Man what a wild move in the market today!

If you didn’t catch the large pop in stocks… don’t beat yourself up because I believe there will be more momentum trading opportunities out there to hunt down.

This morning, I was able to take profits in Gogo Inc. (GOGO) — a momentum stock that I spotted and let my subscribers know about in my watchlist on Friday — after it gapped up.

Today, I want to show you my “weekend strategy” and provide an inside look at how I’m able to find stocks poised to gap up on Mondays… ahead of time.

[Revealed] How I Spotted The Move In GOGO Ahead Of Time

When it comes to uncovering stocks poised to gap up on Monday mornings… I like to keep things simple. I stick to my bread-and-butter setups and look for areas of value.

My goal is to get in on Friday and take profits come Monday… that way I still put my money to work, even when the market is closed.

Now, I believe it’s helpful if I use an example of how I use my “weekend strategy” to show you how it works.

So here’s what I sent out to Monday Movers subscribers on Friday.

GOGO is the next stock I’m looking to swing. I like this base it’s been developing around $1.60 so that’s where I’m looking to buy above. I think it’s likely the $1.60’s offered today, assuming the market stays red, so that’s where I’ll look for 10,000 shares.

Swing into next week for me and only buying 1/2 size through the weekend. It’s clearly in a bearish trend but what I like is the 8 EMA is turning up toward the 21 EMA and the last time it did that shares went from $1.54 – $3.58 in just 7 trading sessions back in March. Assuming the $1.60 area holds I think a move above $2 is likely.

Buy zone $1.50-$1.60’s. Sizing 1/2 Friday. Goal $2’s. Stop 8 EMA $1.62 tight.

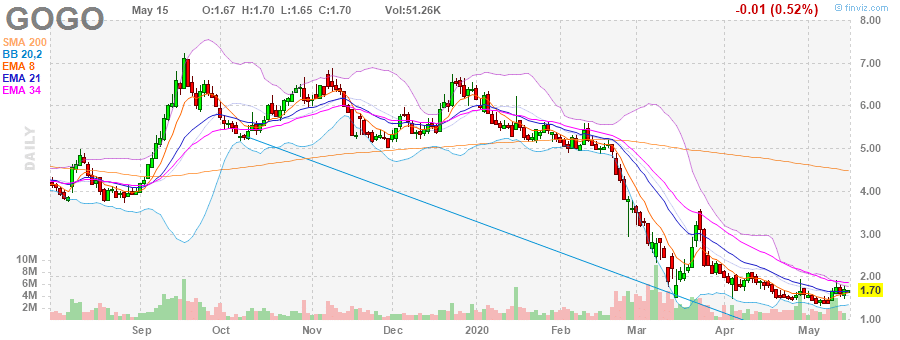

Source: Finviz

If you look at the alert I sent above, you’ll notice I was referencing a key pattern I noticed.

Let me show you a clearer view of the chart in GOGO.

If you look at the chart above, you’ll notice an encircled area. Basically, I noticed the orange line (the 8-day exponential moving average) was crossing above the 21-day exponential moving average (EMA).

To me, that was a signal GOGO could catch a pop and run higher.

You see, it’s known as a moving average crossover… and from my experience, just those two lines crossing could be powerful.

Based on that chart pattern, I was able to devise a concise trade plan… and all I had to do was execute.

Buy zone $1.50-$1.60’s. Sizing 1/2 Friday. Goal $2’s. Stop 8 EMA.

My buy zone was between the $1.50 – $1.60 range…

My goal was $2 in profits…

The stop would be just below the 8-day EMA.

Now, I did fumble on the trade a little bit because I was getting my advance notice alert out to subscribers. Basically, I wanted them to hear about the trade BEFORE I got in.

My entry was actually $1.68 on Friday… and on Monday morning, I took profits at $1.94!

Not quite near my target, but I’m not complaining about a nice $2,600 profit from a weekend hold.

I believe there will be more plays similar to the one in GOGO very soon, and if you want to learn more about my “weekend strategy” and how it can be easier than other trading strategies… then click here and watch this short training lesson.

0 Comments