Good morning.

As you know, it’s not by mistake I’ve been quiet with the swing trading and this week is no different with the Federal Reserve policymakers looking to raise rates for the first time in nearly a decade. Volatility is extremely high right now making it difficult to hit overnight momentum and trend.

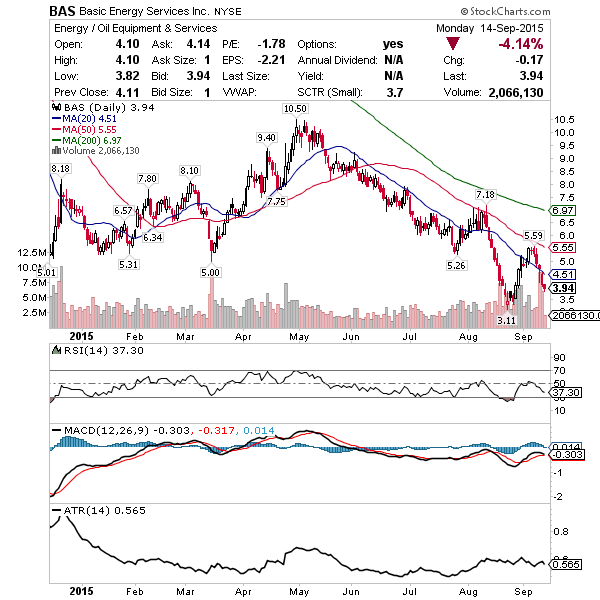

Most recently the trading has been excellent hitting BAS for +15% +$5,400 8/24 – 8/27, XIV for +8% +$1,950 9/2 – 9/3 and GLUU for +4% +$1,700 8/27 – 9/3. Since then I’ve been cash so as to be sure each move I make with this swing trading newsletter is a good one.

I’ll probably remain quiet this week but expect to get very active next week after Thursday’s FOMC announcement at 2 p.m. Eastern followed by Yellen’s press conference. I personally hope they just get it over with and raise rates. Doing so would bring immediate volatility but once it subsided, which I think would be quickly, a myriad of opportunities await.

Here’s what I’m watching this week.

BAS – Indirect play on oil and gas, I think Basic Energy will turn this week around $3.50’s with room to run to $4.80’s for profit.

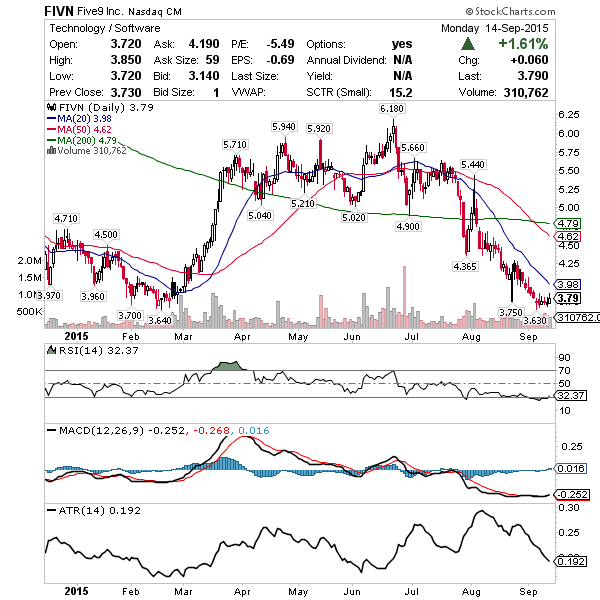

FIVN – Good long term catalysts noted in this Forbes article, I think above $3.70 support, also the 52 week low, a move to the middle $4’s is reasonable.

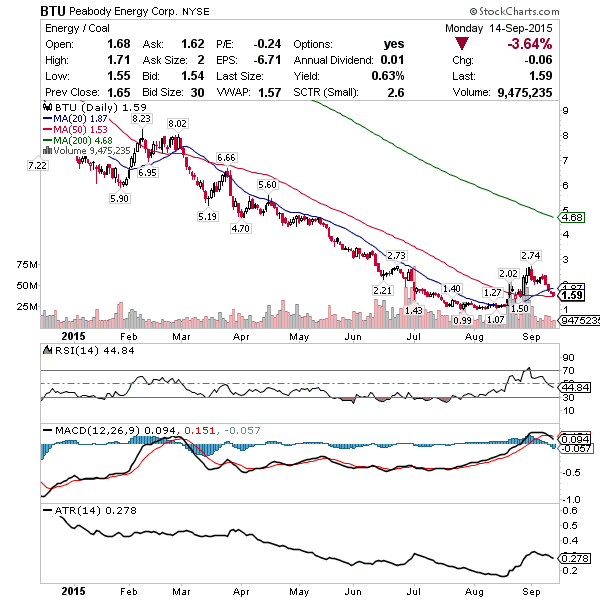

BTU – Settling at the SMA 50 after 4 days of selling, shares are rounding out. Most coal stocks are doomed but I think Peabody will survive.

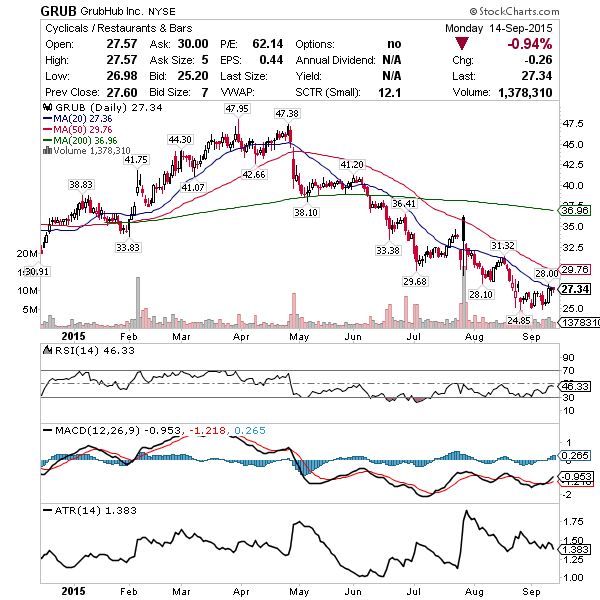

GRUB – Nice long term growth story here. Looking at accumulation above $25 for $5 points into the $30’s.

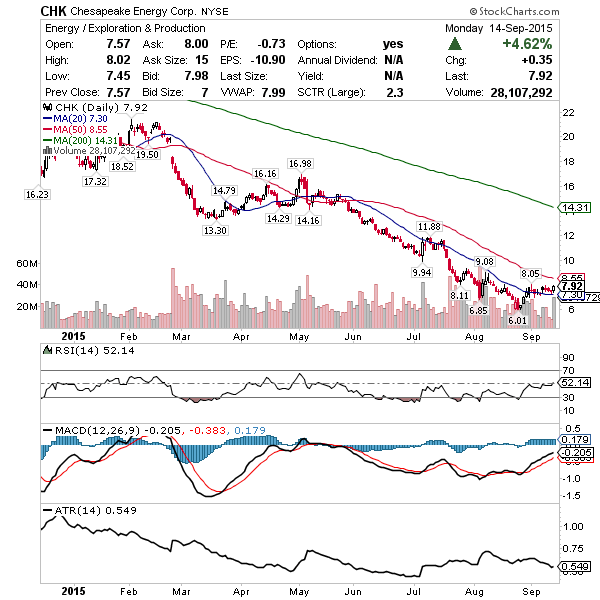

CHK – Great energy play at the moment. Support of the SMA 20 is a good area to watch with 25% upside to $10 resistance from here.

Your Swing Trader,

Jason Bond

0 Comments