My favorite price range for small caps is between $1 and $3 with a $100 million market caps and a Beta above 2 but there aren’t always as many good setups as between $3 and $7. Given the S&P 500 is quite possibly going to bust through the triple top soon if not this week, I went scanning for good setups between $1 and $2 with at least $500,000 in dollar volume Wednesday. VG, AVL, ACLS, PACB and DVR stock all made the cut.

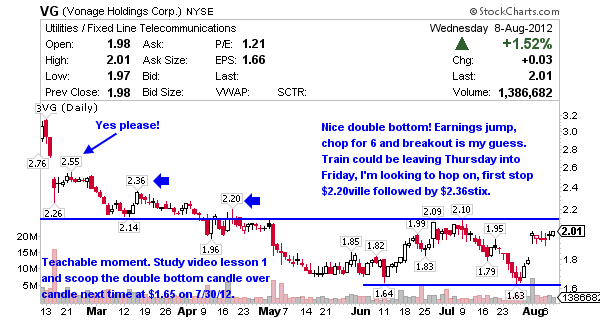

Vonage Holdings (NYSE:VG) provides broadband communication services in the United States, Canada, and the United Kingdom. VG’s stock market cap is $456 million with a Beta of 1.74. The short interest is 5 days to cover and 5% of the float short. On August 1st Vonage reported Q2 earnings and gaped up 11%, dipped slightly and is now challenging $2 resistance. Should the overall market pull I’ll look to scoop the Moving Averages but if the major indices blow through the triple top I’d expect to see this one trend to $2.50’s.

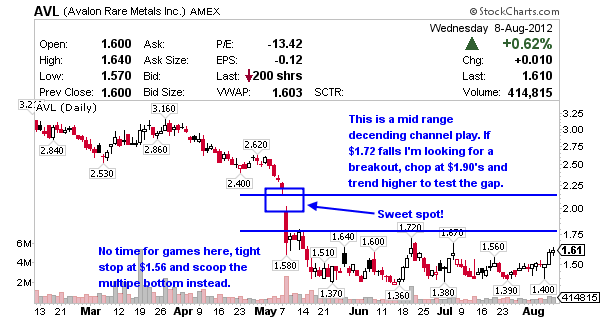

Avalon Rare Metals (AMEX:AVL) engages in the exploration and development of rare metals and minerals in Canada. AVL’s stock market cap is $167 million with a juicy Beta of 3.8. The contrarians make up 7% of the float with 19 days to cover. As China continues to decrease rare earth exports the bigger players like Molycorp, Lynas and Rare Element will get attention and AVL is a great way to play it around a buck. Technically a move to $2 is not out of the question should $1.72 fall. Up quite a bit from its $1.42 low 3 days ago, make sure Wednesday’s doji comes out on top, otherwise accumulate the MA(20) and MA(50).

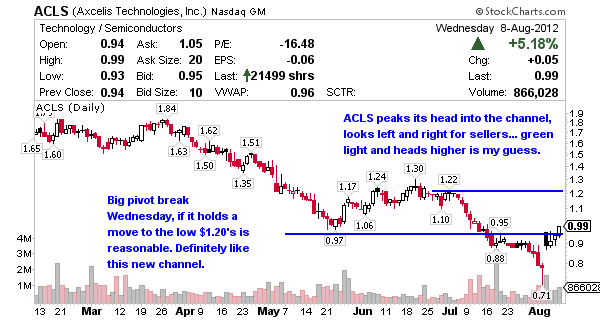

Axcelis Technologies (NASDAQ:ACLS) designs, manufactures, and services ion implantation, dry strip, and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and Asia. ACLS’s stock market cap is $106 million with a Beta of 2.85. The short interest is 5 days to cover and only 3% of the float is short. Up since earnings I’d look for 20% between here and resistance at $1.20. There should be some support at $.94 should it chop before the train leaves the station.

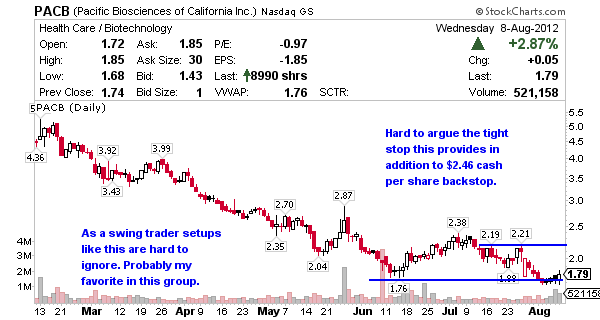

Pacific Biosciences Of California (NASDAQ:PACB) is a development stage company, develops, manufactures, and markets an integrated platform for genetic analysis. PACB’s stock market cap is $100 million with a Beta of 1.97. The short interest here is 13 days to cover and 9% of the float is betting against the stock. PACB has $137 million in cash, $6.8 million debt, 56 million outstanding and wait for it… $2.46 cash per share. With PACB closing Wednesday’s session at $1.79 just off a double bottom at $1.76 I’d say the swing risk is worth reward here given the tight stop loss and cash per share backstop. This is my favorite trade on this list and one I’m looking to move into.

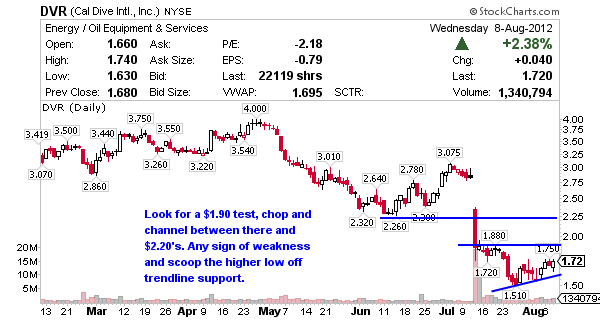

Cal Dive International (NYSE:DVR) is a marine contracting company, provides manned diving, pipelay and pipe burial, platform installation, and platform salvage services to the offshore oil and natural gas industry. DVR’s stock market cap is $159 million with a Beta of 2.5. There’s very little short interest at 2 days to cover and 9% of the float is short. The PPS has slowly been creeping higher since it moved out of oversold just after earnings. From here I expect to see a test of $1.90, chop and a push to $2. Should a pull take place before the $1.90 test I’ll look to scoop $1.60 trendline support.

can you get out of this program aytime you want

No, once you pay once you recur for life haha! Of course, you just email me at anytime. Hopefully you’ll like it and be around for years to come though.

well i work a weird schedule so there will be some weeks i wont be able to participate.

i am just learning so i am a little skeptical