I’m constantly on the hunt for solid swing trades like EONC, AXK, ABAT, CXZ, AMRI, TSON, EVC, GLCH, AMR and PNCL. Normally I try to position before the move like I did with HDY recently at $3.06 before it ran about 30% the following day, however, sometimes swimming with the current is an easy way to grab quick profits too. Swing trading, for those of you who are unaware, is a speculative activity where stocks are repeatedly bought or sold at or near the end of up or down price swings caused by price volatility. A swing trading position is typically held longer than a day, but shorter than trend following trades or buy and hold investment strategies that can be held for months or years. Many of the charts below will be short lived opportunities, however, back-testing on this filter shows some push forward considerably despite being overbought. My filter for the stocks on this list is between $.25 and $3 with 300 trades or more the previous day. The following stocks could deliver some decent profits moving forward if they continue so here’s what I’ll be watching for.

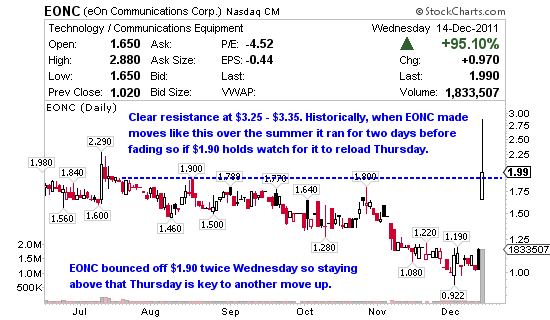

eOn Communications Corp. (NASDAQ:EONC) provides communication solutions in the North America, Puerto Rico, and the Virgin Islands. The balance sheet shows $1.85 million in cash, $3.7 million in debt and a book value of $2.17 on 2.86 million shares outstanding. EONC has a tiny market cap of $5.7 million and is well below what I look to trade between $100 – $300 million. The Beta is what I would consider normal around 1.33 but that market cap is the primary reason EONC has these big bursts followed by gradual fades. If you pull up a 52-week chart you’ll see this isn’t the first time this year EONC has made a big move. Back in May it went from $1.44 to $2.10 on day 1 and continued to run from $2.16 to a high of $3.25 on day 2. Just about a month later it went nova again from $1.66 to $2.33 and continued on day 2 from $2.35 to $3.35. In both situations the stock managed to run for 1 days which is why it made the list. Certainly hard to say if it will follow that trend but one thing is for certain, if some sizable bids show up Thursday this thin stock could certainly squeeze aggressive shorts before fading. EONC is overbought and does not have a history of holding that level for long, so be sure you note the Relative Strength here.

Accelr8 Technology Corp. (AMEX:AXK) focuses on the research and development, and commercialization of proprietary surface chemistry formulation and quantitative bio-analytical measurement instruments. Another small market cap at $21.10 million with a Beta of 1.38. The balance sheet shows $775.86 thousand in cash, $0 debt and a book value of $.43 on 11.10 million shares outstanding. This is a stock I happen to like and have written about before. If it looks like it can hold this run I’ll certainly swing it because the 52-week chart clearly shows the ability to run for days on end.

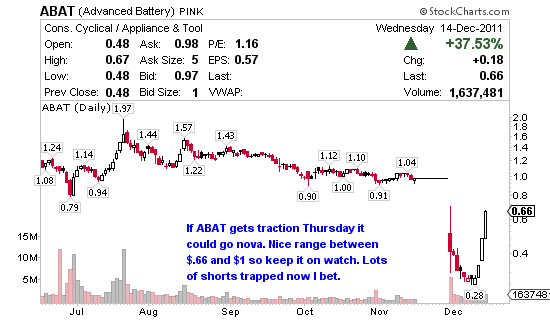

Advanced Battery Technologies Inc. (PINK:ABAT) engages in the design, manufacture, and marketing of rechargeable polymer lithium-ion batteries. ABAT has a small market cap at $50.25 million and a Beta of 1.23. The balance sheet shows $74.04 million in cash, $0 debt and a book value of $3.11 on 76.14 million shares outstanding. I’ve traded ABAT twice in the last year and written about this company quite a bit, I’m 1-1 on the stock. Shares were recently halted after the company failed to report earnings on time. Consequently ABAT was delisted from the NASDAQ and fell quite a bit once trading opened back up. Wednesday ABAT announced opening a new battery production facility which I’m certain long term shorts didn’t like. This move has been on fairly small volume so far but it is building so if big bidders show up it certainly could go nova Thursday. I’m sure the short interest must be fairly large still so keep this one on watch.

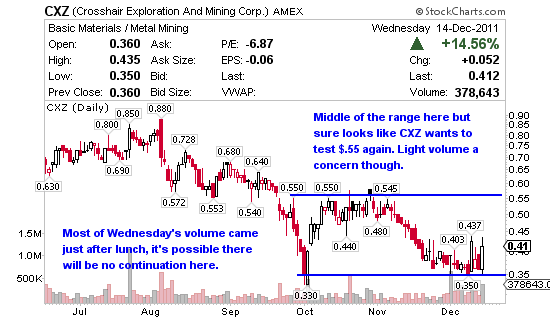

Crosshair Energy Corp. (AMEX:CXZ) engages in the acquisition, exploration, and development of uranium, vanadium, and gold properties in the United States and Canada. Little light on the volume side but it made the filter so let’s take a closer look. Another small market cap at $19.58 million with a Beta in my wheelhouse at 2.81. The balance sheet shows $9.4 million in cash, $0 debt and a book value of $.37 on 47.48 million shares outstanding. The move up came just after lunch Wednesday on a light surge in volume that faded into the afternoon. My guess is a little short cover here but I’ll keep it on watch Thursday should some large bids show up.

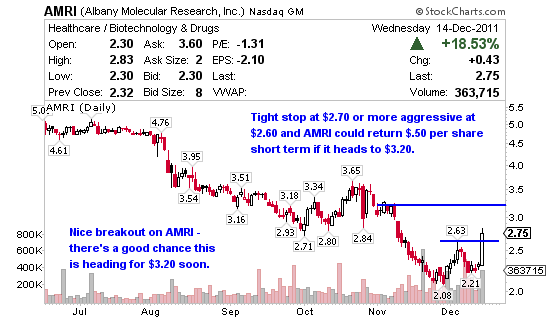

Albany Molecular Research (NASDAQ:AMRI) provides contract services to various pharmaceutical and biotechnology companies primarily in the United States, Europe, and Asia. Big move for AMRI Wednesday and it was a steady climber against the grain on strong volume. The market cap here is very close to my liking just below $100 million but the Beta isn’t as volatile as I like to see with a reading of 1.28. The company shows $20.02 million in cash, $9.24 million in debt with a book value of $7.85 on 30.03 million outstanding. This was a great consolidation play off the $2.30 range this week but that’s the past, moving forward I like it between $2.60 and $3.20.

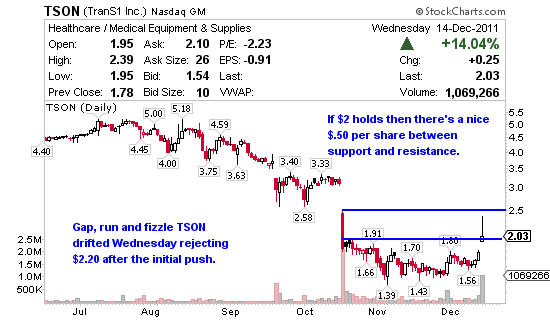

Trans1 Inc. (NASDAQ:TSON) a medical device company, focuses on the design, development, and marketing of products that implement its proprietary surgical approach to treat degenerative disc disease and instability affecting the lower lumbar region of the spine. TSON gaped on news Wednesday, ran hard at the opening bell but faded across the session rejecting $2.20 for most the day as it drifted lower. Small market cap at $55.21 million certainly allows it to move quickly but the Beta of .51 is about as far as you can get from my preferred 2 or higher. Having said all that, this is a momentum news play so I really don’t care about the historically volatility on the stock to consider it swing here. TSON’s balance sheet shows $47.99 million in cash, $0 debt and a book value of $1.99 with 27.20 million shares outstanding. Back in August TSON made a 3 day run rejecting higher levels on day 2 and 3 so it’s definitely possible TSON could run still, especially if some bulls come out on Thursday. Keep an eye on the distribution line to make sure there aren’t other big sellers unloading into a move up.

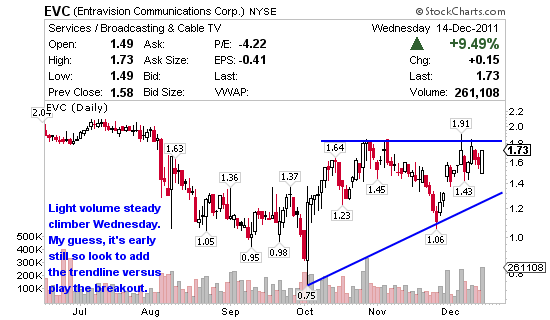

Entravision Communications Corp. (NYSE:EVC) operates as a diversified Spanish-language media company. It utilizes a combination of television and radio operations to reach Hispanic consumers in the United States, as well as the border markets of Mexico. EVC’s market cap is $147.15 million and has a super volatile Beta of 3.58 meaning this is my kind of stock. The balance sheet shows $68.98 million in cash, $395.54 million in debt and a book value of $.07 per share with 85.06 million shares outstanding. Volume was high for the stock on Wednesday and accumulation turned up nicely so if EVC and pound out some resistance just ahead then $2 certainly seems reasonable.

Gleacher & Company (NASDAQ:GLCH) is an independent investment bank, provides corporate and institutional clients with advice and execution in the areas of advisory services, capital raising and research, sales, and trading. I like the market cap on GLCH at $183.51 million and the Beta of 1.4 works for me too. The balance sheet shows $2.25 billion in cash, $496.79 million in debt and a book value of $2.14 per share with 123.99 million shares outstanding. Most of the move Wednesday came just before the close and I suspect some short cover was responsible since the last reported interest was 10.73 days to cover on 11/30/2011. If GLCH holds the $1.45 range Thursday I’ll definitely be watching to see if it can breakout of this short term trend.

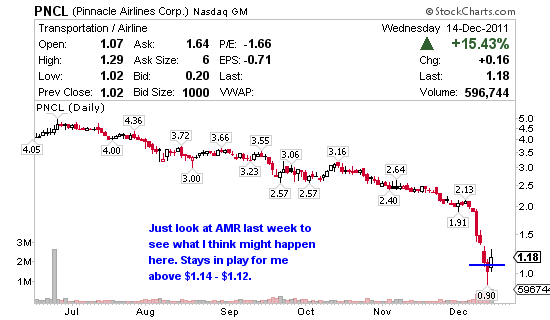

Amr Corp. (NYSE:AMR) operates in the airline industry. AMR recently filed for Chapter 11 i.e. bankruptcy and you’d have to have been living under a rock not to have heard about AMR’s price action recently. Market cap is $229.63 million and the Beta is 2.03. As you can imagine the short interest on AMR is probably climbing of late and no doubt squeezing anyone who tried to short the $.60 ledge recently. Almost picked it up as a day trade on Wednesday at $.64 right out of the gate but missed my entry. At this point if AMR holds $.67 I’ll be very interested to see if it catches hold again and jumps back up into the $1 range before pulling back.

Pinnacle Airlines (NASDAQ:PNCL) operates as an independent regional airline company in the United States. Another tiny market cap here at $22.57 million, PNCL has a Beta of 1.4. The balance sheet shows $81.84 million in cash with a whopping $800.38 million in debt. A recent dive saw shares cut more than 50% from just above $2 all the way down to $.90 before bouncing. Given that PNCL rejected $1.30 on the bounce it’s a pretty good sign that there are still sellers unloading still, however, a drop like that could see a 3 day run no different than the AMR last week so keep this one on watch.

You are the man Jay!

Thanks Scott, was a long night for sure but the only way to find good trades is to put the time in. Hope you guys get some use out of this list today. Add BPAX as a day trade bounce play to that list if you guys are looking for a quick scalp.

Well Jason,

I’m glad I didn’t take positions in any of these (except ABAT). On an up day in the market it was an awful performance.

What’s going on here? I’ve been following your tips with a mind to possibly using your service and they seem worse than mine (which are not too good).

I’m not being sarcastic, just making an observation & sincerely curious as to what happened.

Terence.

Hi Terence, running with the bulls is not my swing trade service. It’s simply a watch list of stocks that were up Wednesday when the market was down. I talk about why they might be up and what you might expect moving forward but hardly ever chase stocks that are already running. Today’s trade and alert by chat, Skype, text and email was GEVO in at $6.10 and out at $6.92 for 13% profit. I understand this might be confusing but my free content is just that, free. If I traded my free content subscribers would have no reason to sign up. It’s not that I’m putting crap on those watch lists – all those stocks did run on Wednesday which is why I cover them Thursday (eyeballs). Whether they go up or down is of little concern to me, rather, I try to illustrate to free subscribers what I look at. Watch lists are watch lists – they aren’t ‘buy’ and ‘sell’ alerts like my trade on GEVO today. Hope that helps.