By the looks of it…

The market is on pace to have its best quarterly performance since 1998.

With the market ripping higher, I suspect there will be some traders trying to short stocks…

Awaiting a potential pullback.

Will the bulls or bears be right?

Who really knows.

But there is something I want to bring to your attention…

When shorts pile into a stock, it actually creates the potential for a short squeeze, which can actually propel a stock higher.

Today, I want to talk to you about one indicator that can help to identify potential shifts in momentum…

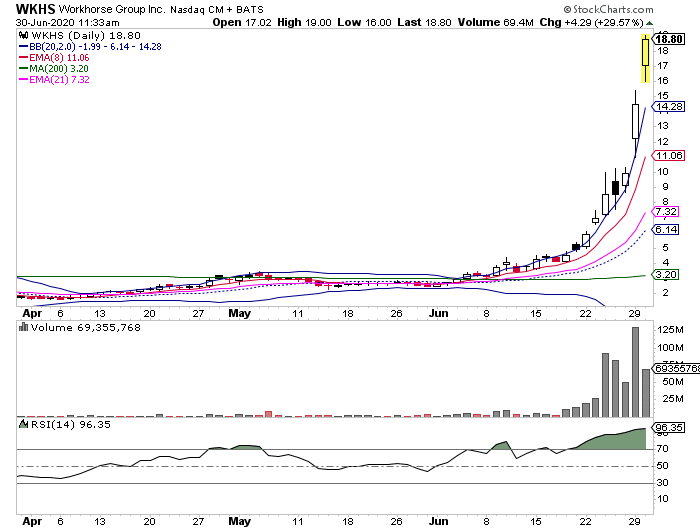

And what better way to do this than by looking at a hot momentum stock — Workhorse Group (WKHS).

This stock has more than doubled in a matter of days… and I believe the shorts are feeling it and may have to cover.

So what’s the one indicator I’m referring to and what can we learn from the move in WKHS?

What Caused The Wild Move In WKHS?

According to ShortSight, there are only 54.71M shares floating for WKHS.

In other words, there isn’t a whole lot of supply out there.

Of those 54.71M shares floating, 13.55M are short — that means nearly 25% of the shares are sold short.

What this can create is a short squeeze.

With WKHS being a low-float and heavily-shorted stock, any positive news events can cause shares to pop.

You see, since there’s so little supply, when there’s a positive news event or break out…

Momentum traders can pile in and push the stock higher.

At some point, the shorts can’t take the pain anymore and realize they’re wrong…

Then they have to buy back shares to cover their short positions, which further fuels demand for the stock.

Thereafter, more momentum players might jump in and push the stock even higher, forcing even more shorts to cover.

It’s a vicious cycle, and that’s why I don’t like to short shares of momentum stocks… if I do want to express a bearish opinion, I would opt for puts, but that’s a lesson for another day.

With WKHS, there were 3 positive catalysts this week alone.

First, the stock was added to the Russell 3000 Index.

Second, WKHS caught a massive upgrade from a Wall Street analyst.

Third, the company announced it secured $70M in financing from an institutional investor.

Those three catalysts caused an epic short squeeze thus far.

Source: StockCharts

The stock is well above its 52-week high, and the stock could continue to build momentum and run higher.

With such a high short interest, I wouldn’t be surprised if the stock breaks above $20 and continues.

Now, the thing is…

There are epic squeezes in the market all the time… and the key is to find these momentum stocks ahead of time.

If you want to learn how to hunt down momentum stocks before they move…

Then grab your complimentary copy of Momentum Hunter.

In this exclusive training guide, I reveal my techniques to locate momentum stocks before they run.

0 Comments