Australian rare earth Lynas Corp. (PINK:LYSCF) is making major headlines as China looks to control its supply of the rare earth market which represents roughly 95 percent of the global demand. Lynas engages in the exploration and development of rare earths deposits and mineral resources.

Lynas is headquartered in Sydney, Australia and trades on the Australian Securities Exchange as (ASX:LYC). Here in the United States, as mentioned above, Lynas trades at (PINK:LYSCF). The market cap on Lynas is right in my wheel house at $1.87 billion so don’t let the U.S. listing throw you off, this company is the real deal and you could compare it to U.S. based Rare Element Resources (AMEX:REE) and Molycorp (NYSE:MCP). As a trader, the implication of the foreign exchange is you go to bed and if (ASX:LYC) was up overnight on the Australian Exchange then you can count on a great day for the U.S. listing (PINK:LYSCF). I’m sending this alert now because I think tomorrow is that day.

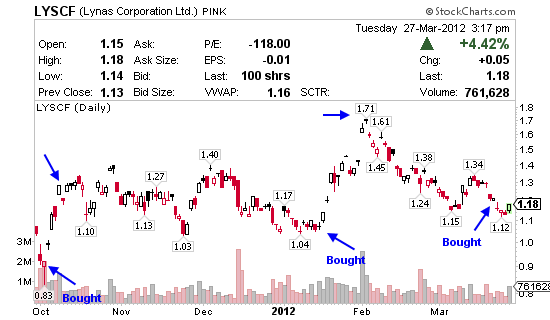

Pull up the charts on MCP and REE if you want examples of why I think LYSCF will start to head back up tomorrow and could be on its way to $1.50 and if we’re lucky and some really bad news comes out of China, $1.70’s. Currently I’m holding 40,000 shares of LYSCF which I’ve been accumulating over the last week at an average of $1.23. From today’s price of $1.18 I think LYSCF has about 30% to the upside before slowing down which is where I’ll start to assess my position.

As a swing trader I’m looking for 10% wins across 1-20 days rinse and repeat. So keep LYSCF on your radar because I think it could deliver a slow and steady winner over the next few weeks.

Thanks Jason! Just bought at 1.18

Want to join, on waiting list.

Excellent Tom, we look forward to having you. Thursday night we should be accepting new clients and I’ll keep that open until Sunday or until it sells out. Regarding LYSCF, I’d be shocked if it’s not up tomorrow and feel pretty good about a 2 week hold to $1.50 or so. I’ll be sure to let everyone know if I sell but no plans right now.

Just put in a premarket order @ 1.18. Waiting for thurs night to join!!! Still undecided on swing trade group or day trade group, thanks for the info J

Cool Cris, I should have got this out to you guys at lunch, sorry about that it’s been a hectic day for me getting the website ready for Thursday. Since this one is PINK it doesn’t trade pre or post so open market is all you’ll be able to do I think, I’m hoping we’re in the $1.20’s to start Wednesday. Keep in touch.

Hi Jason,

Still keeping my eye on you. Just got my computer back. Trading is looking good. Does a person really require an I-phone to do this? Ida.

iPhone, iPad, laptop or a computer – any will do. Nice to hear from ya Ida, hope to see you on board soon.

Hello Jason:

Corresponded with you before and am still interested in joining your service in the near future.

You may wish to know that LYSCF is not available through the broker Interactive Brokers. Some of the pink sheets that are domiciled outside of the US cause IB a clearing hassle and they don’t offer them. So, LYC, via the Australian market would be the only way to play it if clients are at Interactive Brokers.

A rare earth stock that is available at IB is GWMGF. I have had success with that one in the past in similar situations.

Thanks,

Bob

Thank you Jason for your alert!!I think you are an excellent trader and teacher as well and I have faith in you.I respect your hard work for your subscribers and I definitely want to join the club!See you soon!

Thank you Jason for your alert!!I appreciate your hard work for your subscribers and I definitely want to join the club!See you soon!!

Thanks Jason. I am on the waiting list, want to join the club. Is the club suitable for newbies? I am glad no swearing and profanity on chat room.

Hi Christine. We look forward to having you and absolutely on beginners, my expertise in education. Regarding chat, yes I do my best to keep it clean, we all make mistakes but in general that chat is very professional. We’ll have information about enrollment out soon, probably Thursday.

I would be really careful buying this stock before the price goes above $1.22 and holds it with good volume. During the first couple of hours tomorrow, ie Mar 28, 2012, it does look like it might go up to %5. I would lock my profit and then look how it would behave later. Buying it at $1.18 is a little too early in my opinion.

We’ll you were right Yuri, good call here by you. I’m shocked LYSCF isn’t up with MCP and REE today, if it’s not up overnight then I will definitely have some concerns as MCP broke out against a bear market today.

Hey jason, your site is awsome and i am looking forward to joining, just not sure of “day trading” or “swing trade”, any advice will help, i am a new at the whole trading thing. thanks for your help.

Hi Billy I’d always start with swing trading, it’s easier and less stressful, then move into day trading down the road. Let me know if you have more questions.

Aloha Jason:

Thank you for the tip on LYSCF. It looks like a great swing trade particularly for a person like myself who has to work during most the the market hours and cannot be at the computer all day. Still, I will make certain that I get an order in at 3:45 am Hawaii time… There is now a 6 hour difference between Hawaii time and Eastern Standard time!

Have a nice day and mahalo for the tip!

Michael

Hi! So far no dice but I’m going to sit on this one for a few weeks, I’ve traded LYSCF before and I’m fairly confident we’ll see $1.50’s, however I am trying to figure out why it wasn’t running today with MCP and REE.

That is how I determined $1.22 price. I compared it with moving average 20. Normally I adjust Moving Average for every stock and might be 10, 15, 20 or 50 days. I do pay attention to promotion, other stocks correlation, indexes…. However, in addition to that here is my main indicators: Gann Fan (my own interpretation, I don’t agree with what described on the web), volume and price (obvious), Elliott Wave Oscillator for 1 hour, half an hour and 15 minutes (all depends on the amount of money, the more money I invest, the lower time period), MACD 7 100, TRIX 12 vs Moving Average 7.

Based on the above and especially Gann Fan and as of today I wouldn’t buy this stock unless the price goes above $1.17. If it goes above it, the next resistance will be at $1.337. Meaning, should be sold just a little below it to lock the profit. And again, only if the price goes above $1.17 and Elliott Wave Oscillator for 1 hour shows uptrend. Would also be nice to keep in mind William’s A/D and RSI 50.

Just went through this stock analysis again. I don’t want to be an arguing person, but in my opinion, only based on the charts, nothing else (good news might help to reverse the trend), this stock is about to go down as low as $1.026 tomorrow if it doesn’t get enough volume to go up again. If it doesn’t go above $1.131 in a couple of hours tomorrow morning and stays that way, the things don’t look good at all.

The market is about taking one side or the other Yuri, I’d hardly call that arguing and I welcome opinions because those who think they know it all in life usually don’t go far in my experience. The good news is it turned back up and did not go to $1.02 but instead to $1.15. I like this play and I think $1.40’s to $1.50’s is still possible.

I like the way this stocked performed today. I would really like if it goes to 1.22. Then I will be buying it too.

So far not much to write home about but I think it’s a solid play so I’ll hold for a couple of weeks and see.

I bought it at 1.12 and have been sitting on it, will try to hold on for couple of weeks but the movement is slow. Hopefully it will pick up but on news or volume based remains to be seen.

Muku

Ya so far no move. I’ve nailed this one twice for big profits, this time not so much but I’m still holding some shares here so we’ll see.

I still like this stock but I am not ready to buy it yet. It almost reached its minimum. Tomorrow it should go up to about 1.119 at least. This stock remains a high liquidity ticker. That is very important in my opinion. If it goes down, it might go down up to about 1.04. If it goes down with good volume, I think (depending on the situation) I might buy it and sell it next day on a gap. If it goes up, I still will be waiting for a good “green” volume before buying it.

Hey Jason,

As always thanks for the great plays. Been watching LYSCF since you first made the call and think you were on point but it’s just taking a little longer than expected. Looks to me like we may have a bottom developing at $1.05. The chart looks somewhat like the that chart before the run to $1.70 in mid January. IMO at $1.05 we have a lot of upward mobility and could make a very quick move to $1.40 before continuing higher. Who do you feel about the current set up and what would you like to see before opening a new position?

Thanks Mark. My timing was off a bit on LYSCF but it caught good news last week and I fully expect it to hit the $1.30’s to $1.50’s soon. As far as a new position, I’m looking to add this week between $1.05 and $1.11 and hold it for about 1 month. Of course that’s subject to change daily and I’ll alert subscribers by chat, text and email when I make my move.