Good morning.

With the DJIA failing to reach 20,000 by Friday, no champagne corks were popping this week. Oh oh. That’s five-straight weeks of a failed 20,000.

As of Friday’s trade, the major indexes closed as follows:

DJIA: 19,885.73; (-0.39%)

S&P 500: 2,274.64; (-0.10%)

NASDAQ: 5,574.12; (+0.96%)

Russell 2000: 1,372.05; (+0.35%)

Bank, technology and small cap stocks outperformed the DJIA and S&P 500 this week, as the Russell 2000 put in a better performance this week than last week’s. That’s a plus. But the banks, measured by the BKX Index, look tired—for the fifth week in a row—as another $0.37 rise in the index to close at $93.11 failed miserably to follow through on Friday’s surge past $94.00.

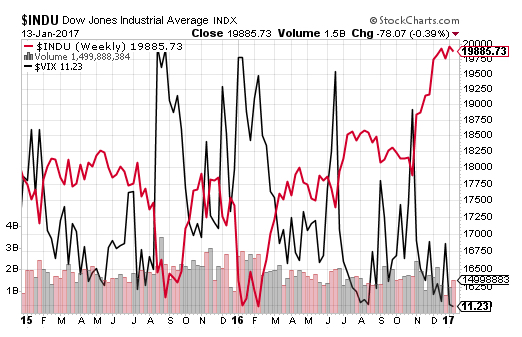

The VIX again provided nothing positive in the way of stock prices in the industrials this week. Even a strong slam down of the indicator on Wednesday and Thursday (by whom?) wasn’t enough to raise the DJIA close enough for a last-minute push above 20,000. Maybe the rumblings about the advice volunteered by Morgan Stanley and, now, Jeff Gundlach, to sell the ‘Trump rally’ on, or before, Inauguration Day has the market spooked. I know I’m spooked, especially as we enter the fifth week of teases from the blue-chip average.

Below, is a chart I asked Jeff Williams at PennyPro to make for me, so subscribers of Jeff’s newsletter are already familiar with the chart. My VIX/DJIA algo shows a deep overbought condition, so a visual look at the two should serve to make my point of being especially cautious now, maybe even withdraw from the major indexes until after the Inauguration on Friday.

And any help from the yen was completely void this week. The financing currency of choice spiked 1.86 yen to the US dollar for a hefty 2.17% move higher this week. US stocks typically rise with concurrent falls in the yen against the US dollar. So, if the VIX isn’t doing the job of elevating stock prices, can we expect some timely and dovish jawboning from the governor of the BOJ, Haruhiko Kuroda, soon?

And as far as the euro this week: ditto. The principal rival to the US dollar and most heavily-weighted currency of the USD Index rose 1.05% for the week to 1.0643, but still trades well below its 52-week moving average. The French elections are coming up in March. A win for the populist candidate, Le Pen, certainly has traders of the euro running shy of the currency.

My guess is, that the euro is already pricing-in a nail-biting election now waged between the conservative and populist parties in Paris. And I don’t see much changing over the next six weeks, or so, if the polls don’t change much from a consistently good showing for Le Pen. The bottom line is: an uncertain Europe keeps global traders in US assets.

The precious metals are on the rise once again. Gold and silver prices rose $22.80 and $0.25, respectively, this week, the third-straight week of rising prices. My price targets for both dollar-gold and silver prices are $1,350 and $21.00, respectively, by the end of the first-half of 2017.

The bond market performed to my liking this week, as the yield on the US Treasury 10-year dropped a modest two basis points to close at 2.40%. And for those interested in the thoughts of one of my favorite fund managers on the all-important subject of yields, zerohedge.com published a piece, covering DoubleLine’s Jeffrey Gundlach’s latest comments about the bond market, Donald Trump, and Bill Gross. His comments about Bill Gross, although not mentioned by name were surmised as directed toward him when Gundlach referred to those “second-tier bond managers” who suggested a 2.60% yield on the US Treasury 10-year note would spell trouble for US stocks are wrong.

Gundlach, obviously, disagreed noting “the last line in the sand is 3 percent on the 10-year. That will define the end of the bond bull market from a classic-chart perspective, not 2.60%” as Gross suggested. He then added that “almost for sure we’re going to take a look at 3 percent on the 10-year during 2017, and if we take out 3 percent in 2017, it’s bye-bye bond bull market. Rest in peace.” Such a jump would would have “a real impact on market liquidity in corporate bonds and junk bonds.”

It would also hit stocks, as 3% on the 10 Year would spell “trouble for equity markets.” He also said that “a 10-year above 3%, with the 30-year yield approaching 4%, would also be trouble for the equity market because they would start to look like ‘real’ yields to investors.” Previously Goldman reached the same conclusion, however when looking at 2.75% as the selloff bogey.

Gundlach said it’s not radical to forecast a 6% yield on the 10-year by 2020.

However, that won’t come quick: in predicting the next steps for the benchmark Treasury, Gundlach said “I think the 10-year Treasury will go below 2.25 percent … not below 2 percent” before once again starting to rise.

There’s a lot there to think about from Gundlach, and will be the focus of the rest of the first-half of this week’s report.

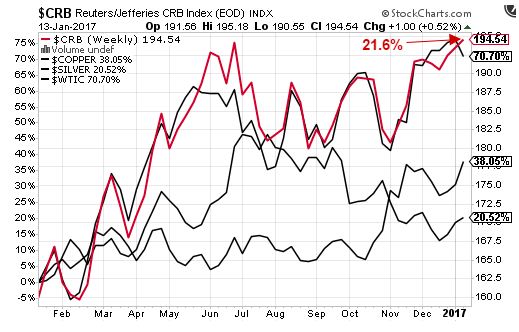

For those of you who know me, I’m of the same thinking as Gundlach on a lot of issues, and higher bond yields is certainly one of them. Why? Look at y-o-y copper and oil prices, and the CRB Index and silver prices; they’re way up! See chart, below.

Year-over-year, the price of WTIC rose by 70.7%; copper by 38.05%; silver by 20.52%; and the basket of commodities (as measured by the CRB) is up by 21.6%. Therefore, wholesale and consumer price inflation is on the way to the US, and should really heat up overseas as well, where finished products supplied from countries of SE Asia and China must raise prices to offset rising costs of imported materials and parts, both due to rising commodities prices (in dollar terms), as well as due to weak local currencies with which these materials and parts are paid.

As I stated, I see what Gundlach sees, and rising yields must result as a byproduct of eight years of central-bank QE. And for those readers who think the jig will be up for stocks in the coming years during an expected bear market in bonds, you most likely will be shown to be correct in the sense that most stocks with leveraged balance sheets will perform terribly in a high-yield environment.

However, there will also be bull markets amid the sea of struggling large-caps, mid-caps, FANG and FANG-wannabe stocks. And I know where to look for these emerging bull markets, but that day will come in due time.

But notice the theme that Gundlach has been preaching for more than six months, which is, that rising commodities prices while the US dollar hangs high foreshadows stagflation. So, where do we go when the time is right?

Oil, natural gas, mining companies, food, beverage and entertainment stocks do well during stagflationary conditions, along with, of course, my usual selective plays that I anticipate will be immune to the misfortunes that will most likely fall upon the vast array of institutional favorites.

And in the ETF world (Jeff Bishop’s bailiwick) Inverse Exchange Traded Funds (IETFs) and sector funds work well in a stagflation environment, too, for those playing ETFs. Don’t worry; the fun will indeed continue with, or without higher interest rates.

Okay, let’s talk stocks. I want to provide updates regarding my Watch List and discuss a two trade I made this week.

This Week’s JBP Stock Ideas

TWITTER (TWTR)

Original report: 11/14/2016

On November 5, I alerted a Call position I took in TWTR at a strike price of $20.

To read my rationale for the Twitter Call, follow the link to my report: ‘Twitter Takeover Play’.

My bet with a Call option includes the possibility a suitor who can fix Twitter’s sluggish attempt to monetize the company may be announced by the expiration of my March 2017 Call.

At the close of Friday’s trade, the contract settled at $0.59. The option expires in 60 days.

I’ve been asked, from where do I expect a bidder for Twitter to come: Alibaba (BABA).

Update 01/16/2017:

There was absolutely no stock-specific news worthy of discussion this week. The stock traded within a 4.8% range during the week, and was rejected by the 52-week moving average at $17.47 on three separate trading days after managing to close above the average on Monday.

ABOUT TWITTER (TWTR)

Twitter, Inc. operates as a global platform for public self-expression and conversation in real time. The company offers various products and services, including Twitter that allows users to create, distribute, and discover content; and Periscope and Vine, a mobile application that enables user to broadcast and watch video live. It also provides promoted products and services, such as promoted tweets, promoted accounts, and promoted trends that enable its advertisers to promote their brands, products, and services; and subscription access to its data feed for data partners.

KANDI TECHNOLOGIES (KNDI)

Original report: 12/17/2016

As I alerted on December 14, I bought 7,000 shares of KNDI at $5.44 per share.

KNDI traded up $0.05, to add to the previous week’s $0.10 rise, to close at $5.05 on Friday.

There was no company-specific news this week, but the short position increased to 15.91% from the previous week’s 15.2%.

Here’s why I bought the stock:

I have traded KNDI earlier this year for a nice profit. Since then, the stock has come down significantly from the $6 and $8 range, dropping to as low as $3.40 in mid-November amid concerns of a hold to incentive payments due from the Chinese government.

So, what was the result of the hold on the company’s subsidy payment from the Chinese government?

On November 9, Kandi released a compete earnings report disaster. Revenue crashed to $6.4 million during Q3, down from $50.5 million, or -87%, from Q3 of last year. The company cited a freeze of incentive payments as the reason for the decline.

Kandi’s primary business is selling electric-vehicle parts to an electric-car joint venture, Kandi Electric Vehicles Group Co., with automaker Geely Automobile Holdings (NASDAQOTH:GELYF). The partnership is heavily dependent upon subsidies from the Chinese government, whose economic development plans include the development of electric vehicles.

However, because of nationwide investigates by Beijing into fraud allegations across the industry, incentive/subsidy payments throughout the industry have been frozen until the government completes its investigations. In the case of Kandi Electric Vehicles Group, without government funding, only 184 units of EV products were sold in Q3, a 96.9% decrease, y-o-y.

In response to the dramatic drop to revenue during Q3, Kandi Chairman and CEO, Mr. Hu Xiaoming, stated, “China’s central government preceded a review on the subsidies paid to all the EV manufacturers, which caused the 2015 subsidy payments remain unpaid industry-wide. The delay in subsidy payment heavily impacted the Joint Venture’s production and sales, which resulted in a significant decrease in our EV parts sales.”

Hu further stated that Kandi had been working with government officials and expressed confidence that the subsidies will be coming “soon.”

Earlier, in September, five of Kandi’s rivals were fined and removed from the list of companies eligible for subsidies.

On 29 November, KNDI announced that its wholly-owned subsidiary Kandi Electric Vehicles (Hainan) Co. Ltd received a subsidy payment of RMB 100 million (approximately US$14.5 million) to support its research and development expenditures for a new model of electric vehicle. This news of a subsidy payment to one of Kandi’s subsidiary suggests to me that the subsidy payment to the joint venture may in fact be sent “soon.” Why would Beijing clear a Kandi subsidiary but not the partnership?

News on progress of new factory in Hainan:

In the last earnings call, the company announced the following:

“Our Hainan facility construction proceeds smoothly and we have started to install the equipment as scheduled. We also made progress on the designed product in Hainan’s factory. We expect this product could be well received by the market. With respect to the production license for the new energy vehicle, we have accomplished last or fundamental work. We made our endeavors in the application and hope to opt in the license within 2017.”

This news release clearly indicates progress is being made according to the company’s production plans. I am expecting news from the company at some time between now and mid-2017 regarding the vehicles expected to be produced at the plant.

Insider buying:

On five separate days, from November 23 through to December 2, CEO/president Hu Xiaoming, 10% owner of Kandi Technologies Group Inc. (KNDI), purchased a total of 230,000 shares at a total transaction cost of more than $1 million. Hu’s purchase price range of $4.16 and $4.99 suggests to me the range of support for the stock will fall within this range and strongly suggests to me that Hu really does believe that the frozen subsidy payments due the company are, indeed, on the way.

The Play:

With 15.91% of the stock’s float held short, any positive news may drive the price rapidly higher, similar to the 11% price spike on November 29, the day of the news release regarding subsidy payments received related to the Hainan facility.

Now trading at the $5 level, I will be looking for the next move to the $5.50 level. The next resistance level may be at $6.00.

In the meantime, there’s a lot of time for news to be released about the company’s frozen subsidy payments before the company reports Q4 earnings is released, scheduled for early March.

My question is: if the CEO has bet $1 million on a favorable outcome to Q4 and/or imminent news regarding the company’s frozen subsidy payments, why wouldn’t you follow the CEO with your own stake?

Update 01/09/2017:

The latest inside purchase was on December 27, when CEO and President, Hu Xiaoming, bought another 57,060 shares at $5.15, for a total purchase price of $293,859. Xiaoming now holds 12,342,411, according to the SEC. That’s more good news.

Update: 01/16/2017:

There was a slight change to the stock’s short interest; it remains at a high rate of 15.92% of the stock’s float, slightly down from 16.02% of two weeks ago, but up from 15.2% at the close of trading on January 9. The short ratio has dropped slightly to 15.26 days, which is still a very high number of days to cover.

ABOUT KANDI TECHNOLOGIES (KNDI)

Kandi Technologies Group, headquartered in Jinhua, Zhejiang Province, is engaged in the research and development, manufacturing and sales of various vehicle products. Kandi has established itself as one of China’s leading manufacturers of pure electric vehicle (“EV”) products (through its joint venture), EV parts and off-road vehicles.

LIQUIDMETAL (LQMT)

Initial report: December 14

There was no news to report this week, but the stock traded up $0.0133 to close at $0.2281, a 6.2% gain. So, I’m well into the ‘green’ with a 16.3% profit on this stock, after only 30 days of holding it.

On Wednesday, December 14, I bought 100,000 shares of LQMT at $0.196, and plan to increase my stake by an additional $30,000 in the future.

LQMT is a long-term trade, and has been a winner for me in the past. On November 1, I sold LQMT for a $4,300 profit from a two-month holding time period.

I now expect to be holding the newly-acquired shares for at least six months. My price target is $0.40, at minimum.

I attended the new CEO conference call on December 8 (after the close), and believe LQMT is a sleeping giant, with the potential to be profitable and to be listed on the AMEX in the coming years.

WHY I’M LONG LQMT

Background:

On March 10, Liquidmetal and DongGuan Eontec Co., Ltd. entered into an agreement, whereby Professor Yeung Tak Lugee Li, Chairman of DongGuan, agreed to purchase up to 405 million shares of LQMT stock for a purchase price of $63.4 million.

A term of the deal included the purchase of 105 million shares at $0.08 per share for a purchase price of $8.4 million, which did indeed happen on March 10. An additional term of the deal included the purchase of an additional 200 million shares at $0.15 per share for a purchase price of $30 million, and the purchase of 100 million shares at $0.25 per share for a purchase price of $25 million. In total, Mr. Li is eligible (board approved the agreement in May) to purchase 300 million shares for a purchase price of $55 million.

In addition, Liquidmetal issued a warrant for an additional 10,066,809 shares at an exercise price of $0.07 per share.

So, who is Professor Yeung Tak Lugee Li? He is the Chairman of DongGuan Eontec Co., Ltd., in China. The company symbol on the Shanghai Exchange is (SHE:300328.SZ), where the shares currently trade at (yuan)14.02, or $2.10 per share. The market capitalization of DongGuan Eontec is approximately $850 million, and is a highly profitable company, with net profit margins exceeding 10%. The company manufactures next-generation metals for other commercial enterprises involved with the production of consumer products, just as Liquidmetals is in the business of producing.

In 2012, Li founded Leader Biomedical.

In 2013, he acquired a majority stake in publicly-traded aap Joints, a division of aap Implantate AG in Berlin, Germany.

In 2014, Li acquired EMCM, a biomaterials contract manufacturer, from aap Implantate.

All of these companies that Li purchased are in the business of developing and manufacturing next-generation metals for commercial products. Therefore, my stake in LQMT is motivated by the modus operandi of Mr. Li taking control of LQMT with plans to move LQMT onto the AMEX.

On December 14, the company announced that it has named Professor Lugee Li as President and Chief Executive Officer of Liquidmetal Technologies.

“Professor Li has served as a member of the Company’s Board of Directors since March 10, 2016 and is the sole owner of Liquidmetal Technology Limited, a Hong Kong company that is the Company’s largest shareholder,” according to the news release. “Professor Li will not be taking any compensation as a result of his appointment as President and Chief Executive Officer.”

Now that Li has taken control of Liquidmetals, I expect rapid progress. This trade idea is very similar to FNMA, in that the stock is at an inflection point. Right now nobody is paying attention to the stock, just as no one was paying attention to FNMA when I bought 40,000 shares of the stock at $1.72.

With Li on board, I’m going to be patient with LQMT, as I expect the stock to start and stop until more news from the company begets more investors and liquidity moves to higher prices during the coming year.

Update 01/16/2017:

The company issued a news release, stating “it has ordered its first amorphous metal molding machine from its Licensee, Eontec Co., Ltd. The machine design is based on a die casting platform and is complementary to the injection molding machine developed with Engel. Delivery of the machine is expected in March 2017.”

A company doesn’t order production equipment unless a market has been targeted, or has been penetrated through contingency agreements. Not unlike other micro-cap companies, Liquidmetals’ plans are opaque to investors, which is a good thing for those seeking to get into a stock at very low prices. The bad, of course, is the lack of information in order to make a judgment regarding the stock. But in my case, I attended the conference call held by the company’s new CEO in early December, so I’m as close to an insider without actually being one. Hang in with me on this stock; it’s doing fine.

ABOUT LIQUIDMETALS (LQMT)

Liquidmetal® Technologies researches, developments and commercializes amorphous metals. The company’s revolutionary class of patented alloys and processes form the basis of high performance materials in a broad range of medical, military, consumer, industrial, and sporting goods products. Discovered by researchers at the California Institute of Technology, Liquidmetal alloys’ unique atomic structure enables applications to achieve performance and accuracy levels that have not been possible before. As the company controls the intellectual property rights with more than 70 U.S. patents, these high performance materials are dramatically changing the way companies develop new products.

Source: Liquidmetals Technologies

FANNIE MAE (FNMA)

FNMA traded down $0.04 this week for a 1.02% loss. The stock still hovers close to the $4.00 mark.

As loyal subscribers know, I made a killing on FNMA after selling out for a $12,800 profit on November 23 on a bet that a Trump victory at the polls would soar the stock. As a reminder to my long-term subscribers, read my article of a year ago, If Trump Wins The White House, FNMA Soars. In the article, I suggest that Trump, the businessman, fully understands the wrong perpetrated by the US government against stockholders of Fannie Mae. That’s not too hard to conclude, and is why the stock soared following his win at the polls.

From the article, follow the links, because if you do and read the supporting documentation of my article, you’ll come away with a firm grasp of the political and legal issues involved with FNMA and the stakes involved to traders of the stock.

Trump takes the oath of office on the 20th, so now what? As I see it, the issue of Fannie Mae’s future now becomes more of a political than a legal one.

Changing the structure of Fannie Mae may turn into a tough fight for Trump on Capitol Hill. The idea of a nearly eight-decade-long legacy government GSE being throw to the wolves (as Democrats might see it) will drain a lot of political capital that each president starts with when initially entering the Oval Office. FNMA is no Social Security issue, but it is huge, especially, with Democrats, and ranks as a high-profile political fight I expect between Trump and Democrats, for sure.

On the Republican side, throwing Fannie Mae to the wolves, if you will, represents the other side of a clear victory for one party over the other. A Republican dream is to allow the private sector to bid for tranches of Fannie Mae’s $5 trillion mortgage holdings. That’s huge business!

What would a privatization that do for mortgage interest rates?

Rates would soar, of course. In droves, potential homeowners would be shut out of the mortgage market, and the US economy would take a whopping hit. Oh, and the 30-year mortgage? Forget about it. The advent of the 30-year mortgage was facilitated by the mere existence of the GSE in the first place. Instead, a 15-year loan would probably become the longest fixed-term loan a borrower could achieve.

Now, picture a prospective homeowner, whose principal and interest payment each month would result to as much as 71% leap under a fully-privatized plan? At a 15-year mortgage term and a, say, 5.5% interest rate on a $170,000 loan, his payment would jump to $1,389 per month, from $811.

So, forget about that! A cold-turkey, fully-privatized plan won’t happen. Even the staunchest anti-Fannies would not vote for such a draconian plan. Under a scenario, even remotely close to this one, would quickly become Trump’s ‘Obama Care’.

So what is more likely to result as a compromise?

The most likely scenario is one that compromises between upholding stockholders’ rights and a fix to the impediments that already work. That’s where the expertise of Trump’s nominee for Secretary of Treasury, Steven Mnuchin, a Goldman Sachs alumnus, comes in, who stated on November 30 that he would like to see Fannie Mae privatized “reasonably fast.”

“We will make sure that when they are restructured, they are absolutely safe and don’t get taken over again,” he told Fox News. “But we’ve got to get them out of government control.”

Ah, so what do I read into Mnuchin’s comments? I think a recapitalization plan may be the settlement Trump and the Republicans hope to achieve, as a first step. That would delight the Democrats, but tick-off Republicans. So, what to do?

To get Republicans aboard a recapitalization plan, Mnuchin and Company may propose a “slow motion” to privatization plan, as I suggested, a plan of which may involve a decade-long unraveling of the implied government backing of mortgages.

A wrinkle to the slow-motion compromise may also involve a slow-motion recapitalization scheme for Fannie Mae, which may actually be the mechanism that facilitates an orderly unwinding of government control, similar to the present FDIC scheme of backstopping the banking system.

I’m aware that reserves at the FDIC are a joke, but this framework may be in Mnuchin’s head as part of a compromise between political parties and between plaintiffs and the FHFA in the ongoing lawsuits. Essentially, a deal may come down to a matter of initially and adequately funding an FDIC-like scheme to backstop the mortgage market, while at the same time let the taxpayer off the hook of Fannie’s balance sheet—in theory, of course. But that may be the pitch Mnuchin can make to both Republicans and Democrats, and may serve, too, as a great talking point for Republicans to make to their constituencies.

As investors of FNMA, there are many more scenarios that involved FNMA stockholders getting paid through a windfall deal (fast or slow) than scenarios that shaft stockholders.

Unlike the financial media hyping the Fannie Mae issue as the next Ali-Frazier fight (Am I showing my age?), as I see the political path to a profit buried in the FNMA trade, a Trump deal to unlock Fannie Mae’s balance sheet to settle lawsuits is doable. In that case, $4 for FNMA represents a potentially huge discount to its underlying value.

I’ll let you know what I decide to do about FNMA.

Update 01/16/2017:

No news about FNMA. And if you look at the chart, FNMA’s range this week was the narrowest since mid-October. Boring.

ABOUT FANNIE MAE (FNMA)

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation’s purpose is to expand the secondary mortgage market by securitizing mortgages in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or “thrifts”). Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac.

CROCS (CROX)

As I alerted on January 12, I bought 3,000 shares of CROX at $7.07. My initial goal is to sell at around $8.50, which is a significant resistance level. I expecting to hold CROX for as short as a few weeks to as long as a few months.

Crocs is a play on a successful turnaround. After Q2 and Q3 showed a decline in revenue and gross margin, I’m anticipating Q4 to satisfy investors. The Q4 earnings report is expect on March 6, and the consensus forecast is for Crocs to earn $0.15 per share. If the company can reach the consensus of $0.15, an $8.50 price target price I’ve set for the stock may easily be reached.

After Blackstone Group came to the aid of Crocs to bring in experienced executives and, specifically, execs who specialize in turnarounds, I see absolutely no reason for this company to not ‘right’ itself. People love this brand much more than they hate it. That’s a good enough brand sentiment to raise the company’s Price/Sales back up to 1:1 from today’s 0.49:1. To me, the share price of CROX is much too low when taken within the context of an industry average Price/Sales of 1.67!

Remember, too, CROX used to be a $70 share price, 10 years ago. If progress is made at the company, more traders will no doubt see the potential I see in the company.

George Putnam of The Turnaround Letter likes CROX, too, stating in his analysis of CROX, “They [Crocs] are starting to get traction” from the new management team. Who’s George Putman? Since 1986, Putnam’s picks have averaged 11.4% gains per year! So, I’m in pretty good company on this pick.

Oh, and one last point. Ten institutional investors jumped on the stock during Q3, a quarter when the stock was trading at between $8 and $12 per share. Well, yours truly is in CROX at $7.07.

ABOUT CROCS, INC. (CROX)

Crocs, Inc., together with its subsidiaries, designs, develops, manufactures, markets, and distributes casual lifestyle footwear and accessories for men, women, and children worldwide. It offers various footwear products, including clogs, sandals, wedges, flats, sneakers, and boots. The company’s primary trademarks include the Crocs logo and the Crocs word mark. It sells its products in approximately 65 countries through domestic and international retailers and distributors, as well as directly to end-user consumers through company-operated retail stores, outlets, Webstores, and kiosks. As of December 31, 2015, Crocs, Inc. operated 275 retail stores; 98 kiosks and store-in-stores; 186 outlet stores; and 12 company-operated e-commerce Web stores. The company was founded in 1999 and is headquartered in Niwot, Colorado.

Source: Finviz.com

GROUPON, INC. (GRPN)

On Friday I alerted a purchase I made of 10,000 shares of GRPN at $3.54 per share. I really suspect that GRPN is running on, both a rumor circulating that Alibaba (BABA) is sniffing around the company with the idea of buy it, and the January Effect.

Who knows, maybe Alibaba will be the focus of a bunch of rumored takeovers this year. Alibaba was rumored to buy Twitter (TWTR), too. Remember?

But Alibaba’s 5.6% stake in GRPN is not a rumor, so Alibaba may in fact be shopping.

So far, GRPN’s 7.8% move higher this year is impressive, and probably has something to do with tax sellers in December picking the stock back up for a speculative play in 2017. But GRPN did get a nice shot in the arm to as high as $3.80 on the Alibaba rumor; so, I’m holding onto this potentially hot stock.

Okay, here’s the ‘skinny’ on GRPN. I believe that the rumor of Alibaba buying Groupon isn’t far-fetched at all. A takeover actually makes sense for Alibaba in a strategical sense, in that it’s well-known that Alibaba seeks to expand globally. And why not enter the largest economy of the world? The US.

Groupon’s US Q3 billings rose strongly by 6%, y-o-y, while the rest of the company’s business overseas stank to high heavens, which isn’t necessarily a bad thing for Alibaba. Alibaba may only be interested in the US market, anyway.

Look at it this way: Alibaba is looking at Groupon’s Price/Book of 0.66. And it appears that Groupon is truly turning around. The company’s earnings have been better than expected since Q3 of 2015, and in Q3 of 2016, 1.2 million net new customers were added to the company’s customer base. With approximately 30 million customers on Groupon’s books, Alibaba may be mighty tempted to buy this customer book on the cheap.

And finally, on a somewhat humorous note, Chairman of Alibaba, Jack Ma, met with president-elect Donald Trump on Tuesday. I can just imagine how that meeting went, as I can envision Ma asking permission of Trump to come into the US and buy an American company. As long as no one heard Trump bellow, “Okay, get ’em outta here,” I think we’ll be hearing more from Ma in 2017.

ABOUT GROUPON, INC. (GRPN)

Groupon, Inc. operates online local commerce marketplaces that connect merchants to consumers by offering goods and services at a discount in North America, Europe, the Middle East, Africa, and internationally. It also provides deals on products for which it acts as the merchant of record. The company offers deals in various categories, including food and drink, events and activities, beauty and spa, health and fitness, home and garden, and automotive; and deals on various product lines, such as electronics, sporting goods, jewelry, toys, household items, and apparel, as well as provides discounted and market rates for hotel, airfare, and package deals. It offers its deal offerings to customers through Websites; search engines; and mobile applications and mobile browsers, which enable consumers to browse, purchase, manage, and redeem deals on their mobile devices, as well as sends emails to its subscribers with deal offerings that are targeted by location and personal preferences. The company was formerly known as ThePoint.com, Inc. and changed its name to Groupon, Inc. in October 2008. The company was founded in 2008 and is headquartered in Chicago, Illinois. Groupon, Inc. is a subsidiary of The Point, LLC.

Source: Finviz.com

Until next time…

Trade Wise and Green!

Jason Bond

0 Comments