With the choppy price action this week and a slight pullback from the highs on Monday, the buy the dippers are eager to make a move.

To be quite honest with you, I am as well.

Today, I want to show you what I’m watching in the market, the catalysts I see, and how my plans to play the potential pullback in the market.

I’m going to go into my bag of tricks in the coming week because I think will be some opportunities.

That means relying on some of my favorite chart setups and utilizing an options strategy with an identifiable edge.

That being said, if you want to buy the dip, consider this first…

A Reliable Alternative To Buying The Dip

When it comes to buying the dip, most traders will often think to buy shares of a company. However, when you look at some of the price tags on some of these large-caps, it’s hard to get the position size I want.

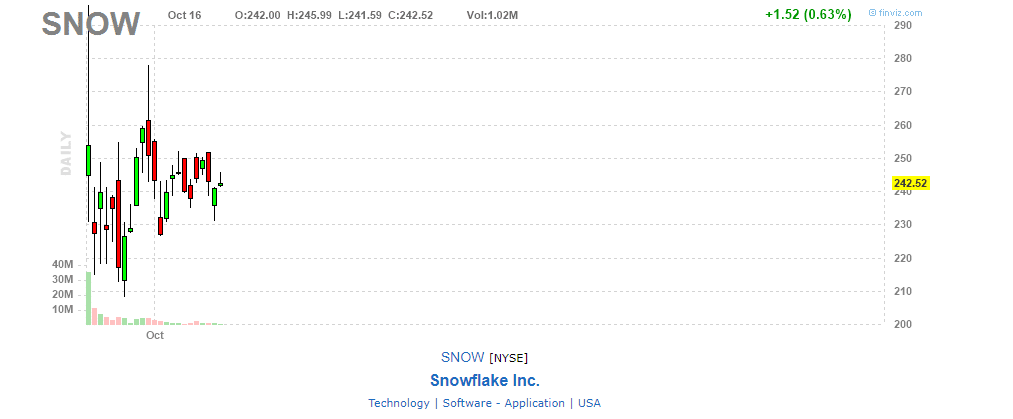

I mean take a look at recent IPO Snowflake Inc. (SNOW).

It’s going for more than $240 per share, and if I want to buy 1,000 shares… it would cost me $240K. I mean that can add up if I want to trade two to three names with a high-dollar.

So what’s a reliable alternative?

Well, I can look to buy calls (which I’ll do, depending on the stock and situation)…

With calls, I would look to buy at-the-money (ATM) or in-the-moneys (ATM) if the stock is around a critical level and the pattern I’m looking at signals the stock can run higher.

Or I can look to sell a put spread.

With a bull put spread, it’s a little bit different. I can still play my favorite setups; however, I’m not really boxed in.

You see, what I’m doing is selling puts around a level where I believe a stock will have a tough time breaking below. I’ll simultaneously purchase a deeper OTM put, which would hedge my position.

Makes sense?

When I sell put spreads, I collect a premium and all I really need is for the stock to stay above the strike price of the short puts by expiration.

That means if the stock falls a little, stays sideways, or takes off… I’ll be in a position to collect a bulk of the premium.

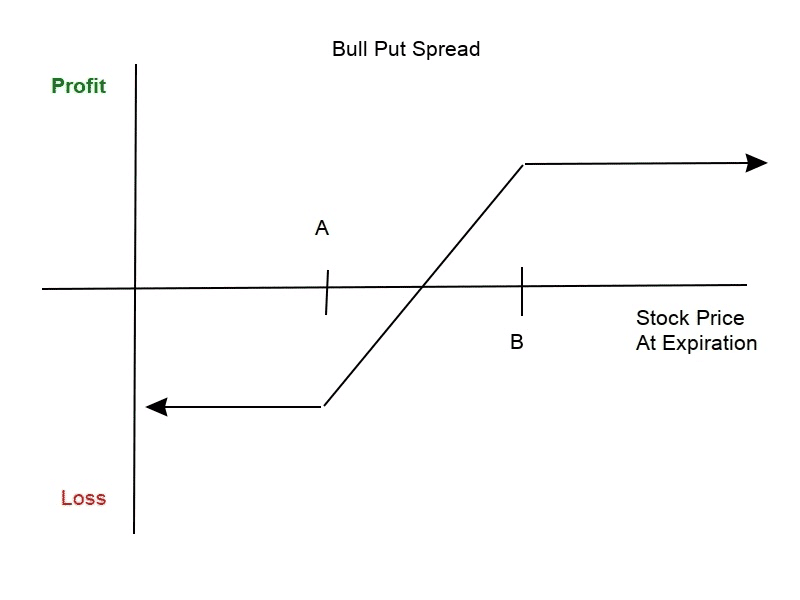

Here’s a look at the risk profile of the bull put spread.

As you can see, at some point, the strategy can either reach the maximum loss or maximum profit.

Now, how do you calculate the maximum profit?

Maximum Profit For The Bull Put Spread

The maximum profit potential for the bull put spread is the net credit received when the strategy was setup. So let’s say you received $1.50 to establish the bull put spread… then the maximum loss would be limited to $1.50.

Keep in mind that options have a multiplier of $100, so for each contract you sell the maximum profit is actually $150. If you sell 10 contracts, the maximum profit is $1,500.

Bull Put Breakeven Point

I think it’s also essential to know where the breakeven point is. For the bull put spread, the breakeven point occurs at strike B less the net credit received when establishing the position.

For example, let’s say you sold a $50 put in a stock and simultaneously purchased the $45 put (to hedge the short put position) for a net credit of $1.50.

That means the breakeven point would be at $48.50 ($50 less $1.50).

Now, knowing the maximum risk in a credit spread is highly important.

Maximum Loss For The Bull Put Spread

On the other hand, the maximum potential loss is calculated differently. The risk for a bull put spread is limited to the difference between strike A and strike B, less the net credit received.

So let’s continue with the hypothetical example from before.

The difference between the $45 / $50 put spread is $5. Thereafter, you would just subtract the net credit received from $5. That means the maximum loss is $3.50, or $350 per contract.

If you do the math, one would risk $3.50 to make $1.50.

I mentioned how I can win in three different scenarios, so I truly believe that over time, the more I utilize this strategy… the more wins I’ll have under my belt.

While I am remaining patient before I look to play the dip, I’ll be keeping these strategies in my mind.

To stalk these plays, I’ll be using some of my favorite chart patterns for trading small-cap stocks because they pop up so often in these large-caps.

Right now, price action matters and if you don’t have a few reliable setups… then I believe you’re in for a rude awakening.

I don’t want that to happen to you, that’s why I want to invite you to attend my exclusive training session on chart patterns.

You’ll discover how to use the same chart patterns I’ve been teaching people for a decade.

I genuinely believe these chart patterns can help you become a better trader and filter out the noise. Don’t miss out.

0 Comments