I’m constantly on the hunt for solid swing trades like PEIX, BIOF, DEXO, ZOOM and GMXR. Normally I try to position before the move like I did with HDY Monday at $3.06 before it ran about 30%, however, sometimes swimming with the current is an easy way to grab quick profits too. Swing trading, for those of you who are new, is a speculative activity where stocks are repeatedly bought or sold at or near the end of up or down price swings caused by price volatility. A swing trading position is typically held longer than a day, but shorter than trend following trades or buy and hold investment strategies that can be held for months or years. The following stocks could deliver some decent profits Friday if they continue so here’s what I’ll be watching for.

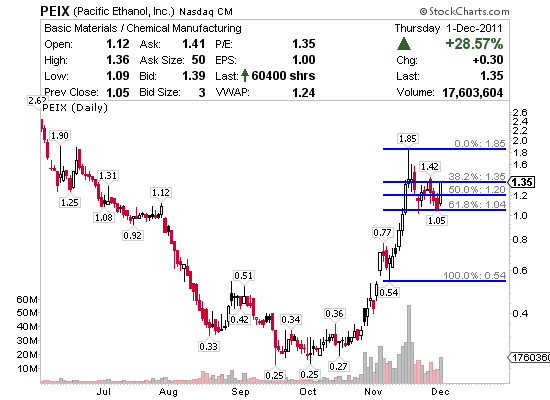

Pacific Ethanol, Inc. (NASDAQ:PEIX) produces and markets low carbon renewable fuels in the western United States, primarily in California, Nevada, Arizona, Oregon, Colorado, Idaho, and Washington. PEIX is making Fibonacci proud!!! If you have yet to hear of PEIX then I can’t help you because everyone on Wall Street with a heartbeat has been looking at this since their last earnings call. I’m actually really happy to report that our chat room moderator got a lot of our traders in around $.30 and one gentlemen I can’t name for privacy cleared a cool $100,000 on the trade in mid November. I followed my rules by not playing through earnings… can you say #fail haha! Anyway that’s over and all that matters is what we can do with PEIX from here. PEIX has $16.81 million in cash, $113.25 million in debt and a book value of $.56 per share. The market cap on PEIX is right in my wheelhouse at $104.09 million and the reported short interest on the stock is 1 day to cover as of 11/15/2011 but I’m positive that’s gone up and is probably part of the reason we saw such a huge rally Thursday. Say anything you want, technically price action rules and right now PEIX is bullish again so long as this move sticks into Friday’s session. This is the perfect example of a bull flag or Fibonacci retracement play in which the stock shakes before it bakes again. If PEIX takes down $1.42 Friday and holds that on the bid aggressive shorts from earlier in the week will all be at a loss and the fun might start all over again for the bulls. The Relative Strength just below the 70 line is a concern but right now PEIX is hot and hot stocks can hold overbought so long as buyer outweigh sellers much like the did almost all November.

BioFuel Energy Corp (NASDAQ:BIOF) engages in the manufacture and sale of ethanol and its co-products in the United States. BIOF has $9.66 million in cash, $188.27 million in debt and a book value of $.88 per share. The market cap on BIOF is $66.56 million and the reported short interest on the stock is 1 day to cover as of the last settlement date of 11/15/2011 but I’m certain that’s grown considerably since. BIOF has been considered a sympathy play to PEIX above, both of which I wrote about in detail after our chat room moderator alerted PEIX at $.30 before their earnings call recently. Technically BIOF retraced more of it’s recent run than PEIX but that’s to be expected. I like it here off $.50 support and if PEIX gaps and runs Friday you can bet BIOF will be right behind it challenging $.69 resistance before it can run to the $.80 level again. Currently both PEIX and BIOF are working up slightly in Thursday’s after hours as I type. I like the Relative Strength on BIOF turning just below the 50 line with accumulation coming back into the play Thursday.

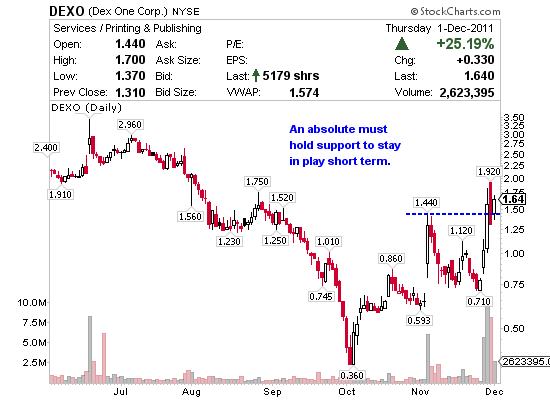

Dex One Corp. (NYSE:DEXO) operates as a marketing solutions company. DEXO has $195.43 million in cash, $2.56 billion in debt and a book value of $.13 per share. The market cap on DEXO is just under my $100 million to $300 million wheel house but it’s close enough to make my radar at $82 million. The reported short interest on the stock has really thinned out as of the last settlement date at 3.7 days to cover on 11/15/2011, previously it was heavily shorted at 14.26 days to cover on 10/31/2011. Technically the price action has been very choppy of late moving up over 100% three times since October which is clearly why traders are flocking to the stock. Right now we’re seeing some resistance at the $2.00 range after which DEXO could breakout again settling just under $2.60 per share. I should note the Relative Strength is nearing overbought again and the last time DEXO was over the 70 line shares retraced about 50% from $1.44 to $.73 before consolidating and ripping off another massive 170% run. A run that traders’ in my chat room swung for massive profits this week because it was alerted at $.80 before it erupted. Anyway, support can now be seen at $1.40 and if it holds there as it consolidates, maybe it’ll rip off another 100% soon.

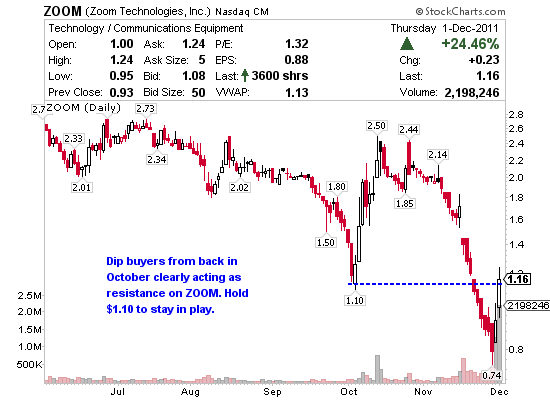

Zoom Technologies, Inc. (NASDAQ:ZOOM) operates as a technology company that engages in electronic and telecommunication product design, development, and manufacturing. ZOOM has $5.85 million in cash, $56.79 million in debt and a book value of $4.26 per share. The market cap on ZOOM is small at $25.88 million and the reported short interest on the stock is 5.74 days to cover as of the last settlement date 11/15/2011. Technically we’re seeing a strong bounce out of oversold at $.74 Tuesday. The last time ZOOM bounced from oversold status it ran over 100% from $1.10 to $2.39 before consolidating. The Relative Strength reading of 40.51 as of Thursday’s close is certain to attract buyers still as the MACD advances toward the signal line. Again, the last time we saw MACD cross the signal line to the upside was during that 100% plus move. Resistance can now be seen clearly at Thursday’s high of $1.24 followed by $1.439 and $1.66.

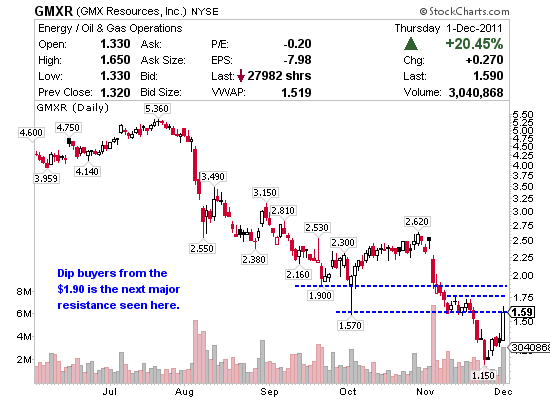

GMX Resources, Inc. (NYSE:GMXR) operates as an independent oil and natural gas exploration and production company primarily in the United States. GMXR has $3.23 million in cash, $372.82 million in debt and a book value of $2.29 per share. The market cap on GMXR is $92.37 million and the reported short interest on the stock is 4.25 days to cover as of the last settlement date 11/15/2011. Technically GMXR is making a move out of the bottom trend line and was oversold at $1.15 a share recently. The last uptrend was in October when it held the 20 Moving Average for almost the whole month before dropping over 50% from $2.54 to the $1.15 low. Look for shares to hold the 20 Moving Average from here if GMXR has any chance at breaking the long term bearish trend it started back in July. First key resistance is $1.73 followed by $2. Support is at $1.40.

So hw can some one infest with your company i will like to be one of your coustomers in ur company.

Hi David! Please take some time to read the quick start guide seen here http://www.jasonbondpicks.com/quick-start-guide – if it’s then something you’re interested in go ahead and sign up for service.