On Wall Street, helping others make money is all I care about, if I do it well, my business will grow. Now I know the penny stock niche better than most and I like to teach clients how to turn small accounts into big accounts using my swing trading strategy to hone in on Wall Street’s hottest penny stocks. Below is a sample, if you want my daily list please sign up for premium services.

My swing trade strategy works at any price level but the one constant we can’t do without is liquidity and a reasonable market caps. You’d be shocked to see the small caps I generally cover are companies like Groupon (NASDAQ:GRPN), Zynga (NASDAQ:ZNGA) and Demand Media (NYSE:DMD). Bet you didn’t know DMD owns LIVESTRONG and eHow? Wall Street calls them penny stocks, I call them cash cows. Cows make milk, milk makes cheddar and I’m the cheddar spreader haha! Next!!!

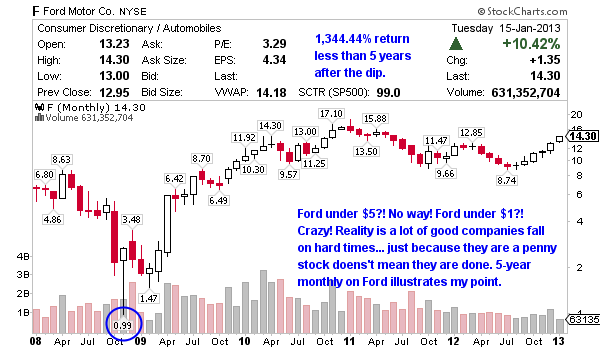

Bet you didn’t know Ford (NYSE:F) was a penny stock not too long ago? Had you been savvy enough to trade in what Wall Street considers the gutter you might be looking at a 1,344% return on your money less than 5-years later. Obviously you’ll never buy the bottom and sell the top, but you get my point.

Think of NEOM when I alerted $.015 and the next day it was at $.06 on millions of dollar volume, LQMT from $.20 to $.60 on the Apple hype (I realized 100% for over $20,000 in 4-days) or more recently, GEVO from $1.63 to $2.43 on the January effect plan which I laid out for clients 1-month before it played out. Catalysts and volume are key, I know how to find them both and time the trades.

Want trade alerts on hot penny stocks???

To start 2013 my profit is $24,464 on 13 swing trade alerts on penny stocks between $.25 and $10. What do you say we find the next big winner together? Before we go further, remember this is only a watch list… I watch, buy & alert in real-time if everything sets up during market hours exactly as I like it, something I teach about in my 20 video lessons. Finally, swing trades are 1-4 day holds for 5-10% profit targets, need to make sure we’re clear there.

Tonight’s momentum scan was for stocks trading between $.25 and $3 with over $700,000 in dollar volume Tuesday and a strong chart pattern with decent trading range ahead. Tuesday’s momentum list had a big winner with Ivanhoe Energy (NASDAQ:IVAN) but I didn’t get my $.80 bid filled so I left it alone, rarely do I chase. Like what you’re hearing so far? Click the button to the right, join my premium group and you can have my $497 DVD download FREE… but this offer won’t last! Haha, sounds like a bad infomercial. Or you can buy my $497 DVD download now, whatever makes you happy. Knowledge is power!

Tonight’s momentum scan was for stocks trading between $.25 and $3 with over $700,000 in dollar volume Tuesday and a strong chart pattern with decent trading range ahead. Tuesday’s momentum list had a big winner with Ivanhoe Energy (NASDAQ:IVAN) but I didn’t get my $.80 bid filled so I left it alone, rarely do I chase. Like what you’re hearing so far? Click the button to the right, join my premium group and you can have my $497 DVD download FREE… but this offer won’t last! Haha, sounds like a bad infomercial. Or you can buy my $497 DVD download now, whatever makes you happy. Knowledge is power!

I’m almost always AMEX, NASDAQ and NYSE, OTCBB is just not liquid enough unless the catalyst justifies the swing trade alert. I’m not into the pump & dumps either, they’re just not for me. Heading into Wednesday I think watching the following penny stocks for swing trades is worth your time. As you know I put my money where my mouth is so if everything sets up right, I’ll be sure to get out an alert.

North American Palladium (AMEX:PAL) engages in the exploration, mining, and production of precious metal properties in Canada. PAL’s stock market cap is $300 million with a juicy Beta of 2.54, I like them over 2. Palladium has been on fire lately so if it continues to advance, PAL is likely to follow. Here’s what I’m watching.

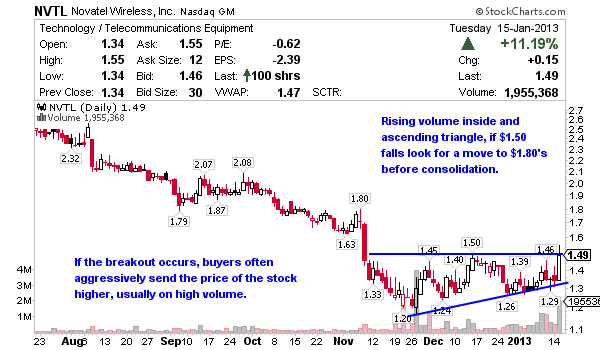

Novatel Wireless (NASDAQ:NVTL) provides wireless broadband access solutions for the mobile communications market worldwide. Much smaller market cap here for NVTL stock at $49 million which means it’ll move faster in both directions, be careful with market orders on stocks like this, better to use a limit. Another juicy Beta of 2.44. What I’d like to see this week is this.

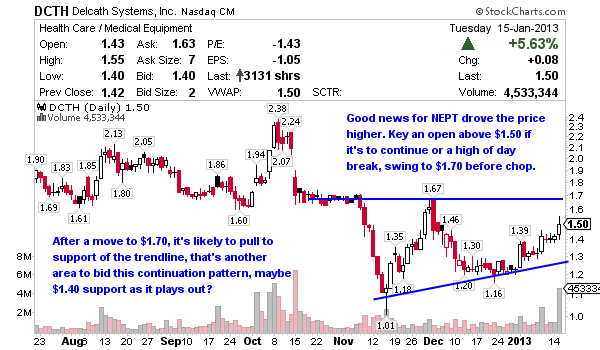

Delcath Systems (NASDAQ:DCTH) operates as a specialty pharmaceutical and medical device company. It focuses on oncology, primarily cancers in the liver. DCTH’s stock market cap is right where I like them around $100 million. The Beta is a slice of heaven at 2.91 meaning this can fly and if you pick the right direction forget 5-10% and let it ride! Anyway, here’s what I’m looking at Wednesday.

Uranium Energy (AMEX:UEC) engages in the exploration, development, extraction, and processing of uranium concentrates on projects located in the United States and Paraguay. Up the totem pole we go with a $217 million company and a Beta of 1.76. I know, I know… these penny stocks aren’t what you expected but remember, Wall Street considers stocks under $5 penny stocks… despite being on listed exchanges. UEC stock is hot right now, that can make us money, that’s what I care about… so let’s take a closer look.

Rite Aid Corp. (NYSE:RAD) operates retail drugstores in the United States. The company sells prescription drugs and a range of front end products. Hate the stores but if the stock can make me some money, I might change my mind there haha. RAD’s stock market cap is a LOT bigger at $1.35 billion and in most cases, I wouldn’t take a trade like this because it generally won’t move fast enough in a 1-4 swing trade time frame, especially with a Beta below 2. That said, the pattern is good and it could rattle off another 5-10% this week… banks don’t pay that but your local pharmacy might.

I APPROVE THIS MESSAGE!

Disclaimer: I am long GRPN and ZNGA

Will get on board opening new account separate from one I have now, are these the same trades you suggest or just a sample of a few for that day? Thanks!

These are just free watch list meant to teach new clients about my program. I put the same attention into them as I do my premium watch lists I provide clients nightly.

Jason: Thanks for staying up and including these lower priced stocks. I am watching and mainly trying to buy the ones you get into. Many times their out of play by the time I get in to look. I buy some off the watch list too.

Thanks;

Joe