Stocks look as if they’re getting tired at these levels, and it makes a lot of sense with the amount of bullish momentum the market witnessed.

I wouldn’t be surprised if momentum stocks take a breather and pull back.

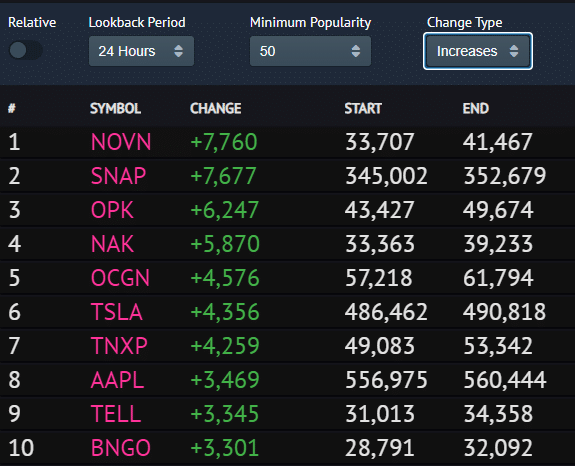

I mean take a look at some of these stocks the Robinhood traders piled into over the last 24 hours.

Snap Inc (SNAP) just reported earnings and the stock got destroyed… yet, more than 7,600 users added it to their accounts.

Tesla Inc (TSLA) is set to report earnings after the bell, and more than 490K Robinhood traders are holding it.

I don’t know about you, but it seems as if they’re chasing alpha right now… and don’t care about managing risk.

They’re not trading with an edge… and I really don’t think many of these momentum traders have a plan.

Now, I’ve been teaching traders how to trade momentum stocks for years now…

And there’s one important technique I believe all traders should get into the habit of.

The Importance Of A Watchlist

Sure, it’s easy to just look up at your screens and trade whatever is moving, and follow the herd.

However, that’s a quick way to lose money over the long term.

It might work now, but I don’t think that’s a viable “strategy”.

So what’s the solution?

Develop a watchlist and trade plan.

That’s actually what’s been working for me quite well recently. More specifically, I find momentum stocks that I believe can gap up the following week.

I like to think of it as a “weekend watchlist”.

The way it works is on Fridays, I find the names I’m willing to hold into the weekend because the patterns I identify typically points to a strong move come Monday…

And potentially days after.

For example, over the last 3 days, more than 16K Robinhood traders added TNXP to their accounts.

The stock was down more than 20% by 11:00 AM ET on Wednesday…

And by the looks of it, these traders will try to scoop up some more — that’s just the pattern I’ve noticed.

The thing is, I actually spotted TNXP to be a potential mover on Friday…

How?

By identifying a bullish pattern.

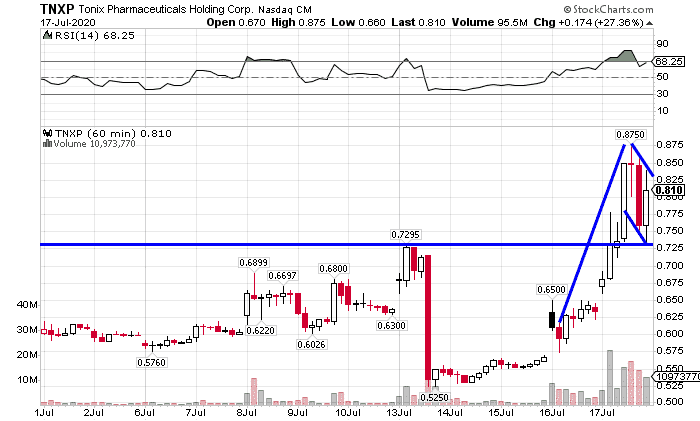

TNXP had room to the $1 level, and on the hourly chart, there was a bull flag setup.

Source: StockCharts

Not only that, but the stock broke out above a key resistance level.

So why did I get in on Friday?

Well, I mentioned how this was a coronavirus name… and we’ve seen stocks like MRNA and HTBX pop.

TNXP could move in sympathy, and with a bullish setup and momentum in the name, coupled with rising volume.

I figured the stock had a chance to gap up come Monday morning.

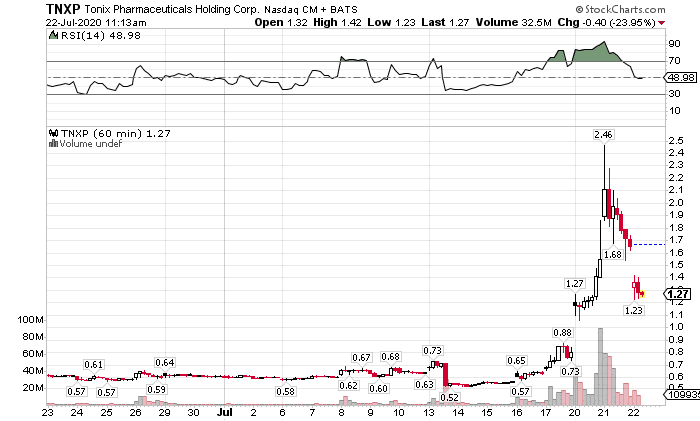

Source: StockCharts

Well, the stock made the move I expected… I bought shares at $0.78 on Friday, and got out at $1.06 on Monday.

Sure, the stock went higher…

But I stuck to my plan… I didn’t change it and buy more, because that’s the right move for my trading style.

If you don’t want to be a FOMO chaser and plan your trades… then you’ll want to learn how to develop a watchlist.

Now, I’m set to release my latest watchlist on Friday, and there will be a few names I’ll keep on my radar.

If you want to receive it, then make sure you’re subscribed.

Act now and receive an 88% discount.

0 Comments