Stocks tried to rebound in the morning session, but there wasn’t any juice behind the move. Whatever the market does, I’ll still be in attack mode.

You see, even if the market tanks — there will be pockets of opportunities. For me personally, I want to focus on small-cap stocks because many of them move to the beat of their own drum.

With these specific plays, it’s important to focus on the price action and reliable chart patterns.

Today, I want to show you how I identified three momentum trading opportunities, and why I believe they can take off.

Can These Three Momo Stocks Take Off?

When it comes to identifying potential trading opportunities, it helps to look at some of the top gainers, whether they’re from today or previous days. That helps with idea generation and filtering for stocks with momentum.

Take a look at some stocks that popped off yesterday.

This filter simply looks for stocks with a dollar volume ($ volume) of $2M or more on the day, and are running higher.

From there I look at the catalysts and chart patterns. That said, let me show you what plays on my radar.

First up, there’s DSS.

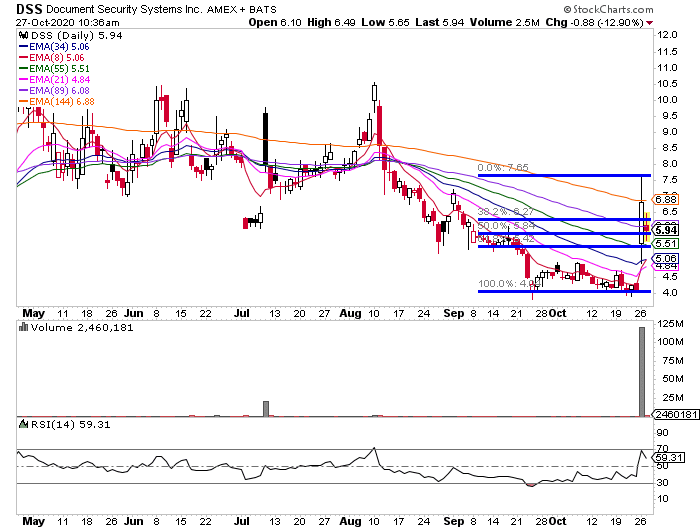

Document Security Systems (DSS)

- The company operates in digital brand protection and securitized digital assets space

- On Oct. 26, the company had a 68% run up following news that some of its board members have joined the board of an affiliated company called Sharing Services. Later in the day, the company also reported upbeat earnings: EPS of $0.70 vs $(1.53) in same qtr of last year, revenues of $4.17M vs $3.53 a year ago.

- Despite the seemingly insignificant catalyst for the first run up, the stock finished very strong and demonstrated clean support above $6 – its 2 month-resistance – and later above VWAP. It’s also traded almost 120 million shares on a float of less than 4 million. The upbeat earnings report can only serve as a boost for another leg higher.

- The pattern that’s setting up in DSS is the rest and retest (Fibonacci retracement).

The $5.85 level is just around the 50% retracement, and I think it makes to look for there for entries. The 61.8% retracement ($5.42) also looks like an area of value, so I’ll keep an eye there as well.

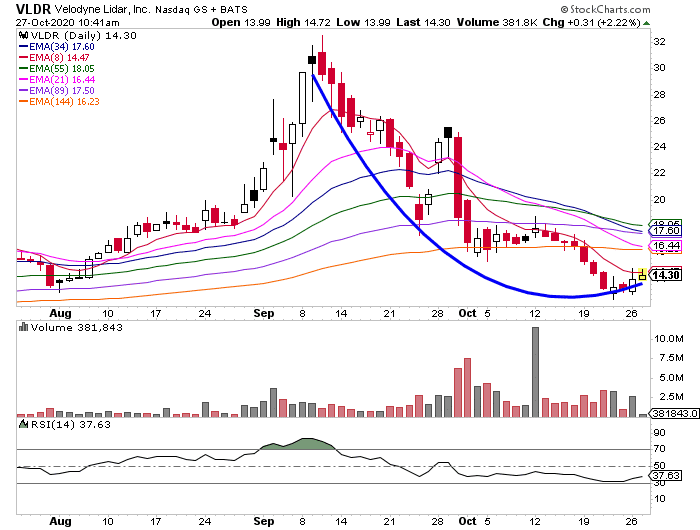

Velodyne Lidar (VLDR)

- The company is a developer of lidar sensors – devices that are at the core of self-driving technologies. Although this is technically not a small-cap stock (it’s got a market cap of $2.4B or so), there’s a pattern developing that I love.

- The company’s main product – Alpha Prime sensor – has generated great interest which culminated in Baidu signing a 3-year supply deal. Earlier this month, Ford also reported a 7.6% stake in the company.

- VLDR has been one of the direct beneficiaries of the EV/Self-driving hype and saw its shares nearly triple over the summer, but gave back most of its gains. Over the past 3 days, the stock has caught a bid and moved higher for seemingly no reason, which gets us interested.

- There’s a fish hook setting up in VLDR right now, and I think the stock could bounce if it breaks above the 8-day exponential moving average (EMA), the red line in the chart below.

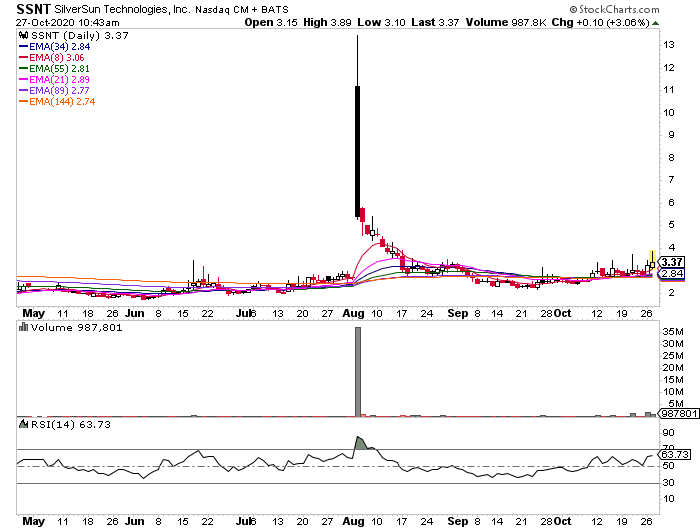

SilverSun Technologies (SSNT)

- The company is a provider of transformational business technology solutions

- We’re not seeing any specific news to support the move, but the stock has had a steady buyer over the past few days and much like VLDR – we believe a news announcement might follow

- With the current float of 1.98M shares any catalyst can generate significant action, and it’s another fish hook setup.

The areas to keep an eye on are $2.60 – $2.80, if the stock pulls back, but if it breaks above $3.50, I think the stock can build momentum and potentially get to $4.50, then $5.

In this market environment, it’s important to focus on the price action, as well as catalysts. With small-cap stocks, I think it’s easier to find opportunities than trying to figure out what the market will do.

That’s why I want to provide you with my chart patterns handbook, so you can learn some of my favorite setups to hunt down momentum stocks before they take off.

Find out how pattern recognition can help make you a better trader.

0 Comments