Oversold bottom bouncers are some of my favorite stocks to swing. When the spin and seal is solid, the technical pivot and squeeze provides lucrative trades quickly. The recent pullback in the S&P 500 along with a number of earnings disappointments has landed a number of small caps in oversold territory. Generally what I’m looking for a 5 – 10% return making on a 1-4 day hold and before initiating trades I make sure the market is trending higher and the stock itself opens above the previous day’s close or goes high of day throughout the candle over candle session. With the market looking to open bullish there’s likely to be some solid winners here.

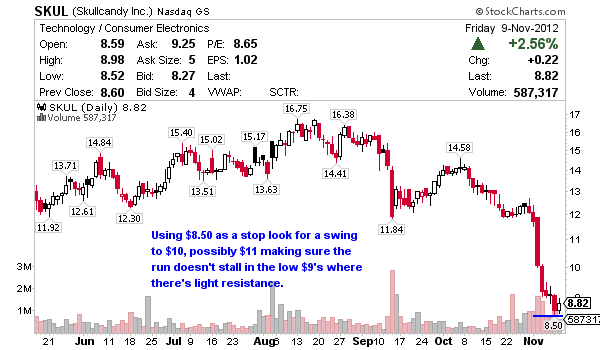

Skullcandy (NASDAQ:SKUL) develops and distributes headphones and other audio accessories to retailers in the United States and to distributors internationally. SKUL’s stock market cap is $242 million with $1.9 million in cash and $5.18 million in debt. Contrarians love SKUL with the short interest at 13 days to cover and an amazing 59% of the float betting against the company.

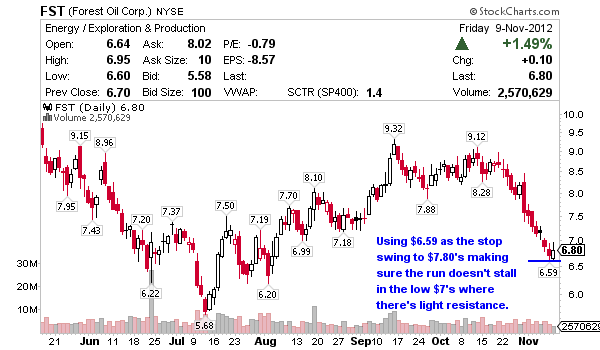

Forest Oil (NYSE:FST) an independent oil and gas company, engages in the acquisition, exploration, development, and production of oil, natural gas, and natural gas liquids in the United States. FST’s stock market caps is $785 million with $51 million in cash and $2.1 billion in debt. Over 22% of the float is betting against the stock and the short interest is 6 days to cover.

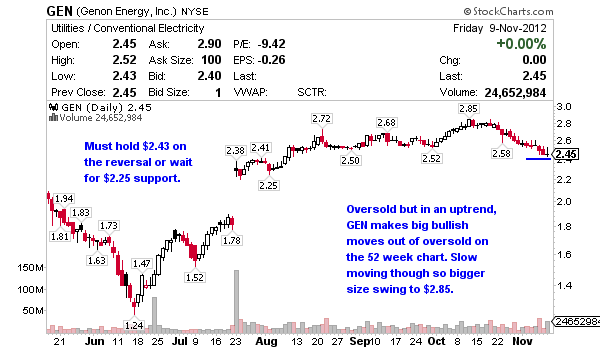

Genon Energy (NYSE:GEN) provides energy, capacity, ancillary, and other energy services to wholesale customers in the energy market in the United States. GEN’s stock market cap is $1.9 billion with $1.86 billion in cash and $4.37 billion in debt. Not much short interest here to support a reversal, the days to cover on GEN is 1 and only 3% of the float is betting against the price action.

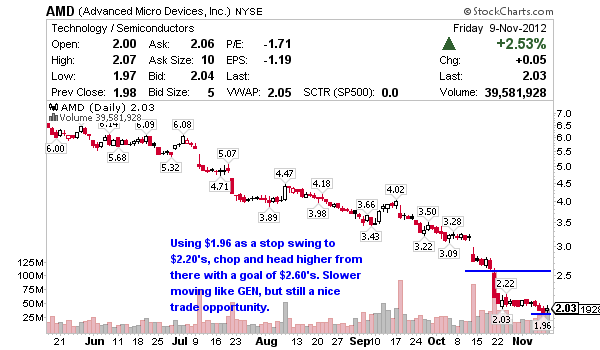

Advanced Micro Devices (NYSE:AMD) operates as a semiconductor company worldwide. The company designs, develops, and sells microprocessor products, such as central processing unit (CPU) and accelerated processing unit (APU) for servers, desktop personal computers (PCs), and mobile devices. AMD’s stock market cap is $1.45 billion with $1.3 billion in cash and $2.04 billion in debt. The short interest on AMD is 4 days to cover with 24% of the float betting against the bulls.

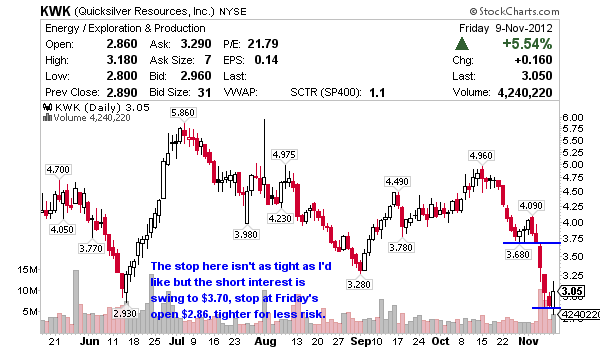

Quicksilver Resources (NYSE:KWK) an independent oil and gas company, engages in the acquisition, exploration, development, and production of onshore oil and gas in North America. KWK’s market cap is $519 million with $7.44 million in cash and $2.17 billion in debt. The short interest here is considerable with 12 days to cover and 32% of the float betting against the company.

0 Comments