With the market back near all-time highs… many traders are out there trying to chase stocks after the monstrous move and comeback we saw last month…

… and you know what, who’s to say stocks don’t continue higher from these levels.

However… if you think about where most stocks came from, it’s hard to buy them at a hefty premium.

I’ve actually mastered a way to profit off the directional moves in stocks… that beats “chasing” any day of the week.

How?

Basically, I’m selling put spreads, which improves my chances of success. You see, my position will profit in multiple scenarios:

- The stock runs higher.

- The stock bounces around between two levels.

- The stock drops, but only a little.

Stacking the Odds in Your Favor

Check out the daily chart in Lululemon Athletica Inc. (LULU)

This is a perfect example of how you could’ve used Weekly Windfalls to get in on this action. It’s quite clear LULU is a strong stock, and let’s say you wanted to play the breakout…

… however, buying the stock outright would be a big capital suck… and when you look at the call options, they’re expensive because traders have bid them up after LULU exploded higher.

So what’s the alternative?

Well, you find a key level — where you think the stock could stay above.

The level that I liked in LULU was the $192.50 level — just above that breakout level. My thinking was the stock should settle around the $190s and make its march back to $200.

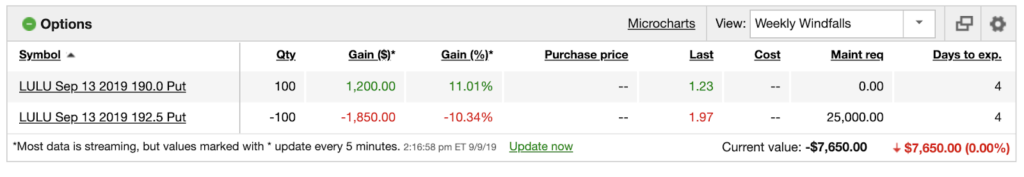

So I sold the $192.50 puts, while simultaneously purchasing the $190 puts.

That meant just as long as LULU stayed above $192.50… I would make money. Well, if you look at what the stock did just a few days later…

… it did exactly what I expected. This pattern is actually called a breakout followed by gap recovery and go (trend)… and I spot this pattern all the time… and it makes trading with Weekly Windfalls even more predictable.

You see, you don’t have to chase stocks up to take advantage of a move higher… you could sell put spreads to establish your bullish opinion on a stock.

On the other hand, it also works when you’re bearish on a stock. Ever see a stock drop and think it could stay above a key level and sell off further?

Well, you could avoid chasing it lower and just sell call spreads… and your position will profit in the following ways:

- The stock drops.

- The stock trades between two levels.

- The stock rises but stays below a specific price.

When you use Weekly Windfalls, you open up the door for a bevy of opportunities… and it actually improves your odds of success and takes out the guesswork.

If you are ready to take advantage of my most consistent strategy to date… and learn how to use a unique options strategy that allows you to profit off directional moves in stocks in the most stress-free way possible… click here to get started.

Join my community:

0 Comments