Last week’s bloodbath was one for the history books… and while I avoided most of it with my Jason Bond Picks strategy, I’ve seen many traders get sliced up. In times like these, it’s okay to stay on the sidelines and trade smaller… especially if you’re trading momentum stocks.

Today, I want to show you a “safe” way to play momentum and teach you how you could reduce your risk and maximize your profits in this environment.

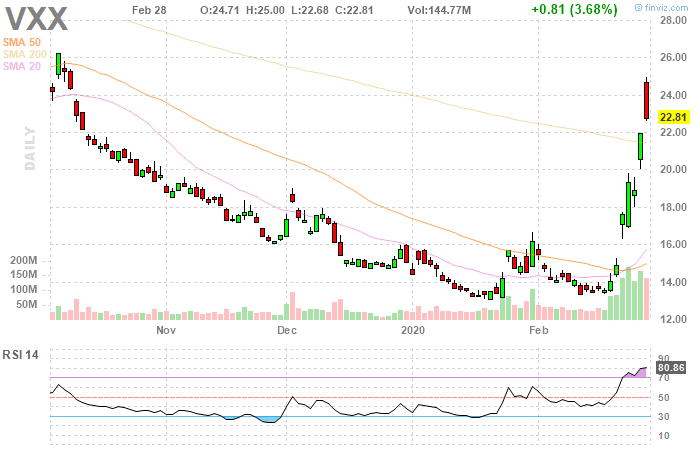

When volatility is rampant, and VXX — an exchange-traded note (ETN) that tracks VIX futures — nearly doubled in just a few sessions… and stocks experienced the fastest correction from highs in history, it’s best to wait until the dust settles.

However, that doesn’t mean I’ll be on the sidelines for an extended period of time. In fact, I’m looking to get back on the saddle tomorrow and hunt down profits.

For the most part, I’ll be looking for my patterns in small, mid- and large-cap stocks because I know if I could just pick the right direction… it might be payday.

The Alternative To Buying Momentum Stocks

I mentioned there’s one pattern I’ll be looking to use amidst this market selloff… and I think it could help me reel in monster profits. The thing is, I’m noticing some opportunity in mid- and large-cap stocks right now.

However, if you know anything about these fast-moving stocks… they’re pretty expensive to trade if you buy shares outright. Just think if you want to buy shares of Starbucks (SBUX), it would cost you more than $7,500 just to pick up a measly 100 shares.

So rather than buying shares and trying to play the bounce in mid- and large-caps, my solution is to trade the options. More specifically, I want to look for in-the-money options.

In other words, if I want to purchase calls, I would look for ones in which the stock price is above the strike price. Additionally, I want to look for ones where the delta is 60-70. What that means is for every $1 the stock moves… the options would move 60 – 70 cents.

Options On Momentum Stocks Could Offer Explosive Returns

The beauty of options is it allows you to leverage your capital and you know your risk when you’re buying options.

Here’s a look at what I’m talking about…

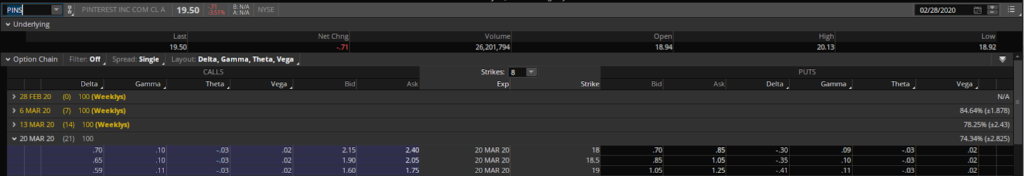

If you look at the screenshot above, this is the option chain for in-the-money calls and puts for Pinterest (PINS). If you look, PINS was trading at $19.50… and the $18 strike price calls expiring on March 20, 2020 had a delta of 0.70.

Those options had a bid-ask of $2.15 X $2.40. So if you were able to get filled mid-market, say $2.25… it would cost you just $225 to control 100 shares. However, if you bought the shares outright, it would’ve cost you $1,950.

If you think about it… if I want to scale my momentum strategy, buying thousands of shares isn’t really viable because it would eat up my buying hour. Think if I wanted to control 10,000 shares on PINS — that would cost a whopping $195,000. On the other hand, the options would just cost a fraction of that.

Not only that, but the most I could lose when I’m buying call options is the amount of premium paid. So that allows me to properly size my positions while maximizing my potential returns.

Sounds pretty simple, right?

I’ve expanded my trading universe by looking to options on mid- and large-cap stocks, in addition to small-caps. That allows me to increase my profit potential… and I’ve realized that my repeatable and scalable patterns work in nearly all types of stocks.

I think my simple patterns will allow me to hunt down massive opportunities in the market very soon, and I’ll look to the options market to maximize my profits.

I attended the Orlando Trading Summit – it was awesome! Fun and so informative! I chose to not take any trades into the summit and so glad I did! Thinking back, I ended my week on a not so positive note so taking that break really came at a good time, for me personally AND because the market tanked! The summit really helped me reflect on what I was doing right, and more importantly, what I’m doing wrong, so I was ready to get back in the game once I returned! Taking it slow, and being smart, my first trade back, I made 27% on LK! I’ll take a profit!! Thanks Nate and Kyle! The summit really helped me regroup. I’ve only been trading now for about 6 months, options for about 4 of those, and it’s so easy to lose sight of the “little things” and destroy your account in the meantime. I learned a lot but taking a break from the market for a few days was probably an account saver for me, and reduced a ton of potential stress. Ready to hit it hard, but smart, this upcoming week. My motto (thanks to Nate’s words of wisdom) is “Don’t Be An Idiot”! I made a colorful poster when I returned from Orlando and have it sitting on my desk next to my computers!

It was great meeting everyone in Orlando! Jason, Kyle, Nate, Jeff (both), Ben. Thanks so much for all your time – I greatly appreciate it!

Thank you for YouTube videos. A person can learn a lot. I’m just starting out. I still have oaper trading to do.

Anita Cherney

Thank you for explaining things so well!! …options and Delta defined!