Following the unexpected announcement that Australia’s Rampart Energy Limited (RTD.AX) had refused to cut a check to Royale Energy (ROYL) to fund Royale’s contract with Kuukpik Drill to construct two wells at the Rosetta Prospect in northern Alaska, the price of ROYL has plunged as much as 29.3% (to $3.48) from the Jul. 21 high of $4.78.

Though the stock is off its low of $3.27, ROYL still struggles to maintain $3.50.

A Brief Chronology of Events that Put ROYL in Play in the First Place

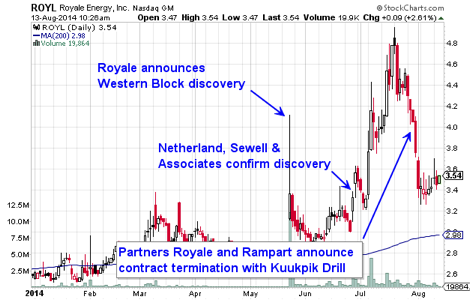

The wild price action in ROYL this summer kicked off on May 22, following Royale’s announcement that the company believes it discovered an oil field under 20,000 acres of land leased from the state of Alaska, on the Western Block, North Slope, just south (offshore) of the world’s 17th largest oil field at Prudhoe Bay, Alaska.

“Seismic data has been loaded by Royale in San Diego for interpretation and analysis. Preliminary interpretation by the Companies has identified a large conventional target, covering an area of up to 20,000 acres,” according to the news release of May 22.

“Supporting the delineation of this target is the presence on the 3D seismic of high amplitudes and flat spots, which the companies interpret to be Direct Hydrocarbon Indicators (DHI’s),” Royale added. “These anomalies are located within a critical interval of prospectivity, where elsewhere on the North Slope the same characteristics have had excellent exploration results. The prospect conforms to thermal maturity windows and is expected to be oil prone.” [emphasis added by author]

On the news, ROYL soared as high as $4.12 (or 46.6%) from the close of $2.81 of the previous day, May 21.

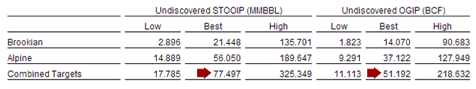

Subsequently, on Jun. 26 Rampart Energy (Royale’s contractor/partner) issued a news release of global independent reviewer Netherland Sewell & Associates’ assessment of Royale’s data, and concluded that Royale’s discovery could contain deposits of between 17.8 million and 325.3 million barrels of crude, as well as between 11.1 billion cubic feet and 218.6 billion cubic feet of natural gas.

The assessment data presented in the news release are as follows:

Source: Rampart Energy

That news is all that was needed to race ROYL from a close of $3.01 on Jun. 25, to as high as $4.95 on Jul. 21, for another 64.5% rally within 30 days.

However, on Jul. 22, ROYL began selling off hard, declining a total of 30.9% from the Jul. 21 high of $4.95, down to a close of $3.42 on Aug. 1.

Three days earlier, on July 29, Royale had notified Kuukpik Drill that it was terminating the contract between the two companies, which suggests maybe some traders had foreknowledge of the event and may have triggered the early sell off.

Since the announced termination, speculation has run wild on message boards as to the reason for the split. Some speculate that Rampart somehow knows the project is no good. Others believe Royale wants another contractor/partner with deeper pockets. While still others suggest that Rampart just wants better terms with Kuukpik Drill, and that the termination is merely a ruse to soften Kuukpik Drill. And so on.

Applying the Occam’s Razor principle to the range of theories of what really happened behind the scenes between the two companies, a mere look at Royale’s SEC Form 8-K shows that the explanation for the termination is pretty straight forward: Rampart would like to renegotiate the terms of payment to Kuupik Drill for the construction of the two wells, and that Royale reasonably expects a resolution of the issue and to proceed with the job as originally agreed and scheduled.

“On July 29, 2014, Royale Energy, Inc., notified Kuukpik Drill that Royale was terminating its contract for drilling two wells on Royale’s block on the North Slope in Alaska, during the 2014-2015 drilling season,” Royale stated in a Securities and Exchange Commission (SEC) Form 8-K, of Jul. 31. “Royale elected to terminate the contract after Rampart Energy, Ltd., notified Royale that Rampart would not fund the initial payment due to Kuupik Drill under the drilling contract. This decision was made to avoid incurring penalty fees that would have become due to Kuupik Drill for failure to make timely payment. Royale believes that the drilling contract could be reinstated for the 2014-2015 season if new arrangements can be made to fund the drilling commitment.” [emphasis added by author]

However, compare Royale’s statement filed with the SEC with Rampart’s announcement of the next day:

“The joint venture [Royale & Rampart] determined that it would not be prudent to proceed with such a significant financial commitment without a greater degree of certainty that funding of the drilling program can be achieved within the available time frame,” Rampart stated in an announcement, dated Aug. 1.

Rampart added that it may need more technical evidence of the potential of the Western Block, North Slope project before engaging a funding partner. However, Rampart also believes there’s a possibility a funding source could be found rather quickly, without the need of further testing and evaluation.

“[I]f a funding partner can be identified in the near term there is a possibility for reinstatement of the Kuukpic rig contract for drilling in 2015,” it said. [emphasis added by author]

So, there you have it. That’s all there is to this story.

After weighing both explanations, we can make a reasonable assumption that the project is going forward, with or without Rampart; it’s now just a matter of whether the project commences in 2014-5 or 2015-6. But Rampart wants to be sure it can handle the deal with little surprise, which could mean that the company is ultraconservative in their approach.

What, Then, is the Big Deal? Our Takeaway on this Development

We see absolutely no reason for the panic selling of ROYL that took place in late July. Our opinion is that the chance of another announcement of a resolution to the payment clause is quite high, and could possibly issued by the end of the summer.

“We ran the numbers on the mean net present value of the Rosetta Prospect project; it’s the lead candidate for a drilling campaign up there in the Western Block,” stated Jason Bond of JasonBondPicks.com. “Our revenue estimate to Royale over the life of the deposit calculates to between $243.8 million to $731.4 million, using Netherland’s best estimate of total reserve, a recovery rate of a reasonable level of 28%, and as little as a 25% piece of the action for Royale. And traders are concerned with whether the project will commence in late 2014 or late 2015?” added Bond.

“That’s bizarre! We’re comfortable being long – long – long at these levels.”

Disclosure: I am long ROYL

did you cut your losses on ROYL jason?

Ya a while ago. Just didn’t hold support so I moved on.