As we approach the Sirius XM (SIRI) earnings report scheduled for Jul. 29, traders of SIRI will be watching for a continuation of the rally and second attempt to breakout from the $3 and $4 trading range that first began in Jan. 2013.

According to SIRI’s price pattern and rules governing Point-and-Figure (P&F) charting, a sustained move above $4 alters the price target significantly higher to $9.25 – or a 169% move from Friday’s $3.44 closing price. And from all indications discussed at length by analysts covering the stock, Sirius management appears to be a motivated participant as the buyer of support during any significant pullbacks in the price of SIRI.

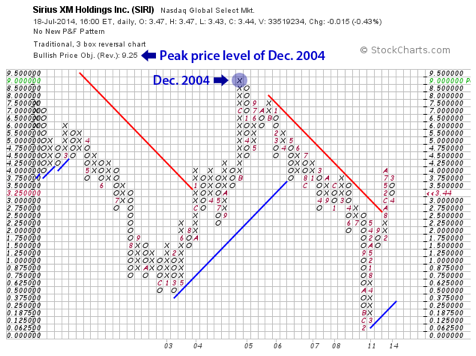

Below, the chart of SIRI shows the $4 price level as a longstanding resistance during bull moves. We present the P&F chart as a better means of illustrating the SIRI’s stock price pattern throughout the past decade.

Because of SIRI’s dramatic exponential moves through the years – mostly on the way down prior to the Liberty bailout – the P&F chart attempts to clear away the noise and clarify major price objectives for the trader who follows this methodology of technical analysis.

According to the rules of P&F chart interpretation, SIRI’s historical price pattern indicates a breakout of the $4.00 price level will most likely take the stock into a huge, new trading range of price discovery between $4.00 and $9.25.

Road Map to $9.25 Paved By Motivated Business & Stock Operators

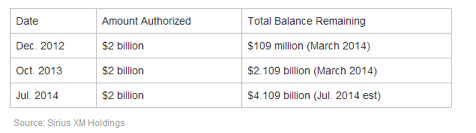

After printing billions of shares throughout the years to finance acquisitions and to avoid bankruptcy, Sirius management has reversed course with aggressive stock buyback programs, starting in Dec. 2012.

On Tuesday of last week (Jul. 15), Sirius XM took another step toward reducing the number of SIRI shares outstanding with an announcement of another $2 billion allocated to additional purchases of the company’s common stock. The authorized purchases, which now totals approximately $4.109 billion, is the third such authorization within two years.

At Friday’s market price of $3.44, Sirius’ board of directors has authorized the purchase of nearly 1.2 million shares (or the equivalent of 20% of the company’s market value).

Tuesday’s announcement comes as no surprise to us at Jason Bond Picks (JBP). Quoted in his article titled, Sirius XM: The Fix Is In of Jun. 6, Jason Bond of JBP concluded the article with his macro analysis of SIRI’s strategic stock buyback plan:

We can only conclude, then, that Sirius will not reduce its outstanding revolver debt or any other debt, senior or otherwise. Instead, Sirius, we believe, will make good on its promise to leverage its balance sheet by raising its Debt/EBITDA ratio. That will be the means of allowing debt to rise as the company uses as much available cash (earned or borrowed) to reduce Sirius’ 6.0B shares outstanding (but more aggressively in 2014) – a clever strategy now popularly deployed by Wall Street’s largest corporations as a means of maintaining earnings growth per share during this era of cheap money from the Fed’s ZIRP.

[T]he fix is in for an attempt to aggressively raise the share price of SIRI, through the retirement of ever more shares outstanding.

Today, we reiterate our Jun. 6 assessment: The ‘fix is in’. And the ‘fix’ is to turn Sirius into more of a cash machine than it already is, with the deep pockets involved in the decision-making behind Sirius’ strategy manipulating the outcome to the benefit of the largest stockholder, Liberty Media Corporation (LMCA).

As of the latest quarterly earnings report (ending Mar. 31), Liberty Media (LMCA) still owns more than 50% of the world’s premier satellite radio, Sirius XM. And now that Sirius has grown into a veritable cash cow – with expected free cash flow reaching $1.1 billion for the full fiscal year 2014 – Liberty’s control of Sirius’ board of directors also places investors of the company’s common shares in the catbird seat.

Though the Sirius press release of Jul. 15 included “transactions with Liberty Media” as one of the conditions to the share-buyback program, we believe that the directors will not allow Liberty to slide under a 50% stake, thereby granting Liberty unfettered control during the process of taking Sirius private in coming years.

“Why would Liberty let loose control of a veritable cash cow,” commented Jason Bond. “If I were in Liberty’s position, I’d follow the Warren Buffett model of taking companies private when the opportunity arises. And in the case of Sirius, Liberty could pull off a privatization deal without using additional Liberty capital. To me, it’s a no-brainer.”

However, we will be reassessing Sirius’ capital structure after the release of the company’s fiscal quarter ending Jun. 30. Any hint of a change about the intentions of the directors may alter our current position regarding the outlook for SIRI. But, until then we like SIRI for the short, medium and long term.

And as a corollary to our analysis: If Sirius begins to aggressively pay-down its $2.9 billion of long-term debt with cash generated from operations, we will reassess our analysis. But, for now, with year-over-year revenues up 11.2%, net operating cash flow increasing $251.39 million (or 48%), a gross margin of a commanding 60.86%, and an outlook that includes a still-enormous untapped consumer market, Sirius XM is poised to continue leveraging its $2.9 billion of long-term debt into hefty bonuses at Liberty executive suites, and churning out outsized capital gains to the retail investor.

Technical Information

The 200-day exponential moving average (EMA) of $3.40 appears to have garnered support among the bulls, with $4.00 implied as the level at which the major fight between the bulls and bears is expected to commence in earnest. A sustained market price above $4.00 could turn a resistance level into a support level of a new trading range of $4.00 and $9.25. (see below)

Looking for another big stock idea like SIRI?

To get a heads-up on other stocks we feel may better your rate of profit, start by joining our mailing list (top of the page). Or, take the next bold step now by joining Jason’s community of dynamic and active traders with your subscription to Jason Bond Picks.

Click here for 2013 Swing Trade Performance Record +77% +$238,830.

0 Comments