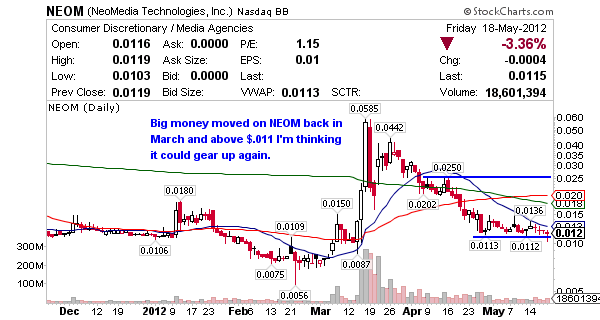

NEOM produced a monster run for us back in March and I think it’s time to start accumulating a position above $.011 again. I’m looking for the price action to start curling and a break of $.0136 should attract bigger money again. This is a possible double scenario if I’m right up to the $.025 resistance range. Remember account builders take longer to work, apply the swing trade strategy buy accumulating support before the potential move and stop tight if it breaks the pattern.

NNVC has the potential to be the next LGF trade meaning I think if you’re willing to hold this long term it’s a possible big winner. LGF was a double from $8 – $16 but I think this stock could be a $5 – $10 stock long term and when I say long, I mean upwards of a year or more. I plan to trade this technically as much as possible until I get the entry I’m looking for long and then I’ll just sit on it. I know a lot of guys on Wall Street who are looking to put some big money into this trade long term.

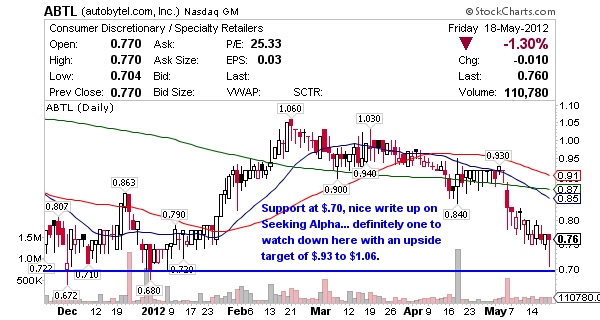

ABTL has an interesting business model if you get the time to check it out. In addition we’re looking at a solid technical setup down here rejecting $.70 on Friday. It’s a light volume trade but that’s to be expected for this watch list… bid support and sell resistance to win these and I think the risk / reward is good here. There was a Seeking Alpha article on this one over the weekend if you want to do a little due diligence on it.

Just put order in for NEOM…Lets go for a runn!!

HI J yesterday t went to seeking alpha they said all the officials (ceo coo vp ect) were dumping the stock . what gives?

I do like abtl though.

oh the stock was nnvc that had people dumping it sorry

You have a link?

Im sorry a link for what?

You said you saw insiders unloading NNVC on Seeking Alpha, I couldn’t find that link and was hoping you could provide it?

thought it was seeking alpha ,butwas surfing so many sites i really dont remmember