Biotech stocks have always provided powerful rallies as well as the sometimes equally-as-powerful declines to traders looking for big movers – either way. Trading on the drama and stock action that an impending FDA decision or therapeutic breakthrough can deliver an unmatched experience (‘rush’) of any other sector. Hands down!

Those old enough to remember the magical carpet ride in the IBB ETF during the second half of 1999, for instance, also remember the trebling (3X) of their stake within only six months.

In March, the IBB spiked to a high of 134.27, from the low of 38.96 reached during the first month of trading in the IBB in July 1999. The lure of muted risk through diversification of the most-promising companies of the sector traded more like a small-cap solo enterprise with a great story to tell.

Then, as we remember, too, came the big correction.

By the summer of 2002, the entire gain in the IBB was wiped out before the process of another rally began anew. Fortunes were made on the way, and lost (or made again) on the way down.

And in the spring of 2009, another rally took the IBB up to a fabulous four-bagger before a correction ensued in early 2014.

So, if recent history of investor panic-buying in this sector is any guide to the future of biotech returns, who needs to wait for an old-fashion gold rush when on any given day one is already in progress somewhere in the Nasdaq.

The old adage, “There’s always a bull market somewhere” isn’t just sales talk from brokers looking to churn an account. Players of the biotech sector certainly know the statement is indeed true.

And to illustrate that point (before we get to the specific companies we have our eyes on for the remainder of 2014 and beyond) take Mannkind Corporation’s (MNKD) stunning double-in-a-day bonanza back in April 1, 2014 (April Fool’s Day – appropriate?) from a surprise Food and Drug Administration (FDA) approval of the company’s inhaler.

“Food and Drug Administration advisers voted 13-1 and 14-0 yesterday (April 1, after the close) that the drug, Afrezza, should be approved for Type 1 and Type 2 diabetes, respectively,” Newsweek reported on April 2. Investors, traders, media and just maybe even MNKD itself were all stunned by the news.

The next day, MNKD opened at $7.75, reached as high as $8.08 (up 101%) before closing at $6.99 – up $2.97 (up 73.95). Wall Street couldn’t get enough of the intriguing story.

Adding to the big payday shocker of Apr. 2, the days leading up to the FDA announcement delivered a sell-off blow to MNKD from sellers and shorts, as the stock crashed to $4.02, down 31.2%, from $5.85 at the high of Mar. 26.

How could investors misread MNKD so badly? It happens; and in this sector, nearly everything has at one time gone delightfully right or terribly wrong, thus the interest among traders seeking some serious octane to their risk capital. The sector has always remained a favorite of Jason Bond Picks (JBP) traders.

So, which stocks do we feel could conceivably blow UP some serious capital gains for JBP subscribers during 2014 and beyond?

Our staff has identified two stocks which fit the criteria of potential JBP “blow ups.” Both have enough cash on hand and recent positive cash flow to financially survive at least another full year to demonstrate progress toward an FDA approval and a blow up celebration.

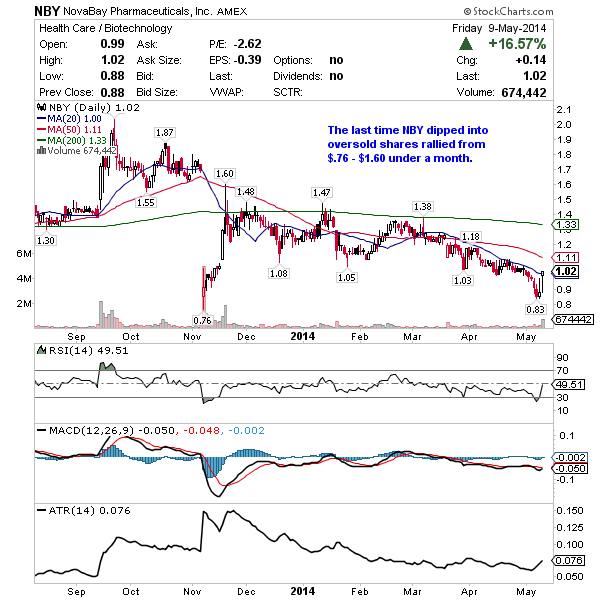

NovaBay Pharmaceuticals (NBY)

With Nova’s cash flow slightly bobbing up and down between a little cash flow to a little cash drain for a better part of three years, NBY has demonstrated its ability to control cash burn and maintain a hefty level of cash on the balance sheet.

The company’s NVC-101 (NeutroPhaseTM) and auriclosene (NVC-422) are under development for the treatment of various bacterial infections. Auriclosene, in particular, is NBY’s lead compound in a “new class of anticrobial compounds,” called Aganocides®.

The market size for antibiotic treatments for bacterial and fungal infections is expected to reach $6.5 billion in 2015.

NBY’s institution investors number more than 20, and the insiders to the company’s operations hold a better-than-average rate of total outstanding shares.

And the additional compelling metric of Price/Book is much, much lower than nearly all components of the major biotech indexes.

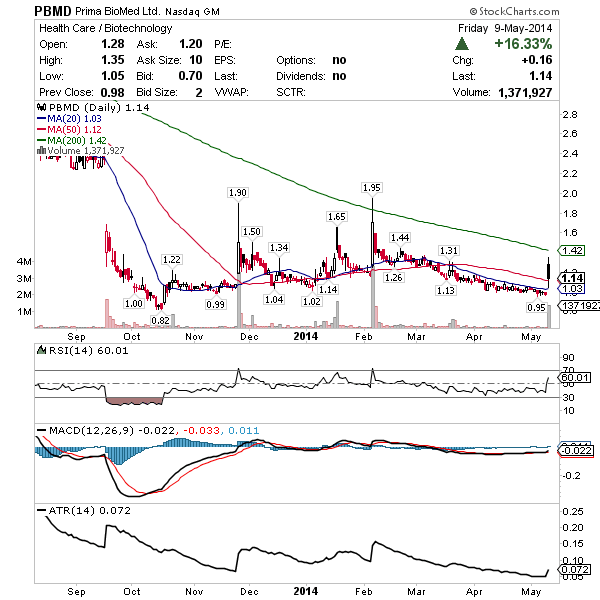

Prima Biomed (PBMD)

PBMD’s hefty cash balances and reasonable burn rate clear the first hurdle of our evaluation of this anti-cancer small-cap biotech stock. We expect at the very minimum one year of cash available to continue operations.

The company’s Cvac is under development for the treatment of aggressive tumors, with the treatment of ovarian cancer as specifically mentioned on PBMD’s various communiques, SEC filings and marketing literature.

The estimated size of the ovarian cancer drug market is $1.4 billion by 2021.

Though institution holdings are quite light, we expect the possibility of additional institutions jumping on board as PBMD moves up to higher levels of FDA trials.

The company’s Cash-Per-Share metric is unusually high, suggesting superior upward potential of the stock following any positive news on the FDA front in the coming months and years.

0 Comments