The story is hackneyed – pump up an unknown stock to dizzying heights on the back of investor greed, then dump it when the foundation goes out of the stock, and make a killing by buying low and selling at a peak. Recently, I noticed this one stock that is looking to me more and more like another of these cute schemes. Investors beware!

3D printing technology has been touted as the next big thing in the technology world. Indeed, investors’ enthusiasm for 3D printing is reflected in the performance of shares of 3D Systems (NYSE:DDD), one of the two biggest players in the 3D printing arena.

In the last one year, DDD shares have gained a whopping 266.25%. That’s impressive by any standard. The other major player is Stratasys (NASDAQ:SSYS). Like 3D Systems, Stratasys has also been seeing significant interest from investors. Both companies are seen as long-term play in the 3D printing industry. The excitement over 3D printing technology has also sparked a rally in shares of Organovo Holdings (PINK:ONVO), with the stock gaining nearly 100%.

All three companies are primarily focused on 3D printing technology business. Another stock that is benefiting from investors’ enthusiasm for 3D printing technology is Perceptron (NASDAQ:PRCP). In the last one month, PRCP has surged nearly 50%. But wait. PRCP has nothing to do with 3D printing technology. The company does offer some 3D scanning solutions; however, it is a small part of its business. On its website, the company calls itself as a global non-contact vision and metrology company with 30 years of experience in laser-based technology and applications. It does mention offering the Helix 3D scanning solutions; however, it definitely has nothing to do with 3D printing.

Then why is the stock gaining momentum in recent weeks? Perhaps this article might explain. Although the author of the article doesn’t mention that Perceptron is a 3D printing company, grouping it with companies such as 3D Systems and Stratasys has probably created the illusion that PRCP is a player in 3D printing technology arena. The article certainly had a positive impact on PRCP shares, as seen by its recent performance. This raises an alarm.

Here’s a line from the article where the author compares PRCP which is clearly not a 3D printing stock to the P/E’s of hot 3D printing stocks DDD and SSYS. Seems fishy, right?

“Again, if I take the $0.45 estimate of PRCP and apply the 40+ P/E of the other 3D tech stocks, DDD and SSYS, I get a share price for PRCP of $18. This may be one of the more exciting stocks to watch in early 2013.”

Here’s what the owner of 3Dprinter.net had to say about that…

“This is not a 3D printing stock. I run 3Dprinter.net, and I can tell you that it is not. So they have a 3D scanning component in the business, a small part of it. There are plenty of 3D scanners and 3D modeling programs out there. There’s nothing to this. Might be a great company on its other merits, but it’s not a 3D printing stock.”

He further questions the article…

“…your entire first paragraph was devoted to 3D printer companies. That means you lump this in with them, otherwise why mention them? There are other 3D stocks that are not 3D printer stocks that you could have mentioned instead, but you didn’t. So, I want to make it clear to readers that it is NOT a 3D printing company.”

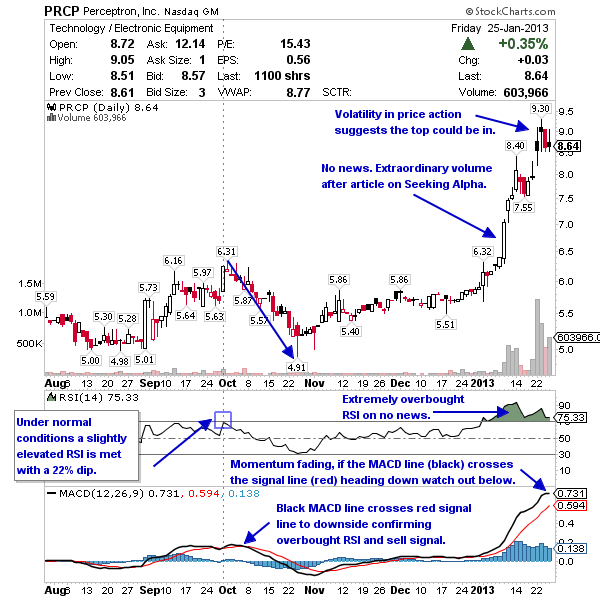

Perceptron then definitely is not a player in the 3D printing technology arena. However, is the company any good? Is the recent rally justified? As I said, the rally has been sparked by the false impression that PRCP has something to do with 3D printing. Of course, the rally is not justified. I won’t be surprised if PRCP shares see a sharp fall in the coming days. On Thursday, the stock fell more than 4% on above average volume. So maybe the imminent drop in share price has already started.

Now that we have established the fact that Perceptron is not a 3D printing company and only offers some 3D scanning solutions, the big question is whether PRCP is still worth investing in at these hyped up levels? I don’t think so.

In its third quarter ended March 31, 2012, Perceptron had reported net sales of $20.3 million. The company’s industrial business unit (IBU) posted sales of $19.2 million in the quarter, while the commercial products business unit (CBU) posted sales of $1.1 million. The company sold substantially all of its assets in the commercial products business on August 30, 2012. So I will be just focusing on the industrial business unit.

For the quarter ended June 30, 2012, (PRCP’s fourth quarter), the company’s IBU division posted sales of $12.8 million, down from $19.2 million reported in the previous year. Sales from the IBU division in the first quarter ended September 30, 2012 was $12.1 million, yet another sequential decline. Declining revenue is certainly not a good sign when PRCP is being touted as a growth stock.

Earlier this month, Perceptron announced that it dismissed Grant Thornton LLP as its independent auditor and appointed BDO USA LLC as its new independent registered public accounting firm for the fiscal year ending June 30, 2013. While PRCP said that the decision to change auditors was not the result of any disagreement between the company and Grant Thornton on any matter of accounting principle or practice, financial statement disclosure, or auditing scope or procedure, something like this always raises an alarm.

3D Printing is an up-and-coming technology that is seeing a lot of investor attention. As we have seen, this company is being made to ride that euphoria – I am not sure who is sponsoring that ride. However, my research definitely tells me that this company has nothing to do with 3D Printing. I would think that a company focused on 3D Printing would at least have a mention of the words “3D Printing” on their website. However, try this out – do a Google search “3D Printing site:perceptron.com” which gives you a site-wide search; you will see that the phrase does not occur even once in that site. This all tells me that someone, somewhere, is providing investors with wrong information. Make sure you know what you are buying into when you consider this stock.

As a teacher of swing trading I am always on the prowl for overlooked small caps to buy or hyped up small caps to short. Given what we know about the recent move on Perceptron, it’s very difficult to believe the stock can sustain these levels. Further, it would appear the author of the article which sparked a run in this stock picked up shares on January 9th, 2013 before releasing the report. This of course is perfectly fine, everyone on Wall Street does that including myself. The concern, which I believe I’ve made clear, is the stock is up considerably under the impression it’s somehow connected to the hottest space on Wall Street right now, 3D printing, when in fact nothing could be further from the truth.

Disclaimer: I am short PRCP.

0 Comments