I’m a swing trader and my swing trade cocktail, I teach thousands of premium clients, just put $46,050 in my pocket in less than 2-months. Real-time swing trade alerts I send by email and SMS text.

How’s my performance 2-weeks into the New Year Year? $23,650 in 2-weeks on 11 swing trade alerts.

Want trade alerts on hot penny stocks???

With a Masters of Education and 10 years of teaching experience in NYS, I believe I’m highly qualified to teach you this strategy.

Money talks and bull$h** walks, if you’re subscribed to a newsletter that doesn’t verify performance, how do you know they’re even making money trading? If you can’t answer that question, you better ask the newsletter author, my guess is you won’t get a straight answer because they’re probably a penny stock promoter fleecing you, dumping free shares into your buying.

If you’re ready to learn how to navigate Wall Street from a real trader with real profits and a background in education, Jason Bond Picks is your new home. I almost forgot to mention, there’s over 400 premium clients in my chat daily, it’s the biggest on Wall Street… this doesn’t happen when you’re not making money.

I focus on stocks from the NYSE, NASDAQ and AMEX between $1 – $7 i.e. the best of the worst penny stocks. The target market cap is $50 million to $2 billion, though $100 million is my favorite.

I focus on stocks from the NYSE, NASDAQ and AMEX between $1 – $7 i.e. the best of the worst penny stocks. The target market cap is $50 million to $2 billion, though $100 million is my favorite.

Add in a juicy Beta above 2, short interest of 10 days to cover and 30% of the float betting against the company and you have now know my swing trade cocktail. A few chart patterns and you too can make the cheddar I’m raking in trading a few times a week. Best part about my strategy, these go with or without you and it’s scalable for big accounts, but works for smaller accounts too. Here’s some trades I’m looking to make to add to my $23,650 profit so far this year.

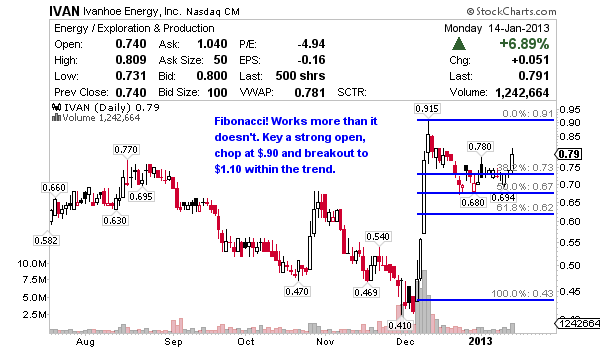

Ivanhoe Energy (NASDAQ:IVAN) engages in the development and production of oil and gas properties. IVAN’s stock market cap is $272 million with a juicy Beta of 2.39, right in my wheelhouse. IVAN recently ran 114% back in December which makes this continuation pattern attractive, especially if it breaks the $.90 resistance. For me to buy and alert this trade, here’s what I’d like to see Tuesday or later this week.

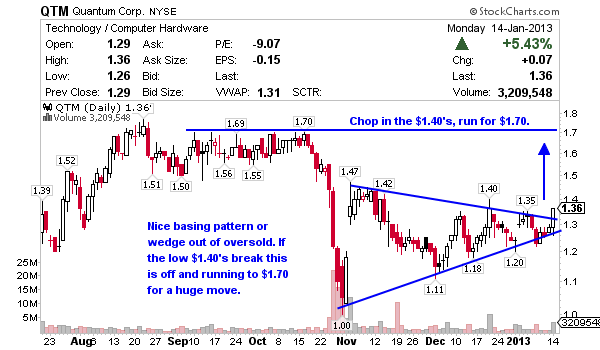

Quantum (NYSE:QTM) provides backup, recovery, and archive solutions for customers ranging from small businesses to multinational enterprises. The stock market cap of QTM is $327 million with a sexy Beta of 2.75. QTM shares took a bath at the end of October but has since put in 4 higher lows across 3-months and is breaking to the upside of a symmetrical triangle. For me to buy and alert this trade, here’s what I’d like to see Tuesday or later this week.

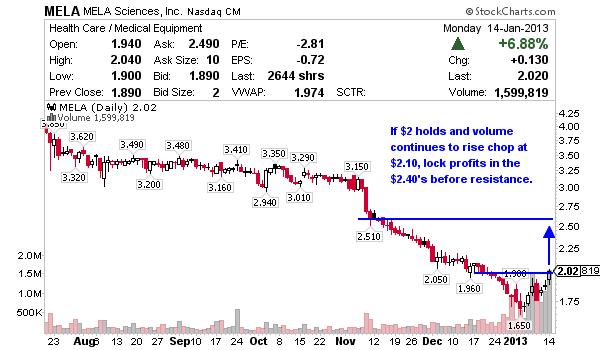

MELA Sciences (NASDAQ:MELA) is a medical device company, focuses on the design, development, and commercialization of a non-invasive point-of-care instrument to aid in the detection of melanoma under the MelaFind brand name. I’m in love with the $64 million market cap on MELA stock but the Beta isn’t desired, though right now it’s moving on volume and as a swing trader that’s all I care about. For me to buy and alert this trade, here’s what I’d like to see Tuesday or later this week.

Whenever I sign up for your service, would the price be prorated for quarter?

How much purchasing cash should I have available in a trading account, and can that accout be an IRA?

Hi Ted, no your 3-months starts from the day you sign up. I have guys who trade out of an IRA, but I have no experience there sorry. How much cash, there’s clients with $5,000 and others with $1,000,000. For swing trading I think $20,000 is a great base.