Markets are closed today in observance of Memorial Day, and I’d like to take a second to thank all the Americans who served in the U.S. military.

Even though stocks aren’t trading today, I want to game plan for the holiday-shortened week because I think it will be filled with action.

Last week, we saw pot stocks make a move…

And if you missed out on the moves in Aurora Cannabis (ACB), Canopy Growth (CGC), Tilray (TLRY)… don’t beat yourself up because many other traders did as well.

However, that doesn’t mean we can’t find momentum stocks in the cannabis space poised to move.

When it comes to momentum stocks, there’s a concept that many traders fail to grasp…

Sympathy Plays

When it comes to momentum stocks, I find that stocks in the same sector have leaders and laggers… and that can help to identify potential momentum trading opportunities.

Today, I want to show you what sympathy plays are and how I identified some pot stocks to keep an eye on this week.

How To Identify Sympathy Plays

With pot stocks making a move last week, there is a chance they can continue higher… however, I don’t necessarily want to chase the ones that have already caught a pop. Instead, I think it can be beneficial to find the ones that are lagging.

In other words, the ones that haven’t already made a massive move like ACB, TLRY, or CGC.

Here’s how sympathy plays work…

Typically, you may see a stock make a move (this would be considered a leader)… then there may be laggards that move in sympathy with the leader.

For example, when ACB made a move… there were pot stocks just popping off.

Now, if you missed the move, then you might want to check out some of its peers to see which ones haven’t made a move.

With ACB’s massive move in the past 2 weeks, it seems as if it’s a leader in the space, in terms of price action (as the stock has made a move from under $6 to $16 in just about 2 trading weeks).

So some names that may be laggards include: APHA, CRON, CGC, TLRY, CRBP, and HEXO. Even those these names have moved higher… they haven’t had the same run as ACB.

In other words, there may be other momentum traders looking for some action missing out on the move in ACB.

When it comes to sympathy plays, I believe it’s important to have a few on a watchlist to keep an eye on them.

With the watchlist, I think it can be helpful to devise a trading plan and have entries, targets and stop-losses in place.

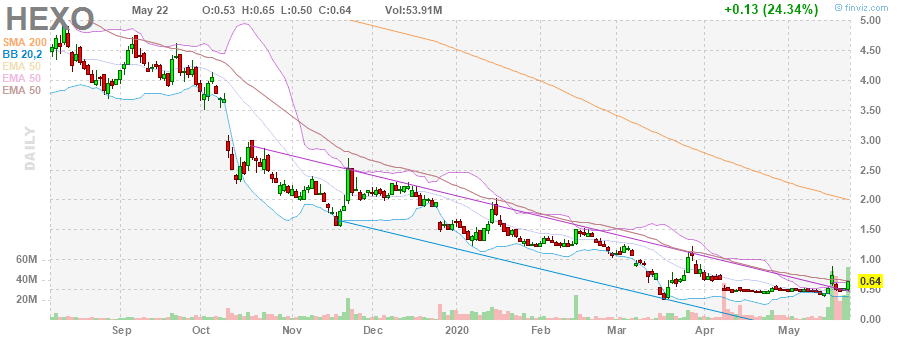

For example, HEXO was actually on my Monday Movers watchlist that I sent out to subscribers on Friday.

Basically I saw it had the potential to make a move… and here’s what I sent out in the watchlist.

HEXO is more of a risky play because it’s already up 20%+ on the day but the pattern has range to the $.80’s and maybe even $1. Offering behind and a sector that’s catching pops, I’m interested in entry around $.58 with a stop loss below $.54 and a goal or 20%+ next week, assuming I take a position. Currently at $.63 I’m not looking to chase but enter on a dip, should one present itself.

Source: Finviz

On Tuesday morning, I’m going to keep an eye to see if these pot stocks come up on my scanner. If they do and I notice one of my bread-and-butter setups, I’ll let my subscribers know in an advance notice alert.

The thing is, this approach can work for other sectors… not just cannabis stocks, and it’s just one of the ways I look for momentum trading opportunities.

Now, if you want to learn how I hunt down momentum stocks poised to run, then you may want to check out this important training session I’ve put together.

In this exclusive training, I reveal my edge when it comes to momentum trading… and how I’m able to hunt down stocks poised to move ahead of time, on a part-time schedule.

Click here to register for this special training series.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

0 Comments