U.S. stock futures dropped on Monday, as investors questioned whether the measures announced by euro-zone leaders last week would be enough to stem the sovereign debt crisis. No major U.S. economic data are scheduled for release Monday. Looking ahead, the U.S. Federal Reserve’s Federal Open Market Committee will hold a monetary-policy meeting on Tuesday.

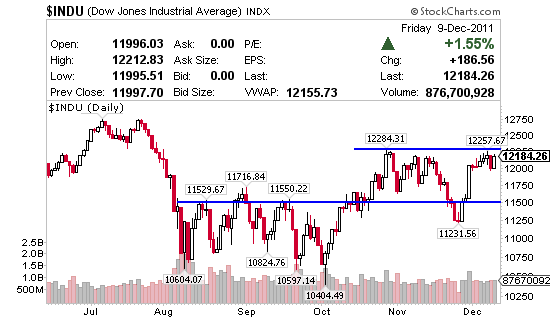

My perception of the market is bullish into Christmas, I think it breaks resistance and trends up from here. Today looks red out of the gate but I’m not going to read into that just yet… let’s evaluate mid-morning and go from there regarding new swing positions. If I’m wrong and it pulls back hard or drifts lower for a few days then I’ll look to swing if / when we turn just above the 11,700 range.

LOCM – up $2,500 here the price action just put in a higher low and now needs to break $2.48 short term and make a higher high for me to reach my goal of $2.70 – $3.00 a share. Like a few other trades in the portfolio I’ve been in LOCM way too long already. I don’t plan on holding future trades this long but I don’t want to rush out of LOCM just yet so long as the chart

PLUG – small position but like the chart here. Ascending triangle with good news coming out of the company should lead to a breakout above $2.60 – $2.70 soon. Short term I’ll accumulate 5k shares at $2.15 and stop out below the 50 Moving Average of $2.13 should it get there. Initially I set out with a tight stop on PLUG around $2.20 which it did hit but the market was down that day so I decided to ride it out for now. I’d like to see accumulation pick back up on this one if it’s truly going to have a chance to break trend and break that top trendline.

HKN – still holding $2.60 but probably not for long unless we get some news out of the company or a bull market into Christmas. If $2.60 holds I’ll continue to grind it out, if not I’ll start to look for a reasonable exit and take a loss.

USAT – horrible trade, absolutely horrible. Let a nice profit turn into a loss and this is yet another example of why you should close a trade green or even but not red after you’re up right out of the gate. If it drifts below $1 today I’ll be forced to look for an exit. Sure would be nice if the new CEO stepped up with some news this week, we’ll see.

0 Comments