The rational:

Recent quarterly earnings and the takeover rumors will provide price support in the coming months. Additional catalysts are the news of new live events and the progress in its reorganization.

1. Earnings: On October 27, Twitter announced their third quarter results: A revenue of $615.93M. Analysts estimated a revenue of $606.29M. The revenues were $9.64M or 1.59% above the estimates. Earnings per share were $0.13. The reported EPS was above estimates by $0.04 or 44.44%. Analysts had estimated an EPS of $0.09. Additionally the firm boosted its 2017 and 2018 EBITDA estimates by 7 percent following this third quarter results beat (http://bit.ly/2fH5OyR). Besides their focus to monetize their business via advertisements, they achieved an increase of the daily active users of 7% year over year. However they still operate at a loss but announced to be committed to turn to the green in the coming years.

2. Takeover: Rumors of a potential twitter takeover have been around all year. Each of them triggered a price spike and retraced as buyout interest faded. An overview can be seen at http://bit.ly/2feA6YU. It’s not always transparent why potential buyers backed off but the price and the unwillingness of its CEO Jack Dorsey will be for sure applicable. As investors are more and more pushing to achieve value (via a sale or increasing profit margins), one may assume rumors will continue in the coming months as the climate is perfect to do acquisitions due to high levels of cash and the low interest rates. How long this climate will remain is doubtful but an interest hike is likely to happen in the coming months putting a pressure on acquisitions.

3. live events: From the shareholder letter (http://bit.ly/2fhYYgo): “Together, our logged out and syndicated audiences represent more than 1 billion people. We’re beginning to capitalize on this very large opportunity by delivering compelling new content via our live-streaming video experience. All three of our audience segments (logged in, logged out, and syndicated) receive the same great product experience with high quality livestreaming video, our curated event specific timeline, and of course video advertisements. We’ve integrated our video player with several significant partners including Yahoo, AOL, SB Nation, and Sports Illustrated on the web and Apple TV, Amazon Fire, and Microsoft XBox on connected TVs. Live streaming of Thursday Night Football on a connected TV Mobile live streaming of U.S. Presidential debates. We expect to add more syndication partners in the coming months. Importantly, both our logged out and syndicated audiences are shown the same ads as our logged in audience and we also provide many of the same measurement features to advertisers across all three audience segments”. Any news on new partners hitting the wire will continue to support the current price level and could potentially generate even a positive pulse. Twitter indicating this type of news will occur in the coming months and the most recent partnership with ‘Game Awards’ was announced November 2nd (https://yhoo.it/2fyvHBJ).

4. Reorganization: “We’re getting more disciplined about how we invest in the business, and we set a company goal of driving toward GAAP profitability in 2017,” CFO Anthony Noto said in the company’s earning statement. “We intend to fully invest in our highest priorities and are de-prioritizing certain initiatives and simplifying how we operate in other areas.” This reasons for the workforce reduction of 9% or 350 employees. They indicated that the associated restructuring charges ($15 M to $30M) will be in the Q4’16 results which mean that it will be promptly executed. However one time additional cost, it is welcomed as a strong signal to strive for future profitability (http://bit.ly/2fbhIBl)

Play:

Technicals are supporting a long position: during the last 9 trading sessions when the market continuously sold off, the price level 17.3 acted as support on the MA(200). The next level is of support is found at 16.75. The daily RSI is in oversold territory and the MACD having a bullish crossover!

You can play this via shares or via options: buying shares in multiple tiers is suggested. After an opening position, any price dip would be an opportunity to add. A first price target is around $20 level followed by $21.5 and ideally a takeover with a decent premium around $30 level.

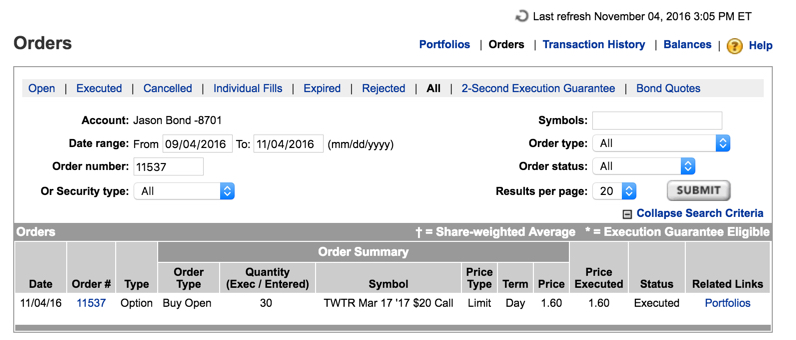

Via options, the monthly CALLs with expiry in March’17 and a strike of $20 can be bought for 1.4 per contract. Buying 10 calls makes your max loss $1400. You won’t be alone holding this contract as it has the highest open interest in the option chains of 40.1K contracts

My position:

0 Comments