If the market pulls off resistance Tuesday or even Wednesday I’m prepared to make moves on the following stocks. I’ve already checked E*TRADE and they have shares on all 4. Stops are strict on shorts since there’s no limit to how far they can run and overbought can stay overbought so long as there are buyers.

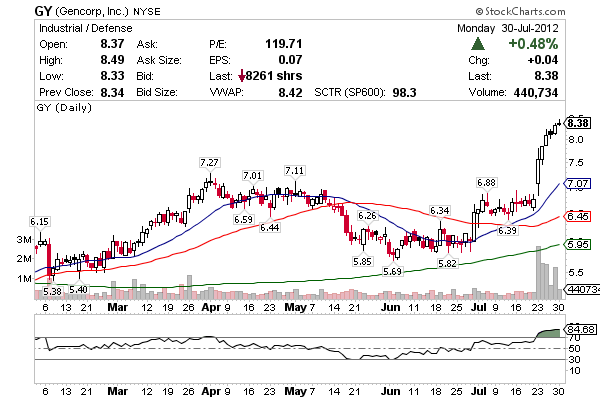

GY – Would you be a buyer here? Me neither and with Monday’s doji I’d be watching for a weak open and pull to $8.10, chop and drop to to $7.50 support. RSI is 84.68 or extremely overbought above the 70 line. Stop would be Monday’s high of $8.49.

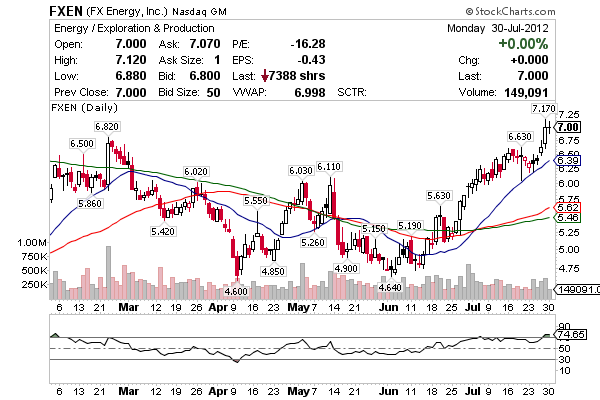

FXEN – Using $7.17 as a tight stop from Friday’s high play Monday’s indecision back down to the $6.60’s. The RSI here is 74.65 and has only been this high once in the last 52 weeks.

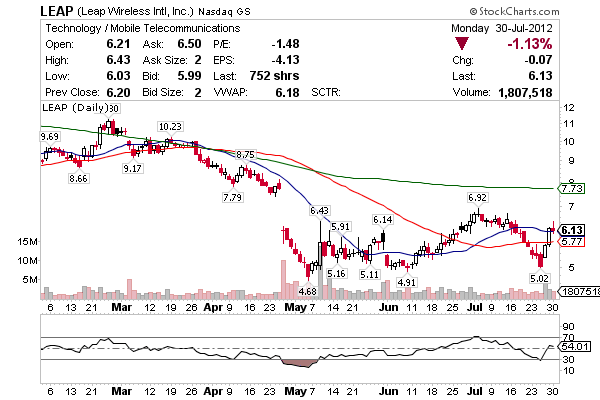

LEAP – Nice reversal after up $1 per share recently, if the market is weak I’ll look to move early… it’s not overbought so a move to the 50 Moving Average is all I’m expecting here in a bear market. RSI is 54.01. This could easily chop and head higher to $7 so I’m only interested if it’s showing weakness early.

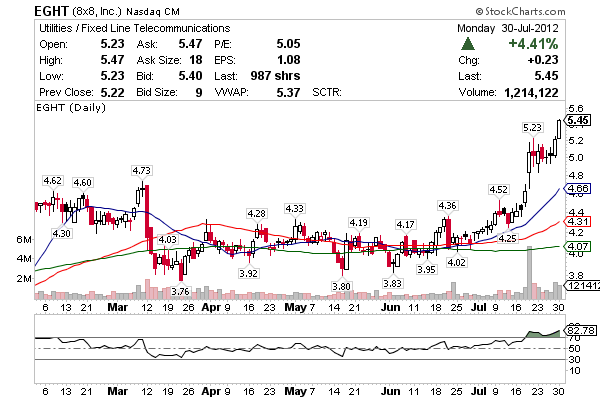

EGHT – This once might not be ready to turn because it’s all bull closing at the high but given the RSI of 82.78 we should be watching for an intraday high to position just under. Once it pulls $5.20 is support followed by $5 so not sure I love the range here.

Jason. I bought alot of AONE. Shud i stay in and wait or sell and buy NNVC? Thanks for ur help.

I’m watching it close for a bottom, same with NNVC.

tx for the shorts J- i think its important to practice being on both sides of plays-like turning the checkerboard around and being in the other guys shoes. gary