Good morning.

It’ll be a low key week for us with the market closed for Thanksgiving Thursday and only open until 1 p.m. Eastern Friday.

Overall I’m still very bullish on the S&P 500 and believe we’ll see a new all time high in December or early in 2016.

I’ve recorded 16 wins and 2 losses since inception of this newsletter for +$29,255 profit in about 3 months.

Currently I’m holding partial size on both positions in the portfolio FCX and GLUU. I’m looking to add more FCX around $8 soon and then put a stop loss in around that level. I’m unsure if I’ll add to GLUU anytime soon, right now I like the partial position and the direction and think holding for 10%+ on this trade will work fine.

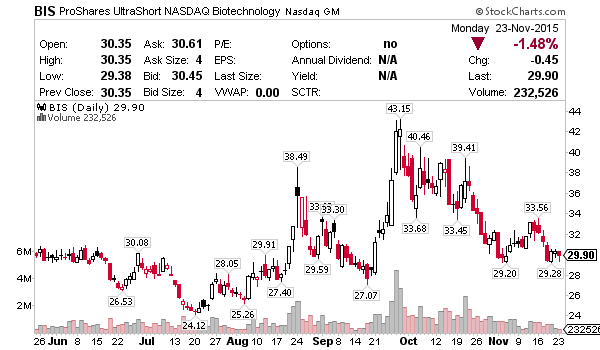

BIS is looking good for a starter position around $30 and profit around $36 as biotechs, which have been on fire, lose momentum into December.

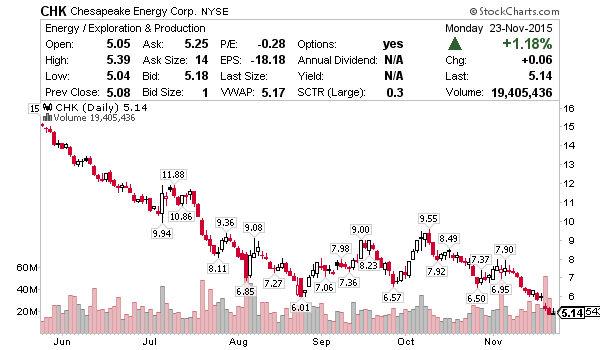

CHK is an oversold play on energy I really like above $5 with range to $6.40 for profit. I’ll probably look to start scaling in soon as the dollar weakens and dollar based commodities bounce.

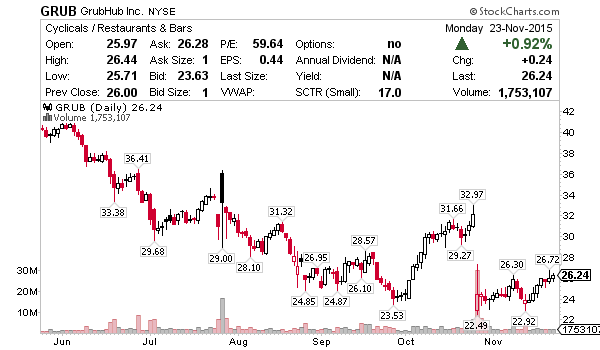

GRUB is pushing into the gap from October’s big drop so I won’t chase it here but continue to watch for entry above $24.

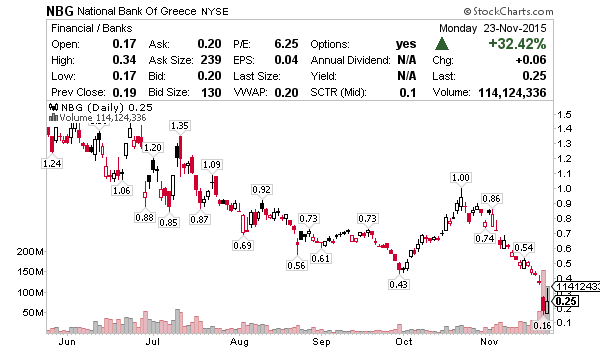

NBG is oversold after falling for nearly a month. I’ll be watching for it to settle around $.20 and position for a bounce. This could be a momentum monster if fear for the bank’s future and recapitalization news fades.

As noted above, probably a low key week ahead but I would expect an alert or two into any S&P 500 weakness so we can attempt to capitalize on the ensuing 52 week high rally.

Jason Bond

0 Comments