ACUR, IVAN, AVL, GERN, MERU, SUMR and SVNT stock are all on fire and many are likely to continue Tuesday! Most of the time I’m accumulating oversold stocks and selling the bounce for 5-10% rinse and repeat but I’ve been known to ride the bull from time to time as well. When accumulating oversold and continuation patterns it could take as much as a week to deliver 5-10% whereas a breakout can deliver those gains in a day, but they can fall just as fast too. The key is being able to read the momentum and technical analysis… here’s what I’m watching Tuesday.

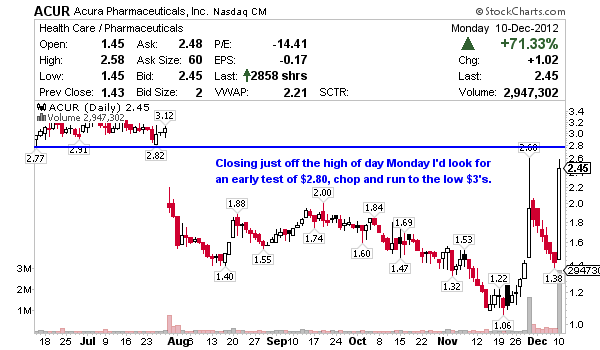

Acura Pharmaceuticals (NASDAQ:ACUR) is a specialty pharmaceutical company, engages in the research, development, and commercialization of pharmaceutical product candidates utilizing its proprietary Aversion and Impede technologies. ACUR’s stock market cap is $112 million, they have $29 million cash and $0 debt with 46 million shares outstanding and 26 million in the float. Don’t look for shorts to support the bid on this one with less than 2% of the float betting against the company and 8 days to cover which makes sense with Acura making headlines for their new nasal decongestant product formulated to prevent its use in the illicit synthesis of methamphetamine. Here’s what to look for moving forward.

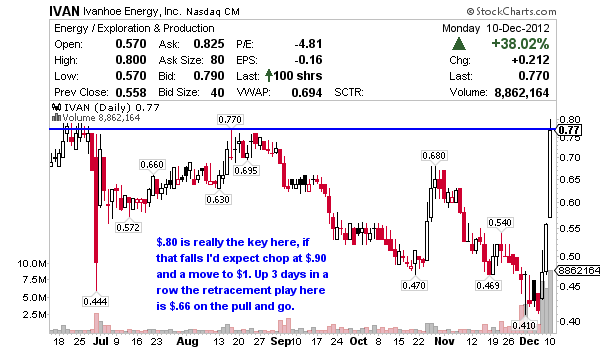

Ivanhoe Energy (NASDAQ:IVAN) engages in the development and production of oil and gas properties. IVAN’s stock market cap is $265 million, they have $17 million cash and $125 million debt with 344 million shares outstanding and 257 million in the float. The short interest here is 15 days to cover but less than 2% of the float is short so don’t expect much of a squeeze to back this move. Shares of Ivanhoe began to run on large volume last Thursday when the company said that its wholly owned subsidiary, Sunwing Zitong Energy, has won approval from the China’s Ministry of Commerce to transfer its participating interest in the Contract for Exploration, Development and Production in the Zitong Block, Sichuan Basin, to Shell China Exploration and Production. Here’s what to look for moving forward.

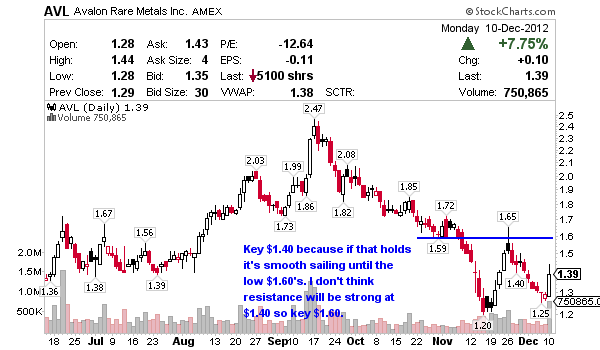

Avalon Rare Metals (AMEX:AVL) engages in the exploration and development of rare metals and minerals in Canada. AVL’s stock market cap is $144 million, they have $39 million cash and $0 debt with 104 million shares outstanding and 100 million in the float. Rare earth stocks were on fire Monday but shorts weren’t hurt here, mainly because there aren’t many with 2% of the float betting against the company and 9 days to cover. Here’s what to look for moving forward.

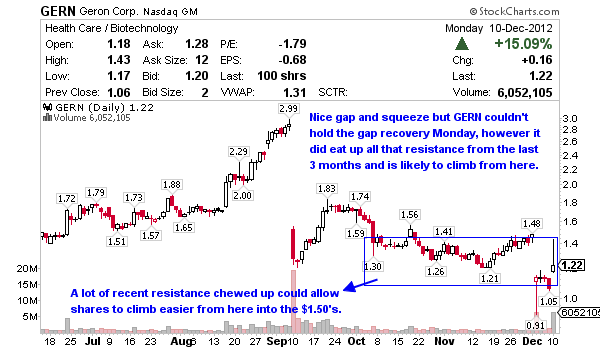

Geron (NASDAQ:GERN) develops therapies for cancer. Its clinical development product candidates include Imetelstat, a telomerase inhibitor, which is in Phase II clinical trials for the treatment of metastatic breast cancer, advanced non-small cell lung cancer, thrombocythemia, and myeloma. GERN’s stock market cap is $160 million, they have $101 million cash and $0 debt with 131 million shares outstanding and $128 million in the float. The short interest shows 8 days to cover and 4% of the float betting against the company, so like the others mentioned above, don’t expect a squeeze. Shares took off Monday after the company reported early clinical trial results for its drug imetelstat as a treatment for a blood platelet disorder. Geron said 100 percent of patients responded to the drug, and most patients who had a specific gene mutation responded to the drug. Here’s what to look for moving forward.

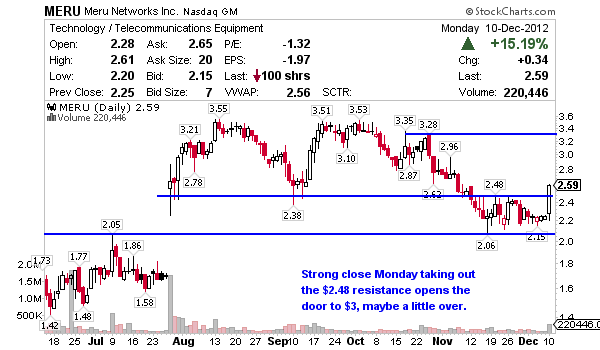

Meru Networks (NASDAQ:MERU) provides wireless local area network (LAN) solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. MERU’s stock market cap is one of the smallest of the group at $47 million, they have $31 million cash and $10 million debt with 18 million shares outstanding and 12 million in the float. The short interest here is substantial with 13% of the float betting against the stock and 24 days to cover based on the light volume. A quick search of news didn’t bring up much so this is looking like a technical reversal. Here’s what to look for moving forward.

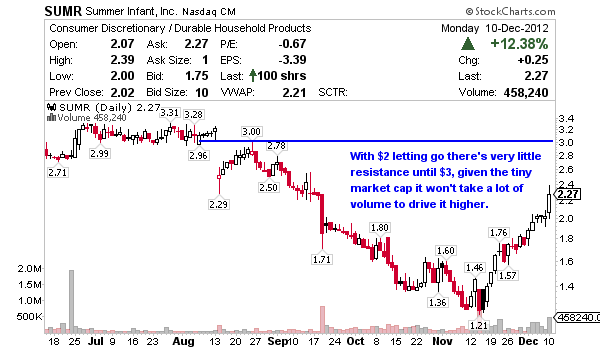

Summer Infant (NASDAQ:SUMR) engages in the design, marketing, and distribution of branded juvenile health, safety, and wellness products primarily in North America and the United Kingdom. SUMR’s stock market cap is tiny at $41 million, they have $12 million cash and $81 million debt with 18 million shares outstanding and 10 million in the float. There’s very little short interest here with 1 day to cover and less than 2% of the float betting against the company. There wasn’t any news to justify the 12% jump Monday but the price action has been climbing steadily off the $1.21 bottom and the break at $2 took shares into overbought status.

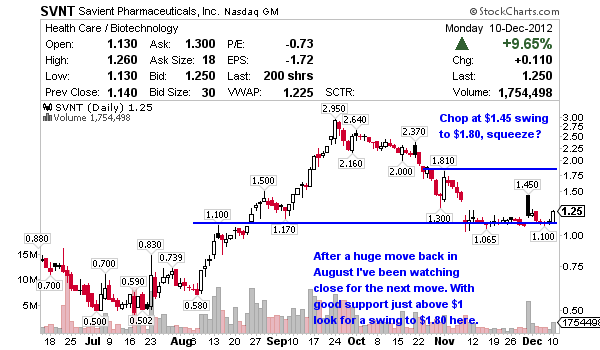

Savient Pharmaceuticals (NASDAQ:SVNT) operates as a specialty biopharmaceutical company in the United States. SVNT’s stock market cap is a juicy $89 million, they have $116 million cash and $219 million debt with 71 million shares outstanding and 51 million in the float. Of the entire group this is the one loaded with contrarians i.e. over 36% of the float is short with 12 days to cover. Here’s what to look for moving forward.

Great stuff Jason!!! keep up the good work

Thanks. I won’t lie, lists like that take me 2-3 hours but now that I’m not day trading I think I can rattle off a few of those each week.

Great watchlist Jason – more like these, please!

Thanks Eli, I’m thinking it’ll be between a a day to swing list with the goal of once you capture your 10% lock in the win.

Jason we will show you how to cut that time to 10 minutes 🙂

I’m all ears 8)

This watch list is on fire! More, more, more please! Fantastic work JB!

Acur made 17.5pct. In 10 min. Thanks Jb you are on fire keep up the good work love your service.

Yes, keep these coming JB. I couldn’t catch ACUR early enough and got in at 4. I managed to get out even 🙂

Yes, more of these lists please. Lovin’ the Account Builder’s type picks!

I’ll be a happy man when I can join up with you guys. Looks like fun. I like it that you don’t mind touting your losses. Very rare in your profession. See you at tax return time.

Thanks Kevin.