Stocks are mixed this morning, as they try to close green for a second straight session.

But you know what?

When you’re trading penny stocks, there is always action out there, and often, penny stocks are the largest movers of the day.

And if you thought trading penny stocks was for small-timers and that there is no money in them…

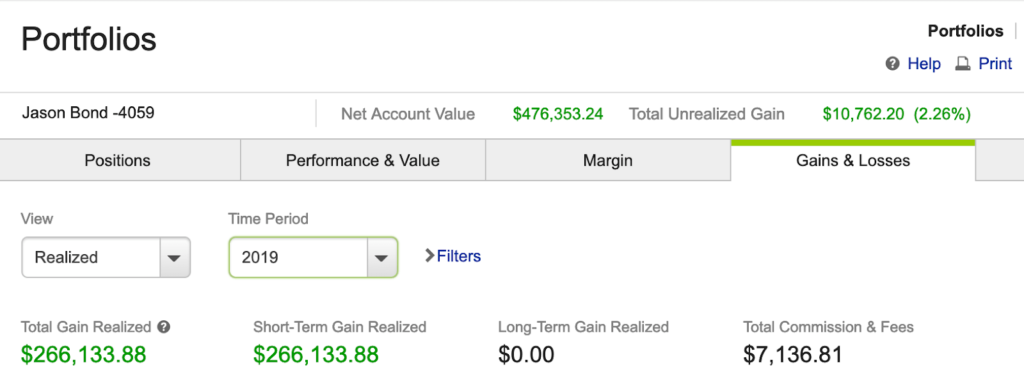

…well, you couldn’t be further from the truth. In fact, here are my trading results as of yesterday’s close.

(I primarily focus on trading three stock chart patterns. Most of the stocks I trade are under $10, and all of them must have a catalyst. I enter the trade only when the risk vs. reward is stacked in my favor. If you missed my webinar… here’s what you need to know.)

Now, as good as I am as a trader… I’m an even better teacher. My service, Millionaire Roadmap, has helped three clients (Taylor Conway, Nathan Bear, and Kyle Dennis) go on to become millionaire traders.

And you know what?

There are more on the way… I can feel it…

Mar 11, 10:38 AM T.R.: YTRA in 1 hr $3287! nuts lol.

Mar 11, 10:40 AM R.B: +2600 YTRA thx JB!

Mar 11, 3:01 PM D.G.: Up 4.5K today

Mar 11, 3.01 PM K.R.: $15K for me

I have to bring my A-game to Millionaire Roadmap every day because people are counting on me. The chat room opens up early, and it’s not surprising to have hundreds of clients in there hours before the market opens.

It’s a great time for clients to discuss the watchlist and talk about the trading plan in greater detail.

You see, my clients don’t just want alerts, they want to develop and strengthen their skills as traders, and that’s what I offer in Millionaire Roadmap…a chance for you to look over my shoulder… and for me to answer your questions in the heat of the moment… and when real money is on the line…

That said, if you’d like to know how my clients and I are making money in this market, read on about these case study examples of some of our best trades.

The Right Stock Trading Mentor Trades Their Strategies

Listen, after years of painstaking trading… trying out different styles… only to realize they were losing strategies… however, I found 3 extremely simple patterns that I use over and over again to extract capital from the market.

In fact, there’s one pattern that’s so strong that I use it nearly everyday… the best part, it’s not hard to find… if you know what you’re looking for.

Let me show you…

Here’s a look at the pattern:

This is what I call the “fish hook”. Notice how the stock has dropped and found a bottom… and the stock – Yatra Online (YTRA) – started to show signs of potentially rising. If you look at the green curved line… the pattern actually looks like a fish hook.

It’s great if you can spot the pattern… but what do you do after? Well, you find an area of value to buy the stock.

What do I mean by an area of value?

It’s simple… you look for an area the stock has had a hard time breaking below. This is also known as support in the trading world. When you identify an area of value, you’ll notice traders are willing to step in… and you’re able to develop a clear, concise, and effective trading plan.

Here’s a look at what I mean by an area of value.

If you look at the blue horizontal line, this is an area of support. In other words, the stock has had a tough time breaking below this… moreover, it’s typically a good area to build a position.

Well, I actually put real money on the line and let Millionaire Roadmap (MR) clients know about my moves in YTRA.

Under an hour after I got in the stock… it had a positive catalyst, and it was raging…

I even alerted Millionaire Roadmap clients when I sold… and whoever was in the MR chatroom witnessed this in real time.

Here’s another look at this pattern…

Uxin Ltd (UXIN) was exhibiting the fish hook pattern. With this pattern, the stock stayed at a value area for some time…

If you look closely, you can see UXIN had a tough time breaking below the green horizontal line (an area of value).

Again, I let Millionaire Roadmap clients know about my moves… and yet again, traders in the chatroom witnessed by buy in real time…

Within the same day, the stock reached my target…

Once it broke above $4 (my target), I sold shares and snatched $12K in the stock.

Now, I did leave some money on the table because the stock reached $4.60 a few days later… however, I stuck to my plan – something many traders have a hard time doing.

Now, let’s reinforce this pattern with another example…

Check out this daily chart on Arlo Technologies (ARLO).

The stock had a pretty nasty drop… and started showing signs of strength after it found support (an area the stock had a tough time breaking below).

So what did I do when I found an area of value? I bought shares of ARLO.

Take a look at what the stock did in a few days…

Well, ARLO reached my target… and I took profits – sticking to my plan.

Let’s look at once last fish hook pattern.

Ask yourself, “Where is the area of value?”

Well, there are a number of ways to play this… I like to wait for the stock to get a pop above the area of value. With this trade, the $3.90 area was a value area. You see if the stock got above that… well, it had room to the $5 area.

Now, I alerted MR clients, as you can see above… not only that, MR clients who were in the room actually saw the thought process behind the trade… and they were able to ask my questions about the USA Technologies (USAT) trade.

Now, if you watched the Brexit developments last night and missed my webinar… well, here’s the need to know about what’s going down.

Nice read and good insight, Jason! Thank you