Man, was it a wild morning session… I’m starting to get a little bearish and I think a pullback may be in the cards.

However, that doesn’t mean I’m not looking for stocks that could potentially gap up.

I know what you’re thinking… “Jason, how can you possibly buy stocks if you think a pullback may be in the cards?”

Well, with momentum stocks, they don’t necessarily move with the overall market.

You see, these stocks tend to move to the beat of their own drum… take HEXO and GRPN for example.

These trades were part of my Monday Movers watchlist and I was able to lock in nearly $4K on these two trades… coming off the long weekend.

Now, I want to show you how I’m able to spot these opportunities with my scalable patterns and set myself up for success.

How I Uncover Stocks Poised To Gap Up

When it comes to momentum stocks, I believe chart patterns and pairing them with catalysts can be beneficial for me.

You see, I’ve actually discovered there are patterns out there that have worked for me… and if I’m able to pair it with a catalyst… then I put myself in a position to profit.

To show you what I mean by that, I think it’ll be helpful to see how one of my chart patterns works in action.

For example, HEXO is a cannabis stock… and the sector has been hot recently. So I figured it could catch a pop.

Here’s what I sent to Monday Movers subscribers in the watchlist last week, on Friday at 1:33 PM ET.

HEXO is more of a risky play because it’s already up 20%+ on the day but the pattern has range to the $.80’s and maybe even $1. Offering behind and a sector that’s catching pops, I’m interested in entry around $.58 with a stop loss below $.54 and a goal or 20%+ next week, assuming I take a position. Currently at $.63 I’m not looking to chase but enter on a dip, should one present itself.

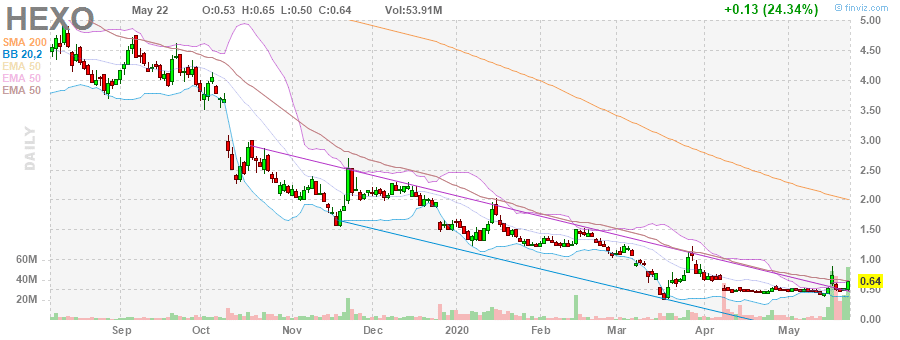

Source: Finviz

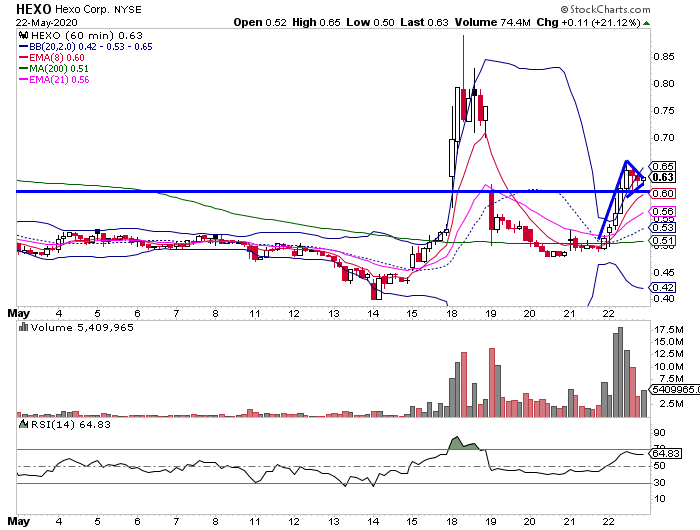

Now, here’s a look at the hourly chart in HEXO.

Chart Courtesy of StockCharts

If you look at the chart on Friday, it was actually getting into the gap… and forming a bull flag pattern. This let me know that HEXO could break out and potentially reach the $1 level.

Not only that, but there is a looming catalyst with cannabis companies potentially being able to have access to credit lines. It’s one way policymakers are trying to prevent the spread of coronavirus in cash businesses.

With a looming catalyst and a bullish chart pattern… I just had to come up with a trading plan and execute.

Now, here was my plan…

I’m interested in entry around $.58 with a stop loss below $.54 and a goal or 20%+ next week, assuming I take a position. Currently at $.63 I’m not looking to chase but enter on a dip, should one present itself.

Of course, I actually wasn’t able to get in near my entry… but I had a high conviction, and I didn’t want to miss out on the potential gap up.

So I actually picked up shares at $0.6177… and planned to hold it over the long weekend.

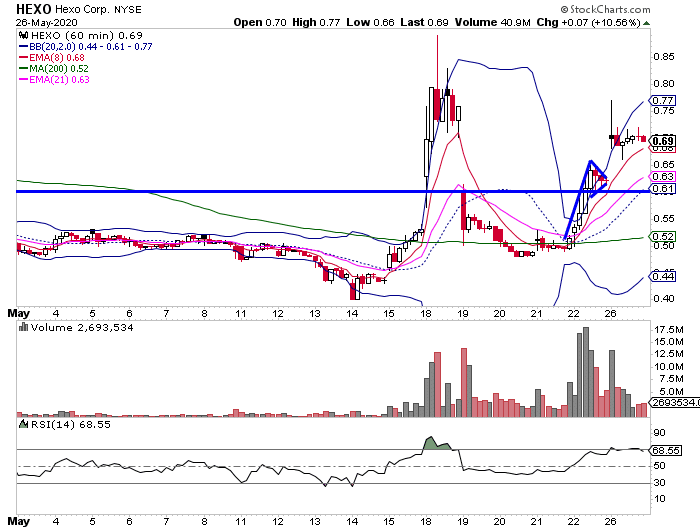

Well, HEXO actually gapped up and hit a high of $0.77 and completely filled the gap!

Chart Courtesy of StockCharts

I used that strength to take profits…

With momentum stocks, I believe I’m able to risk manage and efficiently make money… and go to bed knowing I’m in a position to profit.

Now, if you want to learn how I’m able to spot stocks that are poised to move… then watch this short training clip here.

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer.

Hi, if my math is correct you bought 20,000 shares and made a $2,578 profit. Was the ‘sell’ on Tuesday the 26th? Volume was only 32,508 on that day. Seems lucky you got to sell all your shares. Could you sell them in one sell order or did it take several to get out? A stop loss won’t help if the volume isn’t enough to cover your stop loss order.

Thanks.