How many times have you entered a trade, watched the profits roll in… only for the stock to reverse and give it all back, and then some?

I can tell you it happens to a lot of traders… and it’s a painful feeling once you get out of the trade. You end up telling yourself, I should’ve sold when I had profits… I could’ve taken profits much earlier… or I would’ve taken profits at this level.

Trading isn’t a should’ve, could’ve, would’ve business. Since you’re dealing with your hard-earned money, you have to learn how to protect your profits at all times.

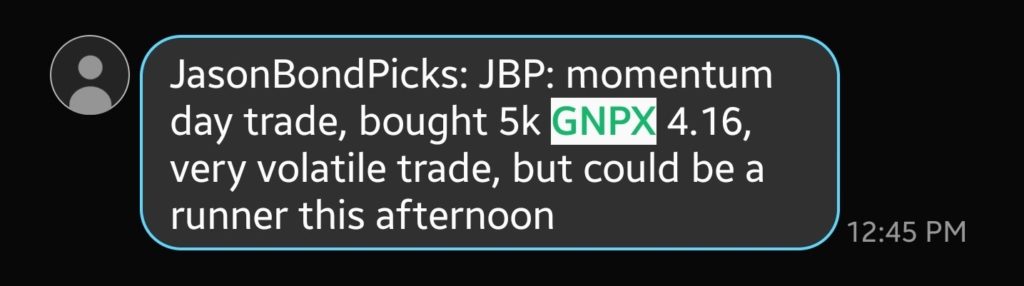

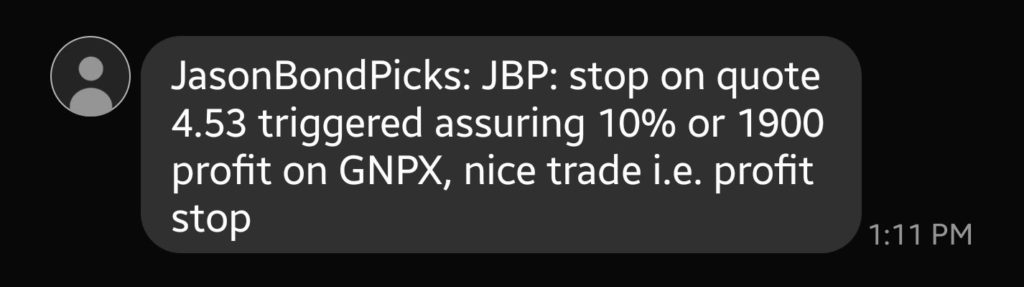

Today, I want to walk you through a real-money small-cap momentum case study in which I locked in $1,900 in less than 30 minutes.

When you hear about the pattern and technique I used to protect my profits, you’ll be kicking yourself for not using it earlier.

How I Spotted And Locked Down $1,900 In Less Than 30 Minutes

If you know anything about small-cap momentum stocks, they move fast… and if you’re able to spot the right pattern, you could lock in profits in just a matter of hours, sometimes minutes. The problem that many traders have is they see the stock pop and think it could just continue higher.

However, that’s just wishful thinking. In reality, small-cap momentum stocks typically pull back and find a key level before catching another pop.

Don’t worry, it’s not as complex as it sounds once you have scalable and repeatable patterns under your belt. Let me show you how you could trade these fast-moving names and lock in profits with one of my favorite setups — the rest and retest pattern.

Basically, with this setup, I use the Fibonacci retracement tool after a stock has made a massive move.

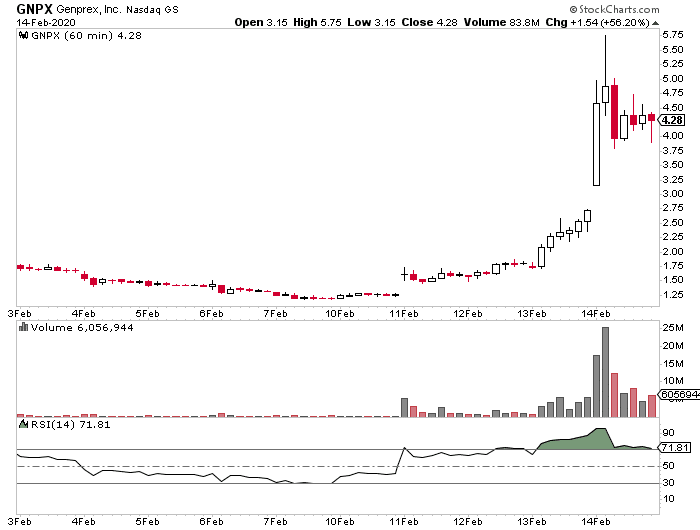

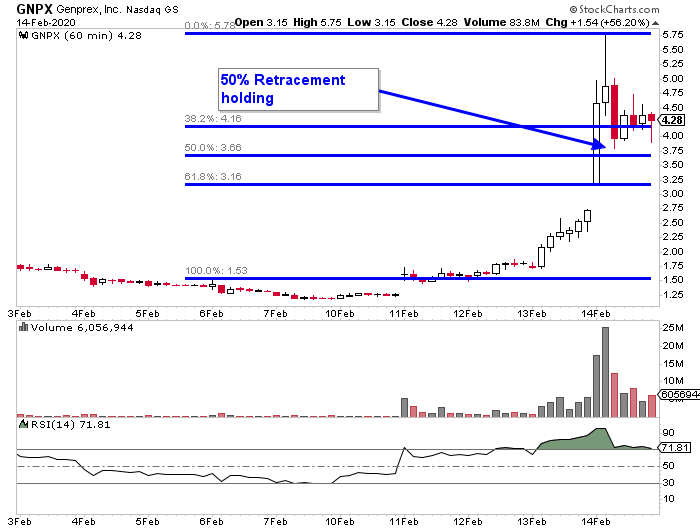

Take a look at the hourly chart in Genprex (GNPX) below. Typically, when traders see a stock like this, they tend to chase the momentum… and buy at random levels.

When you don’t have key levels in mind, it’s very easy to spot the move… buy the stock at the top and watch it pull back and give up all your profits, and then some.

So what’s the solution to this age-old problem with momentum stocks?

My simple rest and retest pattern.

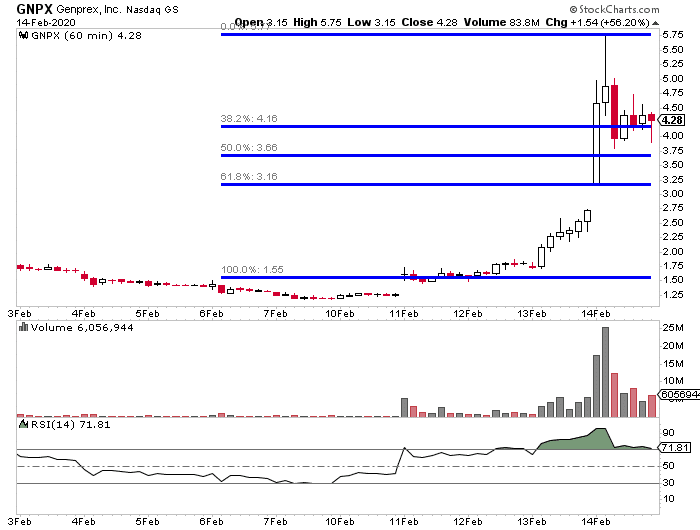

Check out the chart in GNPX below. This time, I put the Fibonacci retracement tool on the chart.

You’re probably wondering, “Jason, what the heck do these lines tell us?”

Well, it’s simple. With this tool, all I have to do is identify where the move started and the high point of the stock over the period. Thereafter, I know exactly where to get in and out of the trade. For the most part, I look to lock in 10% – 20% in profits.

If you look at this chart in GNPX, you’ll notice after the stock made a move… it pulled back into a key level: $3.66.

That’s the 50% Fibonacci retracement level, which tends to act as support. What that means is buyers are willing to buy at that level for another pop in the stock. However, that could be a dangerous game with small-cap momentum stocks.

So rather than buying at the 50% retracement level and stopping out if it breaks below… I like to wait for the stock to make a move before getting in.

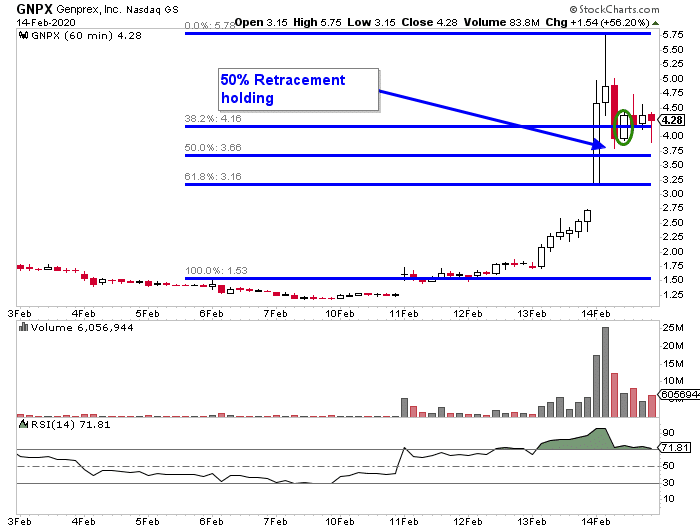

If you look at the chart above, GNPX got close to the 50% retracement level and caught a pop. Once it got above the 61.8%, I took a stab…

If you look at the green encircled candle, that’s where my trade occurred. I bought shares at $4.16… and in less than 30 minutes… the stock got right to my target (10%) in profits.

Basically, I put a stop order to protect my profits. With that order type, all you have to do is place the order and if the stock gets to the specified price, it would be triggered and you would take profits. You could also specify the limit price in order to lock in your profits… which is exactly what I did.

The key takeaway here is to spot the pattern and execute… and you’ll realize how easy trading is.

If you want to learn how to spot winners in small-cap momentum stocks, then click here to watch this exclusive training session on my simple patterns designed for wealth creation.

0 Comments