Good morning,

Stocks rallied across the board this week, led by the 3.35% move higher of the DJTA. The DJIA, S&P 500, NASDAQ and Russell 2000 rose by more than 1%, respectively, as the S&P 500 and NASDAQ closed Friday with weekly record highs.

There was something good for everyone this week. New highs, a strong DJTA for the Dow Theory adherents among us, a stable bond market; a tame forex; and a sudden quelling of market-negative political talk in Washington, came together well to halted last week’s US dollar rout.

Bank stocks climbed modestly in comparison, with the BKX advancing only 0.90% by Friday’s close. Deutsche Bank (DB) was the notable exception to the advance of bank stocks, as it dropped 3.05% for the week.

And did anyone catch the back-to-back articles this week about the subject of suspicions that the VIX has been manipulated? Haven’t I stated my suspicions that the VIX is heavily manipulated. Well, two University of Texas professors published a report Wednesday about the VIX, demonstrating the mathematical likelihood that the index has been ‘gamed’.

And then, old-time financier of the past, Asher Edelman, was interviewed on CNBC this week, and shocked everyone by blatantly pointing the finger at the White House’s Working Group on Financial Markets [better known as the Plunge Protection Team (PPT)] as the likely entity behind the unusually low VIX readings since President Trump’s election victory in November.

He told CNBC:

“We have seen the most extraordinary lack of volatility in the VIX since Trump has been in office, and it’s interesting the night he was elected you may recall the futures came down about 400 or 600 points.

You may also recall that the next morning they were even again. Watching plunge protection for years, I had no doubt that’s what happened.”

Yeah, the strange VIX readings lately have become too numerous to not notice.

In the currencies market, not much was going on here to affect stocks. The euro was off 0.21% against the US dollar, and the yen against the US dollar was little changed. In all, the USD index rebounded slightly to 97.36, from last week’s 97.03 close. I’m watching the USD index very closely each day, as I cannot imagine the euro outperforming the US dollar by the close of the year.

As bad as the monetary and fiscal conditions are in the US, Europe’s mess is far worse. Aside from Germany, household debt to GDP and sovereign debt to GDP are worse than those metrics for the US, at a time when global GDP is decelerating.

Will President Trump get his lower US dollar? Sure Trump can get it, if he cannot get any of his economic agenda through Congress. I think that’s the only way the US dollar can fall against the majors, as a lot of dollar strength has come from expectations of Trump’s dollar-bullish economic policy agenda. What a strange contradiction from this administration: a budget failure may achieve his wish for a lower US dollar.

Here’s a president who has said he wants a weak dollar, but every economic policy items on his agenda suggests to dollar strength as a result. Are you confused yet? If you are, you’re not alone. No one can really figure out any cohesion to Trump’s economic agenda yet.

The US Treasury 10-year rate rose two basis points to 2.25%. The yield curve (10y-2y) closed unchanged at 95 basis points. I’m watch this spread very closely, along with the USD index. Why? A flattening yield curve highly suggests an economic recession is coming down the pike. And if so, how will the Fed square the circle of insisting it sees modest economic growth?

And I’m not alone asking this question, of course. The gold market is sniffing out the self-inflicted quagmire at the Fed, as the precious metal moved higher for the third-straight week of US Treasury market strength. Friday’s forceful move of $11.70 to above $1,260, and off its 50-day MA, impressed me. The silver price, too, closed the week strongly for the third-straight week, and up 7.8% from the May 9 low of $16.06. From what I hear, most of global demand for precious metals has been coming from Asia, specifically China, India, Russia and Japan.

But, taking my proxy for the oil market, Exxon Mobil (XOM), and applying the same concept of watching the precious metals stocks as a means of assessing market sentiment among the pros, I’m not convinced this rally of the precious metals may continue past $1,280 gold and $18 silver.

Here’s why:

Look at the GDX and SIL (let’s leave out the GDXJ because of technical factors affecting the index at the moment). The GDX rallied a scant 0.35% this week, while the SIL dropped a hefty 0.94%. This divergence between strong moves higher in the metals and weak-to-down trading in the stocks doesn’t sit well with me, at all. Just as I like to see XOM move higher along with the oil price; watch the DJTA outperform the DJIA; see Freeport McMoRan screaming higher with a rising copper price, I want to see precious metals stocks fly higher too along with the prices of the underlying commodities.

Bottom line: watch your precious metals junior stocks closely this week, and let’s hope I’m just paranoid.

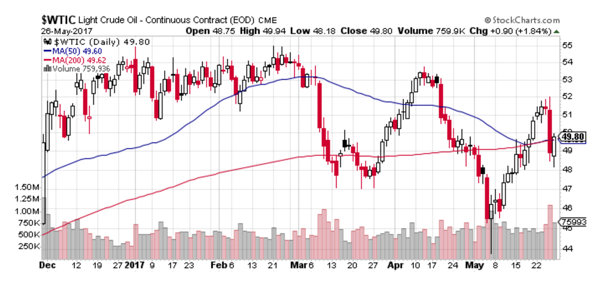

Okay, and speaking of the oil price and Exxon Mobil (XOM), I was spot on (so far) about my suspicions of the rally of WTIC of the past couple of weeks. After hitting $52 on Thursday, WTIC collapsed to as low as $48.18 on Friday, a 7.3% smack down within 24 hours.

Then, the Saudi’s timed the release of an absolutely meaningless statement on Friday in the hopes of buffering what looked like a complete crash of the oil price in the making. The point is: my XOM indicator has not failed me, yet. If you look at the price action of XOM, it has done ‘squat’ while the WTIC was rallying of the past two weeks prior to this week. So, how can this rally in WTIC be for real, if pros seeking leverage to the oil price aren’t buying?

And look at the 50-day and 200-day MA’s of WTIC. And then look where WTIC closed the week. Come on. The Saudis restate their old position regarding its production quota with Russia, and the oil market turns on a dime higher? Sure. That makes sense—not.

As I’ve stated in past reports, I expect further weakness of the WTIC price to again test the $45 handle in the coming weeks and months, unless some political or military event comes to the rescue of the growing headache for the Fed: the debt-ridden oil industry. Maybe, too, the PPT is propping up the oil market, as well. I state this half facetiously and half seriously. You players of oil and natural gas stocks, watch your positions this week.

So, overall, commodities prices were quite soft this week (CRB down 1.66%); stocks were higher across the board, including a nice move in the DJTA; oil got smacked; the US dollar stabilized with bonds; and precious metals continued to rally.

So, what do I make of this week’s action? Right now, I’m thinking that the focus of the entire planet will be on the Fed during its two-day meeting in June (13 and 14). That’s a couple of weeks away. And what will I be looking for? Of course, if the Fed does raise the target range rate of federal funds by 25 basis points, I want to see the reaction in the US Treasury 10-year note rate. If the 10-year rate declines, the Fed made a serious mistake.

But of course, on the day of the expected rate hike, the NY Fed will most certainly ‘game’ the 10-year rate higher to reflect what the Fed wants. Right? We must have a steepening yield curve, you know, to reflect the narrative of a slow, yet growing US economy. But if the rate falls anyway, that’s spells big trouble, with a capital “T.”

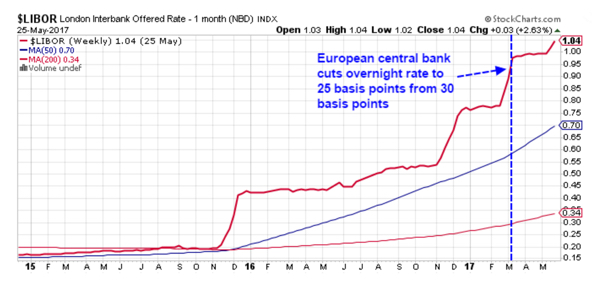

I know that what I’ve just stated may sound dramatic, but the Fed and the global financial system are under tremendous stress right now, although the financial media won’t report any of that adequately, besides Rick Santelli of CNBC, of course. What isn’t reported is the overseas dollar rate; it’s rising, which means there are not enough US dollars to retire dollar-denominated debt and provide liquidity. The risk is, as the overseas rate (30-day LIBOR) crosses the US Treasury 10-year note rate, alarm bells will ring across the globe that a global recession nears.

Right now the spread between the the LIBOR and US Treasury 10-year rates is 121 basis points, with the LIBOR rate rising to 104 basis points. Look at the chart of LIBOR (eurodollar market rate), below.

The rate is soaring.

Is it a wonder why the dollar-gold price began its rebound in December 2015 from its four-year-plus bear market? And to make matters especially crazy, ECB President, Mario Draghi, lowered the overnight rate at the central bank by five basis points in March while the LIBOR was screaming higher.

This chart, above, shows the acuteness of the lack of dollar funding (liquidity) outside of the US banking system. And from the looks of this week, the rise of the LIBOR rate hasn’t stopped at 100 basis points; it’s moving higher. So by the FOMC meeting, what will be the LIBOR rate, and what will be the rate of the US Treasury 10-year note?

And almost no one within legacy media outlets is talking about this crisis of the eurodollar market! Why? Because it’s not especially good news for advertisers, to say the least, and the subject is quite arcane and uninteresting to retail investors. But it’s damn important, as we may soon find out.

I’ve stated this numerous times before: just make sure you’re always hedged for a big move against your portfolio. The VIX is clearly broken, therefore you must rely upon your own judgment and my tutelage for pointing out signposts of potential dangers ahead.

Remember, financial media isn’t on your side; they’re on the side of bankers and policymakers. They pay media’s bills. In contrast, I’m on your side, and you pay my bills. So, my job is to keep you informed at all times. It’s that simple.

Case in point: This week, famed economist, Robert Shiller, told CNBC this week that it’s possible the DJIA could move 50% higher. This story had been ‘milked’ pretty well throughout the week, as Robert Shiller is known for his carefully measured words.

Of course, the DJIA could go up by 50%. It could go up by 1,000%, too. In the interview with CNBC, Shiller merely pointing out the obvious possibility of stock prices rising further, irrespective of a majority opinion of whether stocks are generally accepted as priced above, at, or below ‘fair value’, but didn’t state that a 50% run higher in prices is his prediction.

But here’s the headline CNBC decided to run with, following the Shiller interview:

Nobel winner Robert Shiller: Stay in the market because it ‘could go up 50 percent from here’

“Stay in the market,” CNBC headlines Why? Because a Nobel Prize winner says stocks “could go up 50 percent from here.” Folks, that play with words is an example of sleazy journalism. You must surely know that only a handful of mom-and-pop investors will actually read the interview transcript to clarify Shiller’s thinking.

Here’s what Shiller actually said:

I would say have some stocks in your portfolio. It could go up 50 percent from here. That’s what it did around 2000, after it reached this level, it went up another 50 percent. So I’m not against investing in the stock market when you consider the alternatives. But I think if one wants to diversify, US is high in its CAPE ratio. You can go practically anywhere else in the world and it’s lower. We could even set a new another record high in CAPE. That’s not a forecast.

Does this statement by Shiller match the spirit of the CNBC headline? Of course not. The details are in the article, which few read. To me, CNBC’s headline reads like the “You may have already won” headline, famously printed on the Publishers Clearing House envelopes we’ve all received in the mail some years ago. Sure, you may have already won, but that’s not the Publishers Clearing House’s forecast.

Okay, let’s move on to my holdings.

My current portfolio: LQMT, CROX, LC, SIEN, GRPN and SC

This Week’s JBP Stock Ideas

This week, I’m providing a review of my holdings in an executive summary format. If you haven’t done your due diligence on some of the six stocks held in my portfolio, a couple of stocks I hold are trading at better prices than I paid. So, check those stocks out, especially.

Liquidmetals Technologies (LQMT)

My initial purchase of LQMT was 100,000 on December 1, 2016. I bought the stock because of the large financial interest and control taken by Professor Lugee Li as the new CEO. Professor Li is an executive who’s devoted his life to the technologies developed and patented by Liquidmetals. He is uniquely qualified to take Liquidmetals to the next step of development for servicing today’s changing liquid metals market.

Confirmation of my held faith in the new CEO has materialized with the company’s purchase of a manufacturing facility and equipment as steps toward production, as well as the positive price action by trader who have come to agree with my assessment of the company’s prospects.

With patented technologies, a ready market, sufficient capital, and a CEO whose reputation in the industry precedes him, all the ingredients are in place for a good shot at a multi-bagger play in LQMT.

Lending Club (LC)

The company has been in a turnaround phase following revelations in May 2016 that Lending Club CEO, Renaud Leplanche, had sold $22 million of improperly underwritten loans to investment bank, Jefferies. The terrible publicity surrounding the questionable ethics of the company’s CEO cost LC nearly 57% of market capitalization, the result of which provided a catalyst for my eventual purchase of the stock.

My thinking then, and now, is, that Lending Club is a well-run enterprise and plausible turnaround story, and may quickly regain its reputation back and market cap of $3.0 billion. The stock’s Price-to-Sales is 2.02-times, which is darn depressed, still. And the stock’s bullish pattern suggests that a $3.0 billion market cap, or $7.25 share price, is doable this year.

Sientra (SIEN)

Sientra makes silicone breast implants, and is a budding successful turnaround story from an unfortunate factory stoppage at its third-party manufacturing facility in Brazil, Silimed Industria de Implantes Ltd, in September 2015. Due to a European regulatory agency issuance of a marketing suspension of all products made at the Brazil plant, trouble came to Sientra, although Sientra’s production process had not been part of the European regulatory shutdown. As a precaution, Sientra voluntarily halted production as well, and commissioned its own private inspector to reassure Sientra customers of the safety of its products.

Following the news of Sientra’s voluntary production suspension, the price of SIEN crashed to as low as $3.34 by mid-November 2015, from a high of $26.67 reached in late-June of that same year.

But since the stock’s November 2015 low, SIEN has come back steadily after its production has come back online, and announcements of additional product lines were issued.

I like Sientra, because it’s the only company of the three like it, operating in the US (the other two: Mentor, Natrelle), who offers a two-year guarantee against ‘capsule contracture’, an issue of primary concern of most patients and surgeons. Sientra’s rate of contracture is, indeed, the lowest of the three makers. And the company also holds the distinction of offering implants with the lowest in incidents of rupture. In short, Sientra is ‘best of breed’.

SIEN is a well-run company, and I expect a return to the company’s previous revenue volume by the close of 2017 and the stock price to respond in kind.

Crocs (CROX)

I bought 3,000 shares of CROX at $7.07 on January 12. My initial goal was to sell at around $8.50, which is presently a significant resistance level for the stock. I expecting to hold CROX for as short as a few weeks to as long as a few months.

Crocs is another one of my series of turnaround stocks I hold.

After Blackstone Group came to the aid of Crocs to bring in experienced executives and, specifically, execs who specialize in turnarounds, I see absolutely no reason for this company to not ‘right’ itself.

People love the the Crocs brand much more than they hate it. That’s a good enough brand sentiment among consumers to raise the company’s Price/Sales back up to 1:1 from today’s 0.48:1. To me, the share price of CROX is much too low when taken within the context of an industry average Price/Sales ratio of 1.12:1. And many institutional investors agree with me. CROX has had tremendous institutional support following its fall from grace in the Fall of 2015. My target price for CROX is $10.

GROUPON (GRPN)

I purchased 5,000 shares of GRPN on March 1, and the stock has been my worst performer this year. Thankfully, this happens less frequently than my big scores.

I bought the stock with the bet that the persistent rumor of Alibaba having an interest in buying Groupon made a lot of sense to me, whether the rumor was in fact false, or not. A takeover of Groupon actually makes sense for Alibaba in a strategical perspective, in that it’s well-known that Alibaba must expand globally to achieve meaningful growth. And why not enter the largest economy of the world? The US.

Alibaba is looking at Groupon’s Price/Book of a measly 0.37. And it appears that Groupon most certainly qualifies as a potential buyout target by anyone at this price level. The company’s earnings have been better than expected since Q3 of 2015, except the most recent quarter’s revenue miss (Q4 2016).

After the Q4 revenue miss, I haven’t been sure of this stock’s appreciation potential outside an Alibaba, or like takeover, deal,. But the stock’s Price/Book is awfully low to give up on the stock just yet. With approximately 30 million customers on Groupon’s books, Alibaba may be mighty tempted to buy a customer book of this great size ‘on the cheap’.

SANTANDER (SC)

- The auto loan market is overexposed to subprime loans.

- Santander is almost entirely focused on the auto loan market.

- Therefore, Santander is a short candidate with significant downside potential.

The above-listed bullet points state it all. Don’t they? More reports of over-indebtedness and defaults within the US consumer sector, from student loans to credit cards and auto loans, made the choice of shorting SC a true no-brainer for me. And of the five stocks in my portfolio, SC is my second-best performing stock, with a 9% gain within five weeks. Not bad at all.

I wrote the following in my report, explaining my thesis behind shorting SC:

Santander is one of the leading auto loan providers in the country. However, the auto loan market is currently showing preference for subprime and deep subprime loans. The situation is reminiscent of the mortgage market in 2008, when the market saw a surge in subprime mortgage loans. This growing trend may lead to instability in the broader auto loan market and eventually harm key players such as Santander.

Of my present holdings, SC is my only play on a deteriorating US economy, which has already hit low-income consumers. Historically, credit defaults move along up the chain to the core middle class consumer during a credit contraction phase of economic cycles.

And so far, my short SC play has worked out. I expect further price declines of SC as we move into the remainder of the year. The momentum of credit problems throughout the consumer level has just begun, in my opinion. I’m looking at $9 as my first target price before assessing whether to take SC all the way down to new lows.

That’s a solid basket of small caps to manage so I won’t be looking to add anything new this week but will consider adding size to Groupon (GRPN). Regarding Fannie Mae (FNMA), I’ve removed from my Watch List. I don’t see any catalyst for a big move and in a reasonable amount of time, as the initial enthusiasm for the stock due to the Trump presidential victory has ended for what could be a while. I’m sure I’ll be back to FNMA in the future, and will keep you posted on one of my favorite plays.

I’ll be sniffing around for a good stock to add to my Watch List, and will report it as soon as a good one reaches my eyeballs.

Until next time…

Trade Wise and Green!

Jason Bond

0 Comments