Imagine you can get all your research done and execute your trades all on a part-time schedule — trading would be a heck of a lot easier, right?

For me, that’s a reality.

I’m not saying that to stroke my ego or brag about how fast I can uncover trade ideas.

To be honest, I just want to help you develop the skills to help you uncover trade ideas off just a few trend lines and chart patterns.

You see, in every single market environment — supply and demand dictate where prices can go.

The key is to be able to pinpoint where demand likely picks up and where there may be sellers.

Allow me to show you one of my favorite indicators to use, and reveal how it helps me identify key areas of potential demand.

How I Pinpoint When A Stock Might Take Off

One of my favorite indicators to use is the exponential moving average (EMA). With these lines, it lets me see where the overall trend is pointing and helps to identify key support and resistance areas.

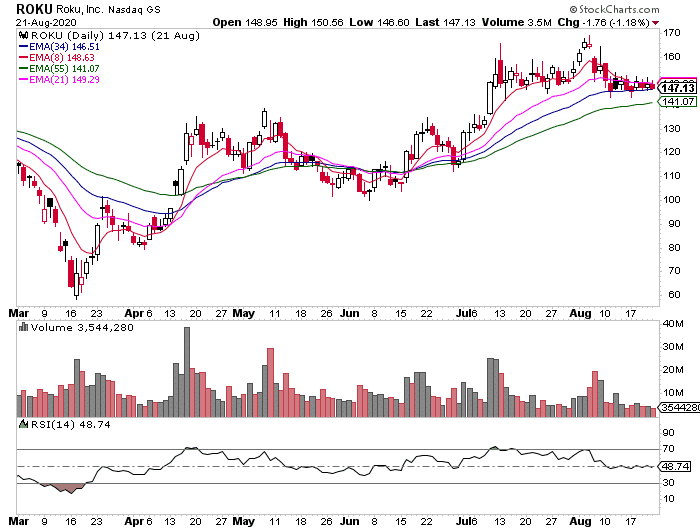

For example, take a look at this chart in Roku Inc. (ROKU).

If you notice those lines in the chart above, they’re key EMAs.

These specific EMAs are part of the Fibonacci sequence — but I won’t get into the math behind it. The EMAs I typically use are the: 8, 21, 34, 55, and 89 periods.

They let me know where there can be demand for the stock, and sometimes, resistance.

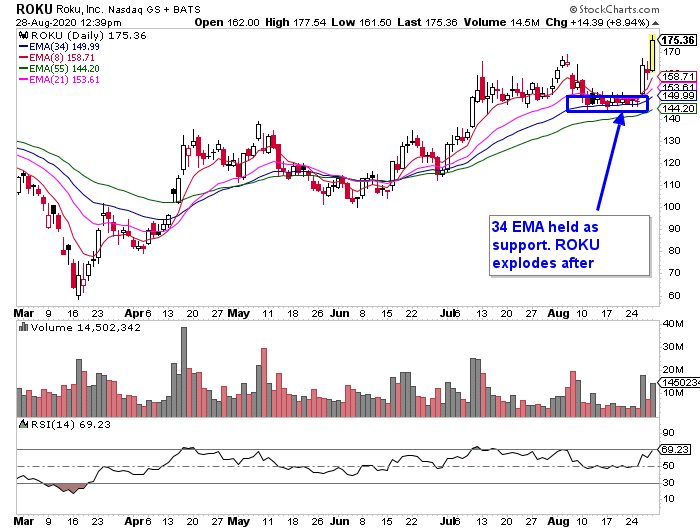

With that specific setup in ROKU, I was looking for the 34 EMA to hold and for buyers to step in.

Here was the plan I sent out to Rooster Report subscribers…

“ROKU is my trade today. I think this is gearing up for a $170 breakout, again, assuming the overall market doesn’t take a dip. It’s in a squeeze on the daily chart and rounding nicely right off the 34 EMA which would offer a really tight stop.

Range to $170 before resistance. Same as always on these options trades, I start ITM (in the money) so maybe $145 calls to give me high delta and more safety from quick decay of the option.

This is what’s called directional trading in which I play the higher priced stock continuation pattern with the lower priced option. As a general rule I’m looking 6-8 weeks out because if I’m too close on expiration and it stalls, the decay of the option speeds up.”

By spotting my pattern and understanding how EMAs work, I was able to make money off those lines.*

*Results presented are not typical and may vary from person to person. Please see our full disclaimer here: ragingbull.com/disclaimer

These lines are one of the techniques I use to uncover trade ideas, and I believe it’s easier than a lot of the strategies I’ve seen out there.

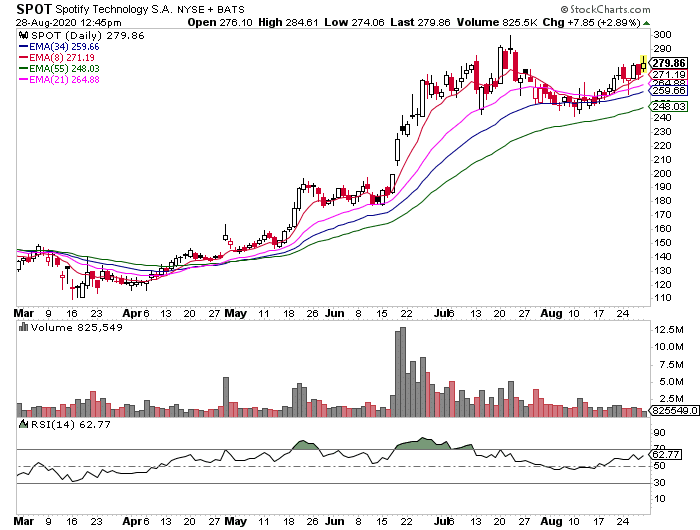

For example, Spotify Technology (SPOT) is on my radar.

I’d like to try and get it not of the 8 EMA, where it settled Thursday, but off the 21 or 34 just below around $263 or $258 depending on the market. Same concept, ITM entry on the calls 4-6 weeks out.

Notice how I can quickly develop a trade plan from those lines.

Allow me to show you how to use my chart patterns, so you can start trading on a part-time schedule.

Find out how chart patterns can improve your trading performance.

0 Comments