of time you practice this. I’ve seen people flush money down the drain so fast day trading it’d make you sick. If it’s a true dream of yours we’ve got the biggest stock chat on Wall Street full of pros but put your time in first, you’ll know when you’re ready.

3. OPTIONS TRADING

There’s a reason your broker requires and additional application here. There are huge returns in options so it attracts traders with small accounts, when they are in fact the last traders who should be participating in this type of volatile trading. Remember, if there’s huge returns, somebody is on the other side of that return i.e. huge losses too. Trust me when I say trading options before you’re an expert trader is like having a loaded gun laying around, something very bad is going to happen sooner or later.

I firmly believe options should require a degree but Wall Street isn’t setup that way so be careful. I warn against options trading in my welcome email yet this is the #1 way I see beginners blow up there account losing all their money. There’s nothing wrong with trying to learn options, obviously many are successful at it but if you’re a beginner don’t even think about it. You’ll thank me later as you hear the horror stories from guys and gals in chat who’ve either messed up themselves and had to rebuild or knows someone who did. Again, this is the #1 way I see traders blow up and those emails always start with, “Jason, I wish I listened to you.”

4. USING LEVERAGE

I do not trade on leverage, period. Yes, I have a margin account, but I’m almost never over my cash balance. Trading stocks on borrowed money is asking for trouble. I don’t get these emails often but when I do it’s painful to read.

No matter how good the stock looks, it’s never good enough to get a 2nd mortgage. I’ve written about why I don’t believe in borrowing money of any kind to include car loans, credit cards, and even mortgages so you better believe I don’t borrow to trade volatile stocks.

5. HOLDING THROUGH EVENTS

Holding through events is what I’d consider gambling, but unlike Vegas, there’s no free entertainment and booze. No matter how much you think you know about a company’s earnings, FDA ruling, etc… it’s still 50/50. Let’s be honest, the only people who know for sure are insiders and since it’s illegal to trade on that information it’s impossible to have an advantage.

Remember, I’m referring to swing trading, not long term trading. I can’t tell you how many emails I get from clients that start out, “I wish I didn’t hold through earnings.” Event trading just isn’t a part of my strategy. I do not hold through earnings, FDA rulings, court rulings or anything of that nature, it’s simply too risky and I see more people get hurt than win here.

6. FAILURE TO CUT LOSSES QUICKLY

This is my #1 rule at Jason Bond Picks… CUT LOSSES QUICKLY. To cut losses quickly you must enter the trade with a game plan. Entering a day trade and turning into a swing trade because it went against you can be extremely risky. Entering a day trade, turning it into a swing trade and then turning into a long term trade is even worse. You might be laughing right now but I see it happen all of the time. When I take a swing trade, defined by Investopedia as a 1 – 4 day hold, I’m looking for my profit during that time. Very rarely do I stretch it unless there’s a good reason. Failure to have discipline in this area will cause more problems than you can imagine. First, you’re trading without a plan – that’s dangerous and undisciplined. Second, while your money is tied up in a loser you’re missing out on winners. Let me give you an example. Last week I woke up to bad news on one of my stocks. Since I didn’t expect this news and my stop loss was hit, it was time to move on. It’s painful losing money on trades but losing is part of the strategy I teach because nobody can escape it and be right 100% of the time, so you better have a plan on how to handle it, which I do and teach. That same stock opened lower the day after I sold it, so had I not taken the losses, even more losses and stress would have piled up.

Even more important, since I wasn’t distracted with the losing trade I was able to hit 3 winners to finish the week which recouped all of the losses and then some. Had I sat on the loser, I’d have missed the winners and still be at a loss hoping the loser comes back. Bottom line is this. You don’t have to agree with me here but you better have a plan because if you don’t you won’t know what to do when the unexpected happens. I can’t tell you how many, “I’m stuck in XYZ” emails I get and each time I gently remind my client, “You are not stuck in anything, you have choices.” Be disciplined, you’ll thank me later. By the way, I learned this the hard way because much of what’s written above, I’ve done myself in the past but not anymore.

7. NOT TAKING PROFITS

In Kindergarten Cop Arnold Schwarzeneggar was establishing classroom rules when he bursted out, “YOU LACK DISCIPLINE” to the students. My wife loves that movie, she teaches first grade. I think we can all agree it’s normal for a kid to lack discipline but there’s no room for it with adults on Wall Street.

There’s no 20 / 20 trading at Jason Bond Picks. Stocks go up and down daily, they are dynamic. If you enter a trade and you don’t know what your exit is, how on earth will you determine when it’s time to get out?! I have a video lesson that teaches clients the psychology behind paying themselves and it’s quite popular. How many times have you been up nicely on a trade only to give back all of your profits and sometimes worse, take a loss. That’s sickening! I say this over and over in my daily watch lists and alerts. GREEN is better than EVEN, EVEN is better than RED. This means if you get GREEN on a trade, in most cases do not let the money slip away, however small it is. And if you get back to even by not taking profit, by all means do not take a loss. Hoping it comes back is not a solution either, all that matters is what you think the trade will do next. Like many of the DO NOTs listed in this blog post, I’ve learned the hard way here. Bottom line is this, establish a consistent method for how you plan to exit trades. For me it’s simple, I look for trading ranges of 20% and inside those ranges I try to capture 5-10% knowing I’ll never get a perfect entry or exit. And I never want to hear, “Darn Jason, I sold too soon” come out of a clients mouth. Goodness, if the stock continues to advance you should be happy you’re picking the right trades. You’re NEVER going to  catch the top consistently but you can capture consistent 5-10% returns. I’m like a robot in this regard, I set my sell for half my position at 5% profit and let the rest ride for 10% profit. Therefore, a winning trade for me is about 7% profit. Do that consistently and you’d be shocked how fast profits add up. I nearly tripled the S&P 500 in 2013 applying this and the S&P 500 had a monster year. Failure to have a profit plan within your trading strategy is asking to fail. Be disciplined, know what you’re looking for on your swing trades and stick to it. Once you take this initiative you’ll find you are in fact in control and that’s the only way to stay alive on Wall Street.

catch the top consistently but you can capture consistent 5-10% returns. I’m like a robot in this regard, I set my sell for half my position at 5% profit and let the rest ride for 10% profit. Therefore, a winning trade for me is about 7% profit. Do that consistently and you’d be shocked how fast profits add up. I nearly tripled the S&P 500 in 2013 applying this and the S&P 500 had a monster year. Failure to have a profit plan within your trading strategy is asking to fail. Be disciplined, know what you’re looking for on your swing trades and stick to it. Once you take this initiative you’ll find you are in fact in control and that’s the only way to stay alive on Wall Street.

Thanks for this email really puts perspective on Every thing

We do at jbp. You not only tell us how to make money but also how not to blow it in losses

I teach trading, that’s correct.

Jason, you talk about the huge amounts of $$$$ you make on your trades. Your trading account must be rather large. I just a small frey in the markets trying to out live my retirement. I have been burned with options (using different strategies) . What is the minimum amount one should start with swing trading?

There’s clients with $5,000 and others with millions, I start each year with $300,000. The service isn’t about keeping up with the Jones, it’s about each person having goals and striving to hit them.

Great article! Regarding risk management, what percentage do you invest in each stock considering you start with $300k per year? Do you adjust percentage based on price of stock or risk/reward?

Thank you for your response.

So at the start of 2013 I was doing 1/10 – 2/10 or $30,000 – $60,000 looking for +10% on the winners or $3,000 – $6,000. As the portfolio grew across the year 77%, by the end of the year I was doing the same 1/10 – 2/10 or $60,000 – $120,000 and making $6,000 – $12,000 on the winners. Each trader should have their own goals. I provide a baseline but there’s thousands of different $$$ amount portfolios at JBP so each trader must figure this out for themselves. I will say this, I think it’s risky being all in on one trade.

Jason real fun/true to read! Good work there, Sir!

Boy did you nail it on this article, and you hit me with #6 – Not cutting losses quickly. That’s been the hard part for me. I hate to lose at anything and losing on stocks is horrible. I guess I should think about it like a baseball game – losing an inning is ok as long as you win the game. I’ve benefited, financially and educationally, from what you are teaching here and know that as I study and listen and read I’ll only benefit more, in all aspects. Thanks for everything.

No problem William, appreciate the note.

Great Read..

I say it once and I say it again, JBP changed my life forever! Love the strategy, waking up to the watch list, and the professionalism on the chat… #PayYourself

Very good article, everybody who reads the lessons should take your advice. I have unfornutely have made 4 out of the 7 mistakes, but still I have made money and am ahead of the game. Please listen to Jason, it will help you. Practice b4 trading. Don’t get over your head, study and know what you are doing, pay yourself, and have it in your head that all trades could be testing a bottom. Have several exit strategies, one for profit and another to minimize losses. I believe these are the most valuable lessons you can teach. Thanks J!

PS – keep studying this lessons for maximum effect!

Hey JB, great job you do there. What’s your personal percentaged limit to cut losses?

PS: Your lessons already reached Germany 😉

Awesome on Germany, thanks Chris. So on swing trades I’m trying to hit 5-10% profit in 1-4 days while managing losses to 1-3%. If you can hit anything close to that and win 50% of the time you should be making good money.

Great article. You can never say those things enough and to have them all in one place really makes the advice stick.

Jason, it you are someone who has $ 1000.00 to invest. Is it the correct thing to do to buy a “seat” for $ 297 for a quarter and to learn and invest with you. (Which leaves only $ 703 to invest). There are many of us out here who are very small investors and don’t have the $5K to invest. Is there a service geared to us?

Just wondering and appreciate your opinion. I have looked over your information and participated by listening in on your free Chat days in the past and really appreciate the info, however, wonder if this is geared more for the people with “more money than I can invest.” Thanks much.

The service is geared toward teaching to be honest. You could learn with a $100,000 paperMoney account at Think or Swim. As far as getting started with $700, that depend entirely on your goals. A 10% win on the full balance is $70 minus $20 in commissions.

Jason, it sounds like I would be in the same boat as Frank as far as not having but maybe 1000.00 to invest. Would you only be recommending pink sheet stocks for my portfolio and what’s your profit/loss ratio on pink sheet stocks?

Thanks

Al

I think you’re better off learning with a $100k paperMoney portfolio at Think or Swim while you build your wealth doing what you do well in life. So if you’re a teacher, save up $50,000 while learning with paperMoney. Then make the switch. Trying to game OTCBB with $1,000 and turn it into $1,000,000 can be done but so can winning the lottery. Odds are against you but earnings $50,000 and then building your wealth is a proven strategy. I’m not pitching a get rich scheme like some of the other newsletters out there, I’m teaching people to build their wealth.

Have you ever thought about getting on to Ditto trade?

No sorry, I have not.

Great Article JB.

Number 6! It’s not just smaller/amateur traders that get caught out by it either. If you look at some of the biggest trading losses in many cases a loss of millions or billions of dollars has grown out of a much smaller loss, which they’ve then tried to win back.

I recently read a review that said the paper money account on Think or Swim was to complicated for beginners. Also, I am wondering if a person without a lot of cash to invest, when he/she starts trading for real, would be better off with a deep discount broker to avoid the higher relatve commission?

Learning anything new is coming to be a bit complicated Dennis, if you want it bad enough you’ll get right down to it. They have plenty of training videos on how to use the system, as well as classes I believe. You could learn your trading there and then switch to a discount broker, yes.

Thanks for the article. I went to one of those free “high profile motivational speaker galore events” a few years ago and signed up for a two day seminar on investing. I don’t remember if they taught that options was the smart, safe way to invest, or if that is just the way I processed the info. Thanks for helping me see what I need to concentrate on, and what I need to avoid, as a beginner.

I will open a Think or Swim trading account, while I continue following your blogs.

Sunday 7:27am I just bumped into your website and signed up for the email alerts. I enjoyed your pitch and don’t mean that derogatively. I was in sales for 20yrs and even the word HELLO… is a pitch. I understand that option call/puts are where the money is being made and don’t understand them yet. I do hope you can help. So we’ll see Jason, I’ve got a little cash but you have to prove yourself before I spend on your news letters. I’ll watch, listen and playout your hands however If I do not make $ before the free trial on your emails stop then I’ll start looking for other advisors. Sound fair enough to you? When I say make $ I mean let’s say $100 bucks. At that point I’ll subscribe,follow and contribute. I currently use fidelity and they have paper money for scenario as you’ve mentioned to learn, project and practice much like what you’ve mentioned. So I look forward to your emails and possible a trip together. My oldest girl has listened to my recommend buys and made mucho plenty. DLGY ( suit pending ) TASR and a few others that rode frm $12 to $96 and back dwn to $25ish. Day trades but profitable. I want to lean options where the money is vs individual trades I believe so lets get going.

Rds,

Michael

Below you recommend logging into wordpress, twitter, facebook or google. Do I really need them?

I can see a twitter acct for quick messaging but is there really any need to use the others?

This article is spot on, I have tried penny stocks on my own, and only made money when I took profits in a timely manner. I had one position that I bought at .09, and I set a sell limit at .27 hoping for a big payday. The stock made it to about .24 and then started slipping… and like an idiot I hung onto it hoping it would turn back up. If I had had the discipline to take those profits at around .20 … Instead I settled for a measly +.03 per share (at least I got that much). Well, lesson learned and on to the next chapter.

Just signed up for a paperMoney account, time to practice while I save up some meaningful capital.

thank you for all the info here i have been trading just a short while but learning and trying out your ideals on TD Ameritrade and have learn a lot from what you have been saying thank you i am a newbie at this but ho;ding my own so far

Welcome! Keep me posted.

Hello Jason. Do you always use TOS as your platform?, like as in Forex they use MT4!

I wonder, when i have a real broker account somewhere, do i have to use TOS also to analyze the stocks or is TOS also a good broker for this type of trading?

Maybe for me it’s different, because i live in the netherlands!

Thank you for your reply!

No, I use E*TRADe PRo. TOS is good for paperMoney though to start. I also like Interactive Brokers if E*TRADE isn’t available in the Netherlands.

Hi Jason, I’m a student looking to make some income as an alternative to a part-time job. Is swing trading suitable for my position?

Yes I believe so, swing trading is great for people who can’t or don’t want to day trade. Start with paper trading to be safe while learning. Treat it like another education.

Hi Jason,I am a student looking for extra income by swing trading. I know very little, but am willing to learn as much as possible, where do I start and where is the best info for me to learn from?

Start here with us. Use Think or Swim’s paperMoney to practice the lessons on the website. Good luck and keep me posted.

Hi Jason,

I’m based in the UK and have a full time job so just looking initially to make some extra income (in time of course) from the methods on here. Looking forward to learning everything I can!!

Welcome Rob, thanks for joining us. Watch the video lesson and let me know if you have any questions. JB

Jason, I am a student looking to invest around $1,000. Do you have recommendations on what areas to strongly focus on while learning Think or Swim PaperMoney?

Yes, Think or Swim’s paperMoney is a $100,000 paper trading platform that will allow you to study my lessons and apply them without any risk of using real money. That’s where I’d start. Also read Steve Nison’s The Candlestick Course book to get a firm grasp of technical analysis. Keep me posted. JB

Why Candlestick Course? Nison himself says do other technical analysis first, and then add Candlesticks, for better oomph. Also, I already trade options, and made decent money last year $200,000, on 1million portfolio. Do you thnk I would be better off doing Swing Trades? I am looking for a way to spend less time on the computer, than I do now.

Hi Thomas, congratulations on the excellent return last year. I can’t say if you’d do better, I’ve never personally spent a year doing just options so I don’t have a baseline to compare to. I made a 31% return in 2014 on a $236,000 account last year. As far as candles go, if you were doing options I’ll assume you had a baseline already? I think his book goes well with what I’m trying to teach and the combination clearly explains the first 3 chart patterns I teach.

Hi Jason, am in Tanzania East Africa i wanted to know if this wall street business would work for me before i subcribe

I don’t see why not, I have clients in 60+ countries.

Hi JB , i used to trade in the 90ies when u could pick a stock and it would fly but after the tech bubble, i still made profit after the bust but have never really been able to trade again for if i did i would usually break even at the end of the year and to be honest u are the only person that i have found that i trust for the 3 day chart schools never helped but u have them up their so i can watch them over and over and i always put in a tight stop loss and a sell at 5 or 10 percent and i am in my 60ies now and am happy if i only get 5 percent but being involved with your site has made me a better trader and maybe i take small gains but like u say green is better than waiting for the red

Thank You

Bill Moran

Good article. Glad you included it in today’s watch list. Regarding # 6, I would remind everyone that a trader always regrets when they didn’t sell for a small lose, instead the trade got away from them and they suffered a larger lose. Much easier to recover! Just food for thought. Thanks for all the lessons!

Sincerely,

Shawn

When I get back in,TIGHTER STOPSwill be my motto.

Good information, Im about ready to pull the trigger but I have one question, what trading service to you recommend and why?

E*TRADE Pro has the best platform, low fees and good customer service. After that I’d go with TD Ameritrade, pretty much same as E*TRADE Pro.

I APPRECIATE YOUR INFORMATION. I WANT TO START TRADING AND NEED THE ABC SO I DO IT RIGHT. I HAVE A BUSINESS BACKGROUND AND CAN LEARN. YOUR INFORMATION SURE LOOKS LIKE YOU CAN HELP ME.

THANKS AGAIN,

ALAN WEED

Greetings Mr. Bond,

I have been trading stocks since 2008, including OTCBB and other penny stocks. I just joined your website and am excited to hear your perspectives on the markets. I was wondering if there was a way to ask your reccomendations on penny/OTC stocks? I have a rather extensive watchlist and was curious what you thought about some names. AVL in particular..Thanks!

Hi Gage and welcome. I really don’t trade OTC anymore because I find there’s better / consistent opportunity in stocks under $10 on the national exchanges.

What if you don’t have a lot of money to start. Is this a loss cause???

Learning how to trade with something like Think or Swim’s paperMoney is never a lost cause. How much you need to get started truly depends on your goals, only you can determine if it’s worth your time.

Hey Jason,

Do you trade and send alerts for canadian stocks (TSX)?

Just NYSE, NASDAQ and AMEX.

Can you start your capital with like at least 200$ because thats all I have to spare, If not can I do it in binary options?

I joined the $99 alerts and i did not make benefits because i did not read all Jason’s words seriously , i mean it !!!

i was green and i did let it to go even and i sell when it’s red, now i am looking for a discipline book while Jason said it in the first place.

Now i will not be greedy and start over with fresh and slow baby steps.

In the member section there are loads of tutorial videos, can you me ones that i should start with ? as they reached 69 videos and i want to recap the ground knowledge ones.

Hi, isn’t swing trading supposed to be riskier than day trading? why you think the other way? thanks

Day trading is much harder I think. The only reason swing trading would be perceived riskier is if you consider the overnight hold exposure but even that can be managed pretty well I think.

So, do you have the Ameritrade transaction records as a proof of your claims?

I use E*TRADE and yes, check my Twitter, I post them all the time https://twitter.com/JasonBondPicks

Hi Jason, I just came across your website and I’m glad I did. I look forward to learning from you.

Welcome, let me know if you need anything.

I saw you recommend doing paper trading for a year before using real money. So am I correct in my understanding that in order to fulfill that recommendation, it would cost me $1200 before even investing actual money? Also I saw you recommend saving $50K to someone before they get started. That’s more than I make in a year and will take years to save. I could likely see starting with $5k. But I’ve already started $1200 in the hole if I follow your recommendations. Am I missing something here?

This is always case by case. An absolute beginner can get up to speed quickly if they work at it. Not knowing how every client will attack the learning, I make general recommendations at times. If you email me your game plan, I can be more specific jason@jasonbondpicks.com – but just know this, $1,200 is not a lot of money to invest in YOURSELF, always remember that, joining with me is an investment in your knowledge. If what I’m teaching works for you, $1,200 can be made in a morning of trading here at JBP. I paid $70k to get a bachelors and masters degree to teach in NYS plus loss of income during that time – required education to be a teacher in NYS, which I did for 10 years before this.

Hi Jason…for those of us that can’t be on the computer at work, what would be an appropriate trailing stop once we enter a swing trade.

I don’t like trailing stops but I think stops at -3 to -5% are about right.

Thank you very much for the information. I have been watching your videos and now following you on social media. Can’t wait to learn more from you.

Jason – your ad from years ago is still spotlighted on Raging Bull. Would you know anything about RB??? site is up, but looks like it is unmanned. RB was a great and popular forum until the new owners revamped the site and membership dropped off drastically. Shame they ruined it and now not many stock forums even worth using.

I won Raging Bull still, just haven’t gotten around to using it yet.

Hi Jason, awesome job and very good advice!! THE BABY COMMERCIAL, ETRADE I LOVE THAT SO MUCH AND IT IS SOO TRUE!! I SAVED IT AND MY HUSBAND AND I WATCHED IT AND JUST LAUGHED, LAUGHED AND LAUGHED!! THAT IS AN AWESOME COMMERCIAL AND SOO TRUE!!

THANK-YOU FOR ALL YOU INFORMATION, I REALLY DO APPRECIATE IT!! P.S. THE ETRADE BABY STOCK COMMERCIAL IS JUST TOO CUTE!! LARA CLARKE FROM MICHIGAN, USA

THANK-YOU!

Jason, I’ve just signed up for the most popular course. I am already affiliated with options House; they have a 100k paper trading program also. Their fees are lower by a bit. Would you recommend switching to TD ameritrade or not. I’m still learning OH’s platform. Thanks.

No I think you’re in good hands. Any paper trading account is a wise way to start. Keep me posted if you need anything.

Jb

We want The Bull’s message boards back. they were the “best on the net”.

Hi Jason! I´m seriously thinking about being a Jason Bond Picks member! Please, could you tell me which minimum bank do you think is necessary to start with your service? And where could I find the historical results from your service (from the begining until 2016 for exemple?)?

Many thanks for your kind feedback !

Start with paper trading, then decide what you feel comfortable with. Email jason@jasonbondpicks.com and I’ll send you my trading journal since inception with all the winners and losers.

Hi JB just wanted to comment on paper trading, I am using a steno pad and started with a 10k portfolio which is more realistic for my actual available starting funds. I keep myself honest, writing down my entries and exits when I see the price hit, as if using limit orders. Been doing this for a couple months and I am up to 18k.

Also want to mention to Boubou to check out Robinhood as a starting platform, no commissions to eat your gains. I look forward to being able to make small trades at first, while I get accustomed to using this platform. At present it only works on mobile devices, they are working on making it available for PC and laptop.

A big thanks to the folks in the chat room who mentioned Robinhood, and to JB for your many helps and your patience with us newbies.

We all started somewhere and nothing is more exciting than getting started, good luck Robert.

Jason, Bring back the old Raging Bull forum, you should be able to have both.

Hi Jason, I’m concerned this elongated bull run on the market could be coming to an end. Does your swing trading strategy including shorting? (I forgot the limits to shorting on small cap/penny stocks, so please forgive the naive question). If not, do you have a sense of how reliably the swings are in bear markets should we enter one?

Firstly, don’t be worried about the market falling, nobody knows if / when it will and traders can profit going long and short. I’ve made $43,000 this year shorting SNAP for example.

I am disabled, not able to work, a senior, with less than $5k to trade with. Prefer swing or long term

trades, don’t know shorts or options, Obviously, I am putting a lot of hope in you and your teachings

Thanks for the opportunity! I hope I can give testimony to my success because of your program, soon

Start with paper trading, this way you’re not risking that important money. If things go well and you like it, then transition to real-money.

Hi Jason, I’m going back through many of your previous lessons and I still learn from this post as A reread it often. Protect your money. You should probably repost it on A regular basis.

Gary

Hi Jason,

I just joined. I am going to do the swing trading. I was wondering if I use your alerts to do my trading until I educate myself on how you trade if that works. Because of my work schedule it works best if I go by you recommendations getting in and out of trades when you say. Do you have customers that only go by your alerts. I am familiar with trading and use etrade.

I think mirroring is dangerous, especially for beginners. Best to study the core lessons and use the watch list buying what you like, where you like and selling per your plan.

Am I with the understanding that you send out alerts when you buy the stock on the watch list? To trade as you do on the swing trading do I have to be in front of the computer all the time?

That’s correct. Watch list is built based on my lessons. Alerts are then sent in real-time.

I am slowly building my E-Trade account with your strategy, it can be done. I am now reviewing your lessons again . I will be well trained in the near future. Thanks for sharing your experiences and knowledge. Isn’t Capitalism Great when you learn the ropes, its a good thing,

That’s fantastic, keep it up.

Thank you for telling the truth of day trading. I have been advised several times about it but i wanted to clarify first and i think i am very clear here.

I have done or been tempted to do all 7. thanks for the pep talk and a little tug on the reins coach.

Hello Jason. I think after reading your above trading plan all members should take VERY careful note of what you have to say about your trading plan…but write it down and remind daily the plan!

The message being is that the trading plan is FOREVER unless you adapt a new plan and then apply and stick by the new trading plan rules you’ve set for your self.

It needs to be RULE # 1 and never forgotten.

i’m relatively new to trading after a 20 year gap . I was i’ve just subscribed with you March 10 2020.

Your first introductory video you posted on Saturday is a very stark reminder of the ramifications that result in not sticking to a trading plan.

I will never forget what you said and will each and every day(night) before starting to trade will remind myself about your video post its something i will never forget!

Thank you for your courage to post the the video.

i look forward to being a part of your trading momentum.

nige60