With the way the market has been acting, I’ve been pretty nimble and wait for opportunities to arise.

I mean it makes a lot of sense major indices stalled at key levels yesterday, and I want to teach you how to take advantage of these moves.

Yesterday, I pointed out to Rooster Report subscribers that I loved the iShares Russell 2000 ETF (IWM) as a potential short play.

Listen, I’ve been following small-caps for a decade and I understand the price action of IWM.

That said, let me walk you through this trade idea…

The chart pattern that let me know IWM was fizzling…

And how I took advantage of the opportunity and locked in a 27% win.*

How I Uncovered The Reversal In IWM

Yesterday, at 2:05 PM ET…

Here’s what I sent out to Rooster Report subscribers.

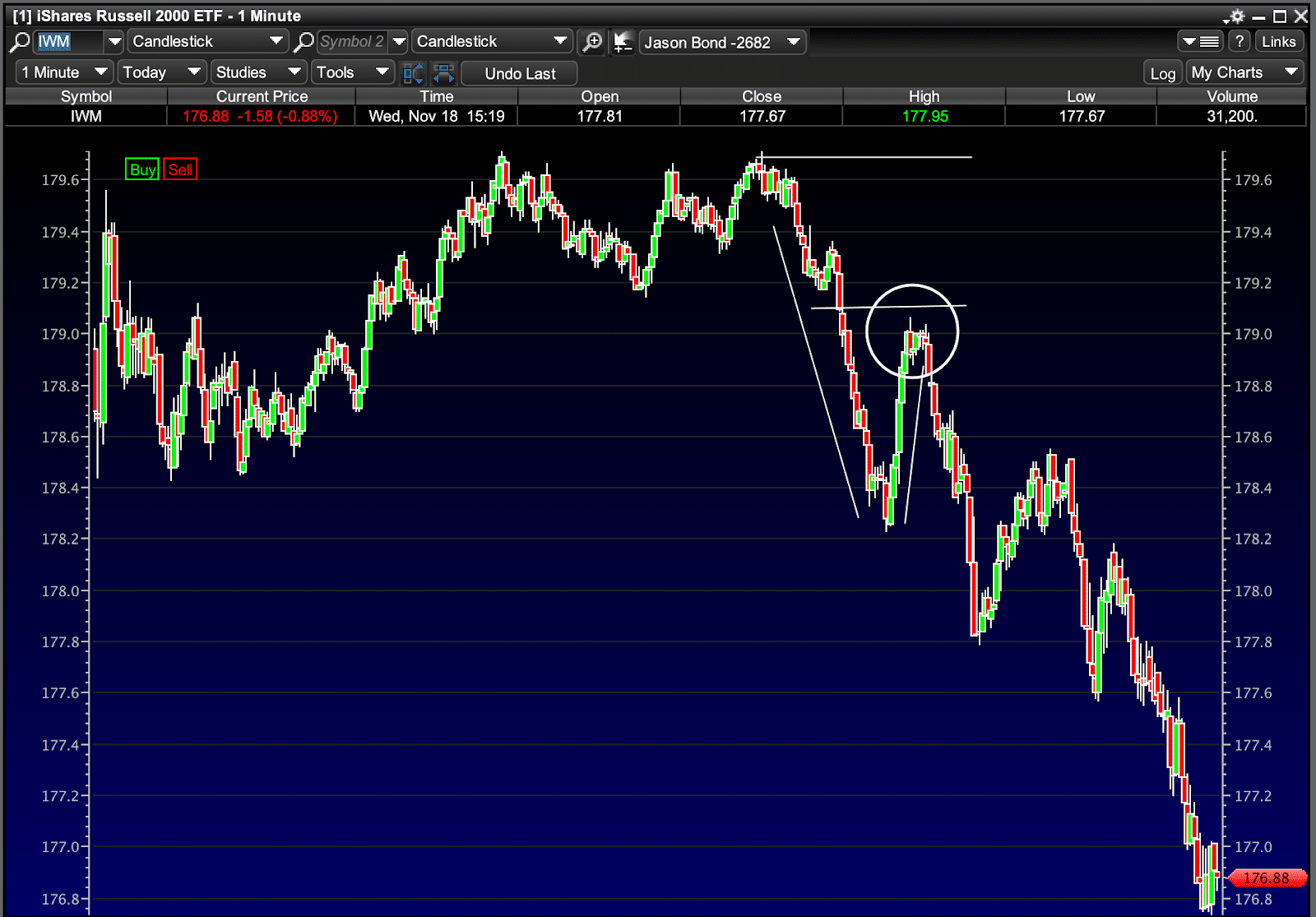

“No, the Rooster didn’t sleep in, I’m just starting to pause a little at these extreme IWM readings. That said, I’m looking at December 11 $180 puts on the IWM to follow up on Tuesday’s thoughts. What I want to do is see if there’s a bounce here this afternoon to $178.80 – $179 and put the trade on then.

My rationale is the IWM is overbought, which in and of itself isn’t a reason to get short, but as I look around at momentum stocks, I’m not seeing much I’m comfortable buying at their current levels.

Usually, if I’m running out of ideas on stocks, it’s because the market is a bit extended. I certainly could be wrong about both points here but to me the risk / reward is betting against another big move up.

However, given the strength of the IWM and it’s resilience on pullbacks, I’ll be very disciplined with this trade should I get in.

Specifically, I think if a vaccine or both get approved, the market is going to rip higher, so I’m shy to short ahead of that possible news. Still, I think short term there’s a shot this works for a quick win so I’ll probably try before the close today.”

Now, I did mention I was a bit worried about potential vaccine news… but I thought it was a great day trade.

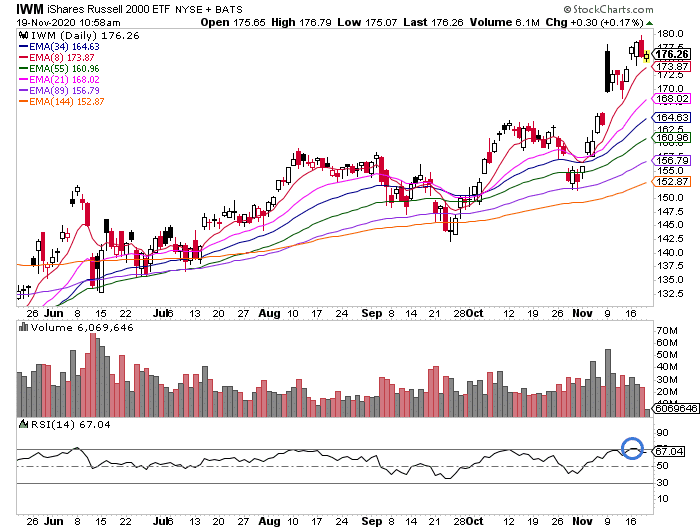

If you look at some of these indicators…

IWM was at overbought levels and once things started to take a turn, I actually bought puts.

This let me define my risk, while maximizing my potential return.

Here’s what I sent out at 2:08 PM.

I bought 20 IWM Dec 11 $180 put for 5.03

At 3:50 PM, I sent out an alert letting subscribers I sold those puts for a 27% win!*

sold IWM puts +27% +$2700 ish at 6.36, nice trade today

that entry there I circled proved to be spot on

Notice what happened when the stock couldn’t break above that $180 level… it started to pull back, and then it got a pop. I used that to my advantage.

Using the puts allowed me to define my risk, and the price action signaled to me this should be my highest-conviction trade idea for the day.

Listen, if you want my very best trade idea every day, then there’s only one place to get it… Rooster Report. I’ve slashed the price given the success I’ve had and how much action there is in the market.

Join now, and be on the lookout for my trade idea tomorrow.

*Results presented are not typical and may vary from person to person. Please see our full disclaimer here: ragingbull.com/disclaimer

0 Comments