Thursday’s and Friday’s action in shares of StemCells Inc. (STEM) gave traders a taste of what this development-stage biotech can do for the charts when success begets more success.

Thursday’s surge to a 52-week high of $2.11, and Friday’s follow-though move higher of an additional $0.05, talks to me as a trader as a telltale sign that some serious money has now become convinced that this tiny cap could just end up as a ‘jackpot’ stock in the coming months.

After STEM reported positive results from a Phase I/II clinical trial of its neural stem cell platform – for the treatment of age-related macular degeneration (AMD) – 32 million shares were traded Thursday, a 20-fold increase from the typical trading volume of 1.5 million shares. And Friday’s trading reached another 25 millions shares, resulting in another up day – a real sign of strength from what must have been a day of quick-buck traders swarming to sell to strong investor hands. Impressive.

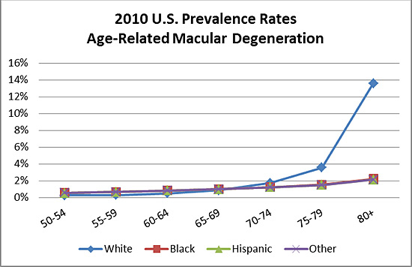

What makes STEM worthy of mention on Jason Bond Picks is the company’s potential for actually developing a treatment for the AMD marketplace, which is estimated to reach $30 billion by 2017. And it’s not like there are lots of company’s developing treatment for AMD suffers.

In fact, STEM’s primary competitor is Advanced Cell Technology Inc. (ACTC), a company that’s not nearly as well-capitalized as STEM is. STEM’s balance sheet indicates it has approximately a year’s worth of cash to sustain operations, while ACTC may have a few months before it needs to raise additional capital.

As of Mar. 31, STEM shows $26.4 million of cash on its books, and has a burn rate of about as much per year. And as funding for biotech has become much more competitive during the impressive rise in the sector (pruning?), we suspect STEM will draw capital away from competitors during the pruning phases, and not suffer from the expected slowdown – which we know is a counter-intuitive take on the whole scare regarding future funding in the sector. We suspect that STEM will continue to surprise with its capital raises.

Moreover, from our standpoint, STEM is really the only game in town in the race to the $30 billion AMD market. And $30 billion will surely and easily attract mere millions. No? We believe the relatively large market size relative to STEM’s market cap remains very attractive still.

And apparently, big money agrees with us. The humongous volume of buying following STEM’s last announcement was well-warranted in that the clinical data show STEM’s AMD platform slowed the rate of macular degeneration by 70%! among the 10 test subjects of the FDA clinical trials. That’s 70%!

Now here’s the part that we like about STEM: the company services age-related pathologies. Any company that services the aging baby boomers (born 1946 – 1964) moves right to the front of the Jason Bond Picks class as a standout to our macro thesis: riding the tide of the 76.4 million baby boomers!

Baby boomers made millionaires of investors of the auto industry during the 1960’s and 1970’s, the diapers and baby-related products during the late 1970’s and early 1980’s, starter-home real estate in the mid-80’s (larger homes in the 1990’s and 2000’s), and investment/brokerage/insurance in the 1990’s.

The baby boomers were primarily responsible for the entire rise in the FIRE (Finance/Insurance/Real Estate) economy of the past 25 years. Today, anything related to aging will make investors a fortune during the next 25 years. So, hang on and enjoy the next big ride on the backs of 76 million-strong.

Technical

The chart, above, shows the gap-up open of Thursday’s trade in STEM. Friday’s trade indicates the initial rally had stalled as the price rose to the two-year long resistance at $2.50 (not shown in the chart), retracing most of the day’s gain.

The gap-up, and trend line developing since May, serves as a magnet during the expected consolidation phase of the big pop.

Traders seeking to grab onto this trade may likely see better prices in coming days, as the backing-and-filling action commences. Watch for support at $1.60, and support at the tend line.

We remain a long-term bull on STEM. Check back for updates from time to time as we gather more information and issue additional analysis about STEM and its exciting prospects.

0 Comments