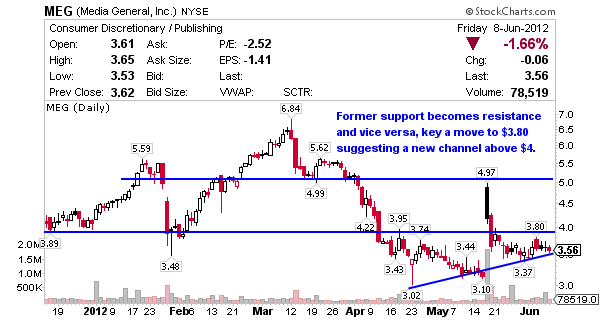

Media General (NYSE:MEG) is a communications company, provides proprietary local news and information over various media platforms primarily in small- and mid-size communities in the southeastern United States. MEG’s short interest is 79 days to cover due to light volume with 23% of the float short. The large volume gap that reached up and touched $4.97 on the squeeze recently would present a very lucrative trade at well over $1 per share from the 20, 50 and 200 Moving Averages where it’s currently accumulating. I’m not interested if it breaks that range, but if it heads toward $3.80 it might warrant a small position.

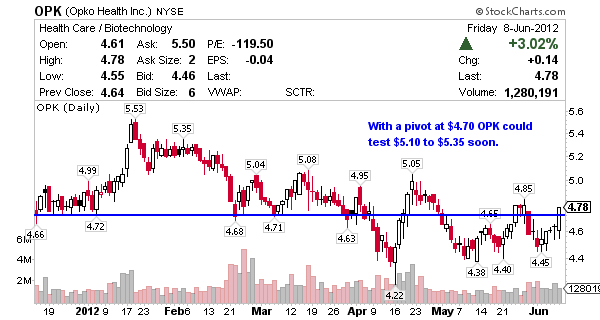

Opko Health Inc (AMEX:OPK) is a pharmaceutical and diagnostics company, engages in the discovery, development, and commercialization of novel and proprietary technologies primarily in the United States, Chile, and Mexico. OPK’s short interest is 35 days to cover with 24% of the float short. Nice squeeze into Friday’s close suggests a break of $4.80 could bring new buyers to this trade forcing the hands of shorts up to $5.10 where I’d look to take half and see if a move to $5.30 is possible with the rest. Should shares pull before it heads back up, I like it above both the 20 and 50 Moving Averages.

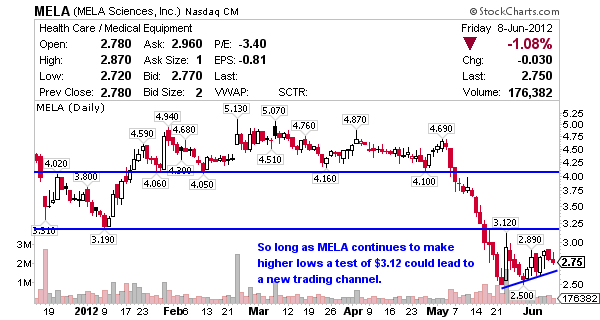

Mela Sciences Inc (NASDAQ:MELA) is a medical device company, focuses on the design and development of a non-invasive, point-of-care instrument to assist in the detection of early melanoma. MELA’s short interest is 20 days to cover with 24% of the float short. I’m watching for a break of the 20 Moving average to signal a move to the $3.20 range where I’d consider taking half and letting the other half ride to the 50 Moving Average around $3.77. Key the recent low of $2.50 as support but $2.60 should bring some buyers too depending on the market conditions.

jason,

i was looking at clearwire [CLWR] as a play UP. what do you think?

thanks,

bob

Market cap is too big for me, slow mover.