Sniffing out small cap explosions is what I do best. The call me blow up Bond for a reason wink, wink! Now if the Wall Street bulls continue to run wild Thursday, the following 7 small caps JBMA, GALE, DCTH, VG, HOV, COWN and GNOM stock are liquid between $1 and $3 in continuation patterns that could erupt for nice 10% moves. Each had at least $500,000 in volume Wednesday and were only up a few percent peeking their price action heads out above the clouds or recent price action suggesting they’re gearing for a possible breakout. This cocktail I’m about to share with you works more than it doesn’t and the best part is, the pattern offers a tight stop in case the trade doesn’t confirm, something I teach all of my clients how to recognize. My favorite market cap is about $100 million with a Beta of 2 or more. Institutions will play the $100 million market caps and they can run the tape, you just need to know when they might do so. Oversold is generally my favorite, but in this case we’re going with continuation patterns. The next part isn’t a deal breaker but I also look for 30% of the float short or more and 10 days to cover. Toss in a 1-3% move in a sideways market with rising volume and you have the recipe for a 10% trade, rinse and repeat my friends.

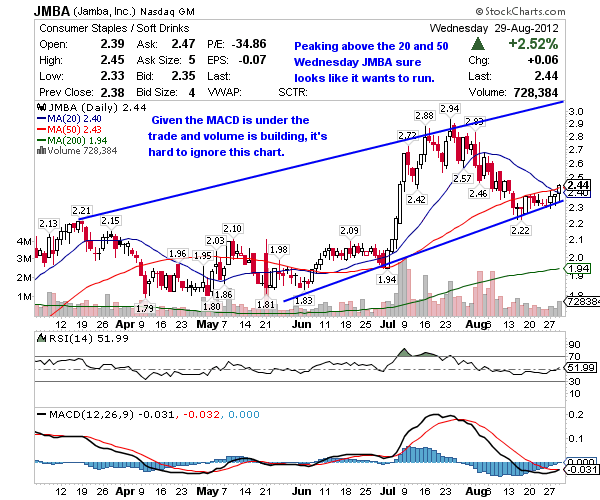

Jamba (NASDAQ:JMBA) owns and franchises Jamba Juice stores. It operates as a restaurant retailer of specialty beverages and food products. JMBA’s stock market cap is $166 million with a Beta of 3.21 which is awfully juicy if I do say so myself. This is my favorite idea on the list. Don’t expect shorts to back you up though because only 3% of the float is betting against this beverage retailer. The 52 week range is $1.21 – $2.94.

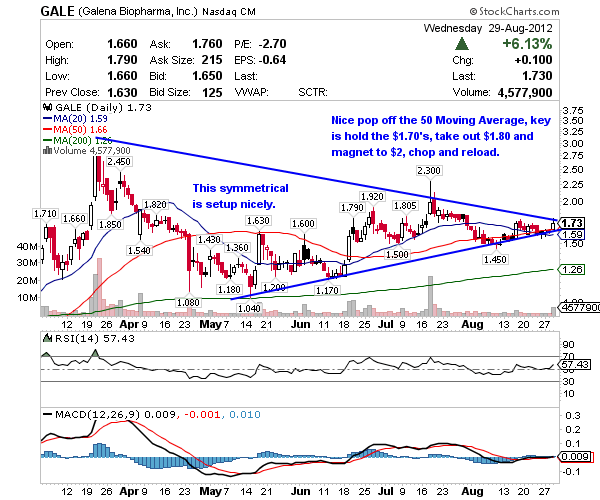

Galena Biopharma (NASDAQ:GALE) is biotechnology company, engages in discovering, developing, and commercializing innovative therapies addressing unmet medical needs using targeted biotherapeutics. GALE’s stock market cap is $113 million with a Beta of 1.24. Up 6% Wednesday, it was the biggest mover on this list and while I don’t chase anything up 3% or more the day before, this chart suggests the rocket could really fly which is why I’ve included it. The short interest is 6 days to cover with 11% of the float short. The 52 week range is $.36 – $3.54.

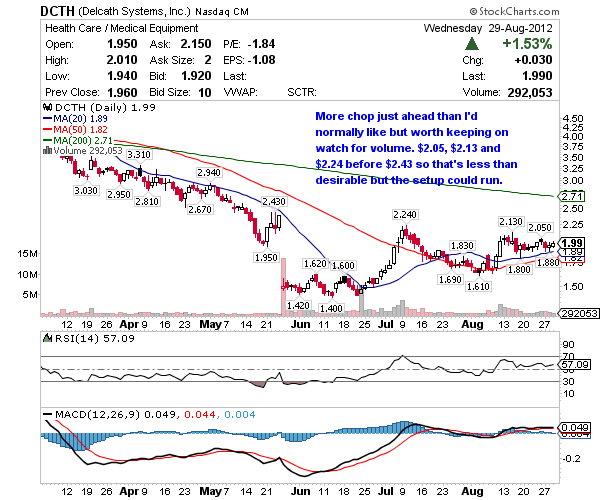

Delcath Systems (NASDAQ:DCTH) operates as a specialty pharmaceutical and medical device company. It focuses on oncology, primarily cancers in the liver. DCTH’s stock market cap is $133 million with a volatile Beta of $3.04, which I happen to love. 11% of the float is short with 7 days to cover and the 52 week range is $1.40 – $4.74.

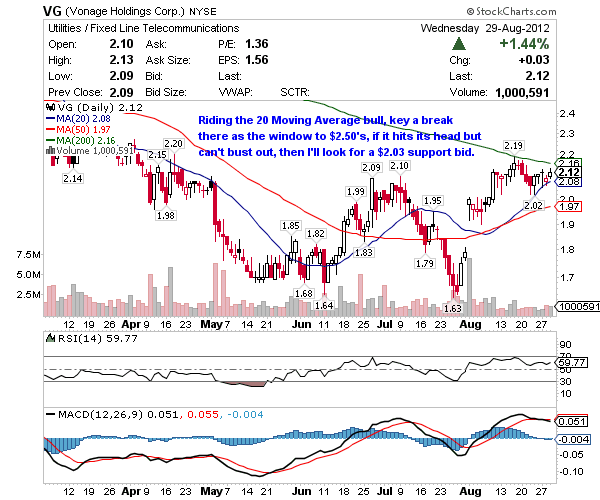

Vonage Holdings (NYSE:VG) provides broadband communication services in the United States, Canada, and the United Kingdom. The largest company on the list, VG’s stock market cap is $480 million and it’s Beta is less volatile at 1.74 so don’t expect as big a move here, should it leave the launch pad. Shorts make up 5% of the float with 4 days to cover, so not much of a backstop there. The 52 week range is $1.63 – $3.62. I happen to like this as more of a swing long than 1-4 day hold.

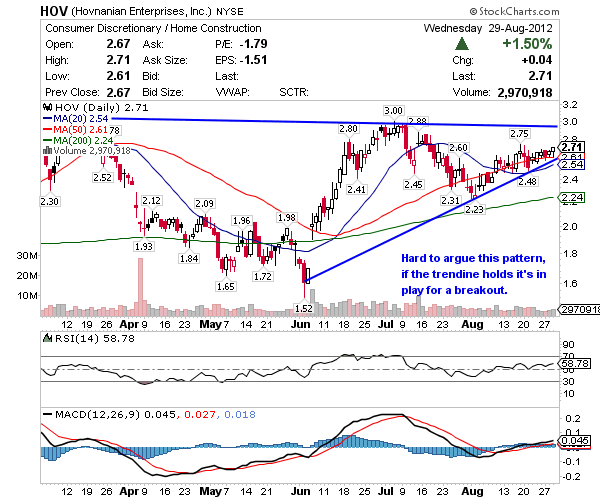

Hovnanian Enterprises (NYSE:HOV) designs, constructs, markets, and sells residential homes in the United States. Smaller than VG but still fairly big for the cocktail, HOV’s stock market cap is $344 million but the Beta is sexy at 2.85, well over my 2 preference. The contrarians are lined up on this trade, with 28% of the float short and 10 days to cover making it a favorite for me into Thursday. At the upper end of the $.89 – $3.31 52 week range there’s still plenty of room for HOV to run.

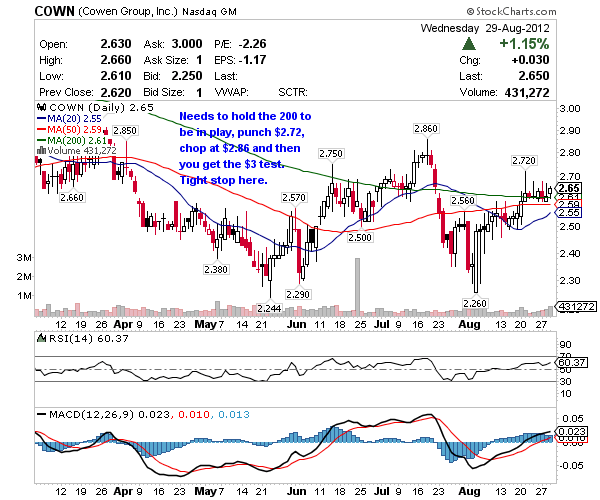

Cowen Group (NASDAQ:COWN) is a publicly owned asset management holding company. Through its subsidiaries, the firm provides alternative investment management, investment banking, research, and sales and trading services for its clients. COWN’s stock market cap is $302 million with a Beta just below 1. The short interest is 14 days to cover but there’s only 3% of the float betting against the stock. With a 52 week range of $2.24 – $3.56 it appears a test of $3 is in the cards.

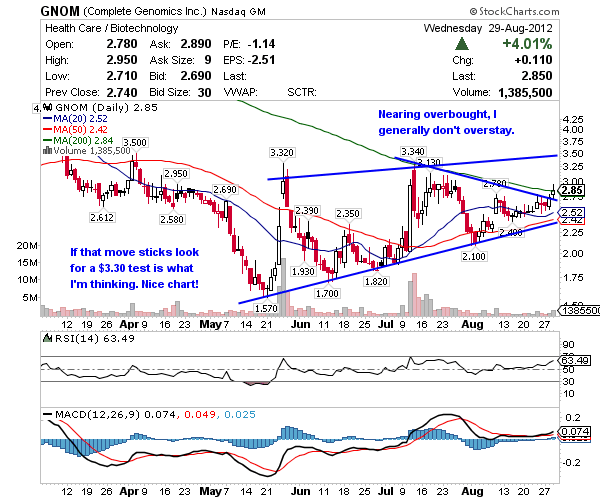

Complete Genomics (NASDAQ:GNOM) is a life sciences company, develops and commercializes a DNA sequencing platform for human genome sequencing and analysis. Love the stock market cap on GNOM at $97 million and the Beta is 1.7. The short interest here is only 2.8 days to cover and less than 10% is short the float. The 52 week range of $1.57 – $9.82 is what attracts investors down here but let’s not get crazy, a simple move to the $3.30’s makes for a great trade.

Thanks for staying up and doing so much work! I’m liking JMBA

Absolutely! Love this stuff, I’m addicted ha. Yes on JBMA, tomorrow if the market is strong I’m very interested. Right now Asia is getting pounded and U.S. stock futures are down with it but the morning is a long way off and with Jackson Hole Friday, any whispers of QE3 might keep the bulls around 1 more day. We’ll see in the morning. Cheers!

HOV is also an Intermediate Term Bullish price chart pattern automatically detected by Recognia® Investment Research. Looks good.

I love the account builders. Would really appreciate a new list if not everyday, that might be a bit much for you, but at least twice a week. And since it is kinda impossible for you to invest in everything, could you, are you allowed, to let us know what would be good to invest in on a particular day. I bought one the first week I signed up and I did not hold long enough. On paper I am doing ok, it is real time that has me cautious. I try to watch the chat on my phone at work, really interesting. I will get the hang of this yet.

I can do more, it’s a very popular list so I’ll try my best Deborah.