Good morning,

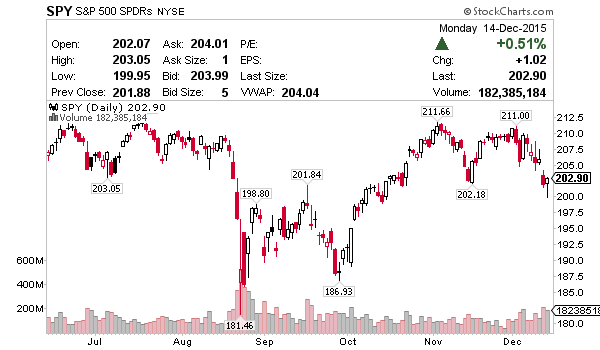

I’ve been reluctant to make any new moves, opting to play it safe and remain cash, ahead of Wednesday’s FOMC announcement where the first interest rate hike in about a decade might be etched in history.

The portfolio, since inception September 2015 or about 3 months ago is +$26,965, profits I want to protect by avoiding certain volatility this week. That said, there’s a few stocks I am watching very closely for entry and might size into anticipating an uptrend in the market and new 52 week high soon.

I think 2016 is going to be an excellent year for small caps, especially the first quarter, so I’ll produce my January Effect report soon, detailing 7 depressed stocks with the potential to double in early 2016.

But for now, let’s take a closer look at what I might do this week.

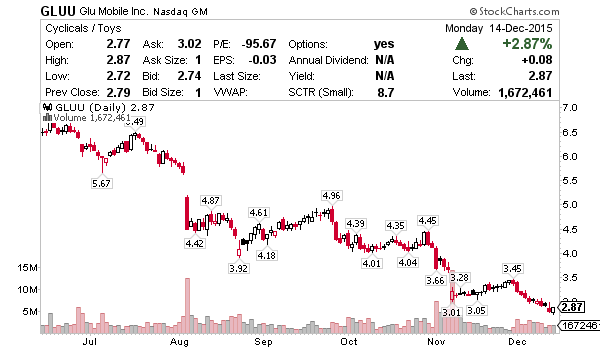

GLUU – Found buyers with the market Monday, always a good sign. Using Monday’s low of $2.72 as a stop loss I’m looking to position into this oversold chart and trade for the middle $3’s in the coming weeks.

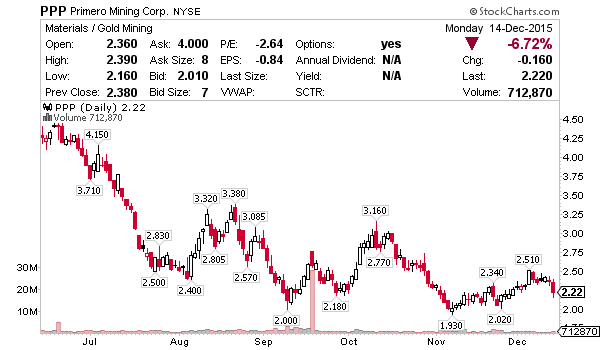

PPP – The strong dollar, up in anticipation of an interest rate hike, has weighed on gold and the miners. I believe the runup in the dollar is due to snap which could trigger a squeeze in gold and the miners soon. I’m watching PPP as my play, looking for entry above $2, stop loss below and profit on the way to $3.

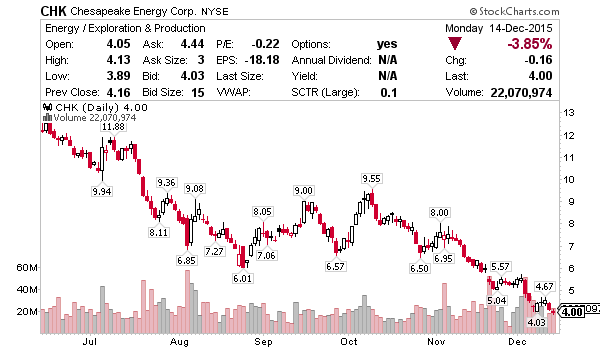

CHK – Probably my favorite play in the energy sector right now, I think something around $4 should be good for a move to $5 soon. Stop loss below $4 and try again later, don’t ride energy stocks lower, just a few week hold looking for the bounce.

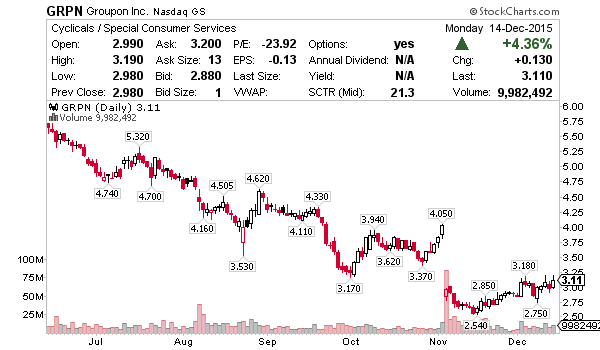

GRPN – Starting to press the gap this is top my list for a nice move if the recent high of $3.18 breaks. The space keeps getting smaller and smaller at competitors pack up their bags and move out of the space, thus giving Groupon an opportunity to monetize their huge footprint.

Trade green!

Jason Bond

0 Comments